American Hartford Gold Products: American Hartford Gold (AHG) is a trusted provider of precious metals specializing in gold and silver investment products. With a commitment to helping individuals protect and diversify their wealth, they offer a range of investment options, including gold IRAs, gold bullion, coins, and other customizable products.

As a reputable company in the precious metals industry, AHG is committed to providing its clients with reliable and transparent services. Whether you are a seasoned investor or new to the world of precious metals, this company aims to assist you in making informed investment decisions.

In the following sections, we will explore the history and background of American Hartford Gold Products, delve into the range of products they offer, discuss the benefits of investing in their products, and guide how to invest in their offerings.

History and Background of American Hartford Gold Products

American Hartford Gold has a rich history rooted in the precious metals industry.

Established in 2015 with a mission to assist individuals in protecting their wealth through tangible assets, the company has earned a reputation for its commitment to quality, transparency, and exceptional customer service.

Overall Rating: 4.8/5 stars

SUPPORT:

TEAM:

SECURITY:

PRODUCTS:

PRICING:

Sanford Mann and Scott Gerlis, two experienced professionals with extensive knowledge of the precious metals market, founded the company. Leveraging their expertise, American Hartford Gold aimed to provide accessible and reliable investment opportunities for individuals seeking to diversify their portfolios.

Since its inception, the company has focused on building trust and fostering long-term bonds with clients. The company has developed a strong network of industry partners and suppliers to ensure the authenticity and quality of its precious metal products.

They offer investment options, including gold IRAs, gold products, and silver products. The company is open to diversified investment choices to cater to each investor’s varying needs and preferences.

Their team understands the importance of education and guidance in the investment process. They dedicate themselves to providing comprehensive resources, personalized consultations, and ongoing support to help investors make informed decisions and navigate the complexities of the precious metals market.

Over the years, they have garnered a loyal client base and positive reviews for their commitment to excellence. The recorded success of the company stems from its unwavering focus on integrity, reliability, and a client-centric approach.

As a reputable player in the precious metals industry, AHG continues to uphold its core values while adapting to the evolving needs of investors. With a solid foundation and a commitment to innovation, the company strives to remain a trusted partner for individuals looking to secure their financial future through precious metal investments.

American Hartford Gold has a rich history rooted in the precious metals industry.

Established in 2015 with a mission to assist individuals in protecting their wealth through tangible assets, the company has earned a reputation for its commitment to quality, transparency, and exceptional customer service.

Overall Rating: 4.8/5 stars

SUPPORT:

TEAM:

SECURITY:

PRODUCTS:

PRICING:

Sanford Mann and Scott Gerlis, two experienced professionals with extensive knowledge of the precious metals market, founded the company. Leveraging their expertise, American Hartford Gold aimed to provide accessible and reliable investment opportunities for individuals seeking to diversify their portfolios.

Since its inception, the company has focused on building trust and fostering long-term bonds with clients. The company has developed a strong network of industry partners and suppliers to ensure the authenticity and quality of its precious metal products.

They offer investment options, including gold IRAs, gold products, and silver products. The company is open to diversified investment choices to cater to each investor’s varying needs and preferences.

Their team understands the importance of education and guidance in the investment process. They dedicate themselves to providing comprehensive resources, personalized consultations, and ongoing support to help investors make informed decisions and navigate the complexities of the precious metals market.

Over the years, they have garnered a loyal client base and positive reviews for their commitment to excellence. The recorded success of the company stems from its unwavering focus on integrity, reliability, and a client-centric approach.

As a reputable player in the precious metals industry, AHG continues to uphold its core values while adapting to the evolving needs of investors. With a solid foundation and a commitment to innovation, the company strives to remain a trusted partner for individuals looking to secure their financial future through precious metal investments.

Gold And Silver Inventory

One thing to note is that the website says you can open either a gold or silver IRA. The Gold and Silver products on the websites change constantly due to availability.Gold Coins and Bullion

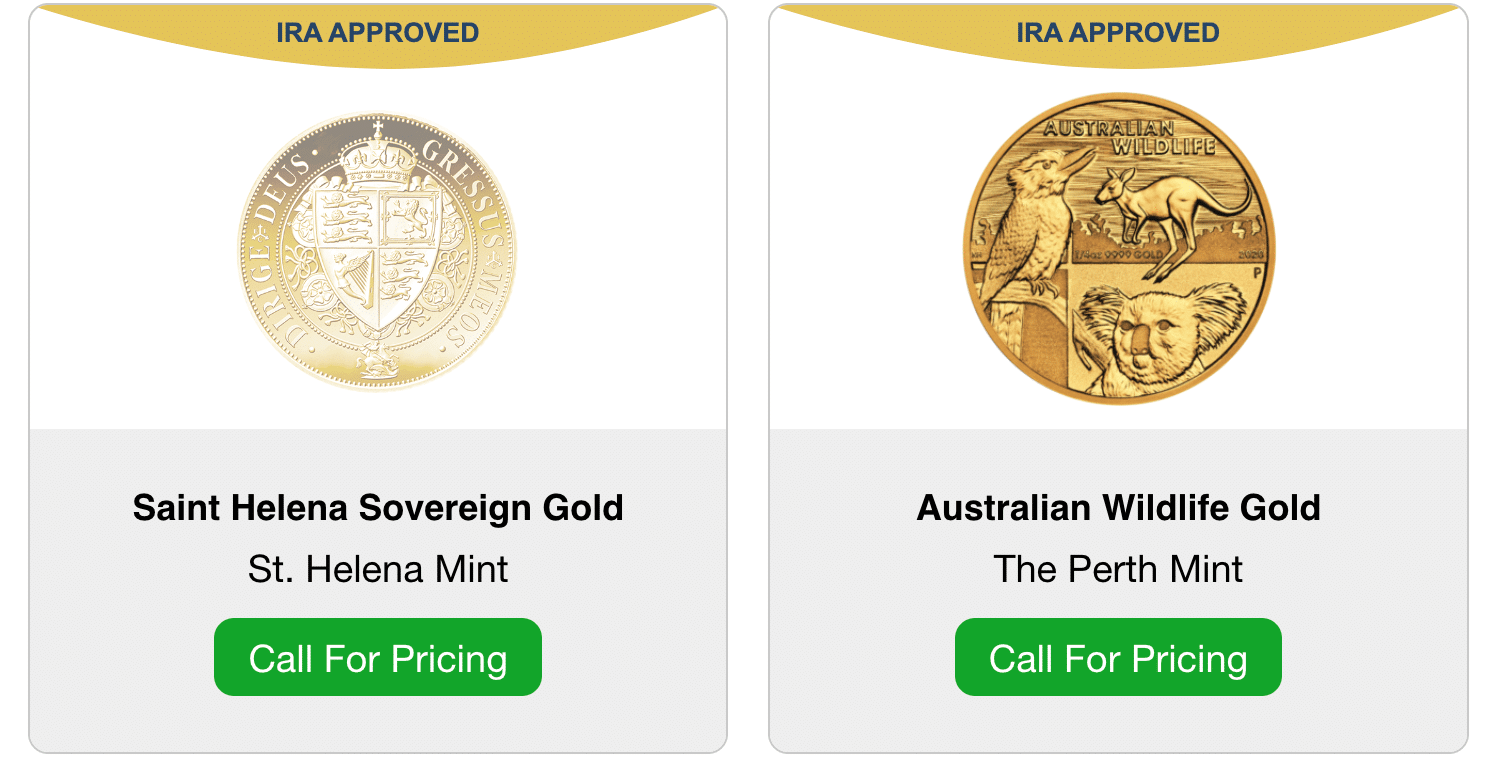

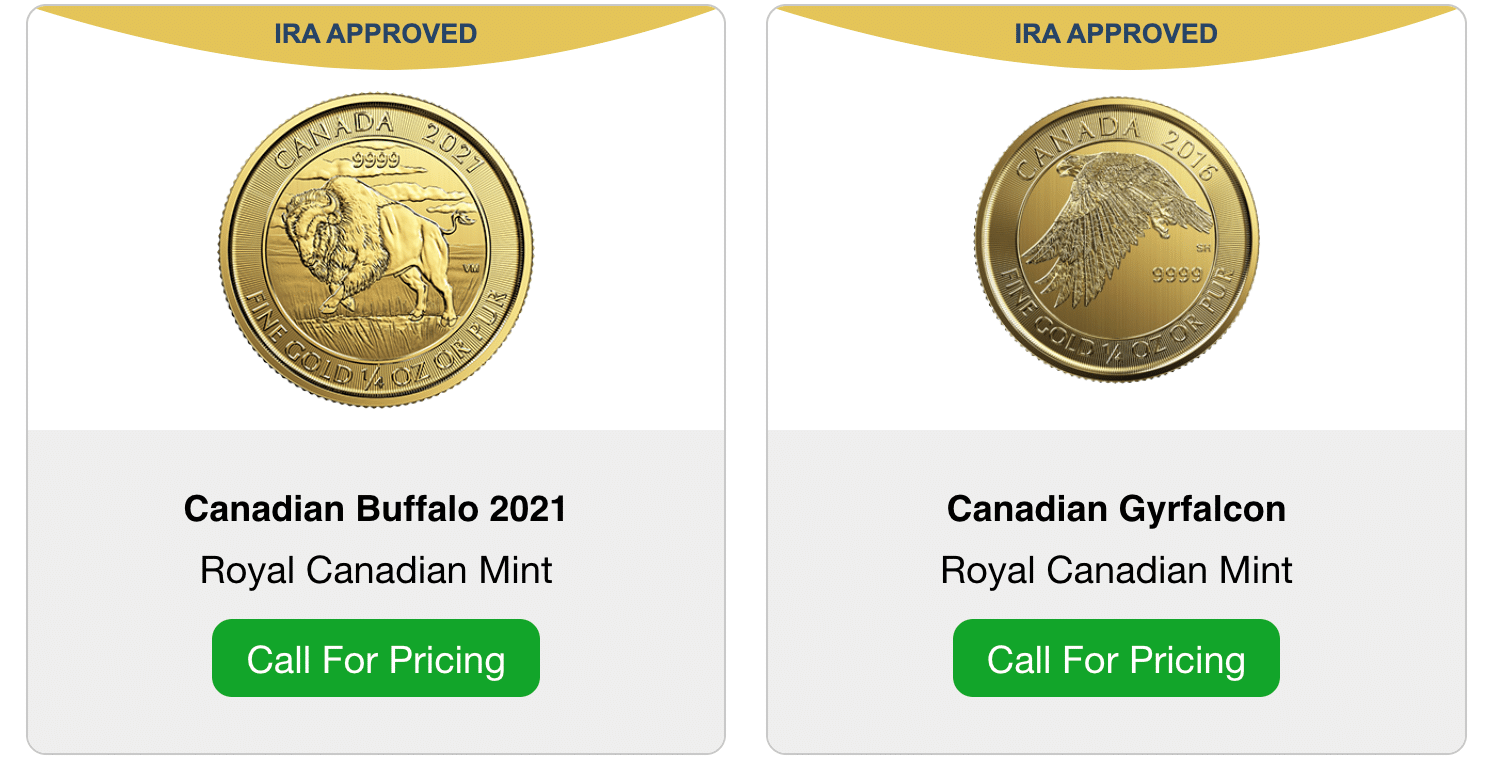

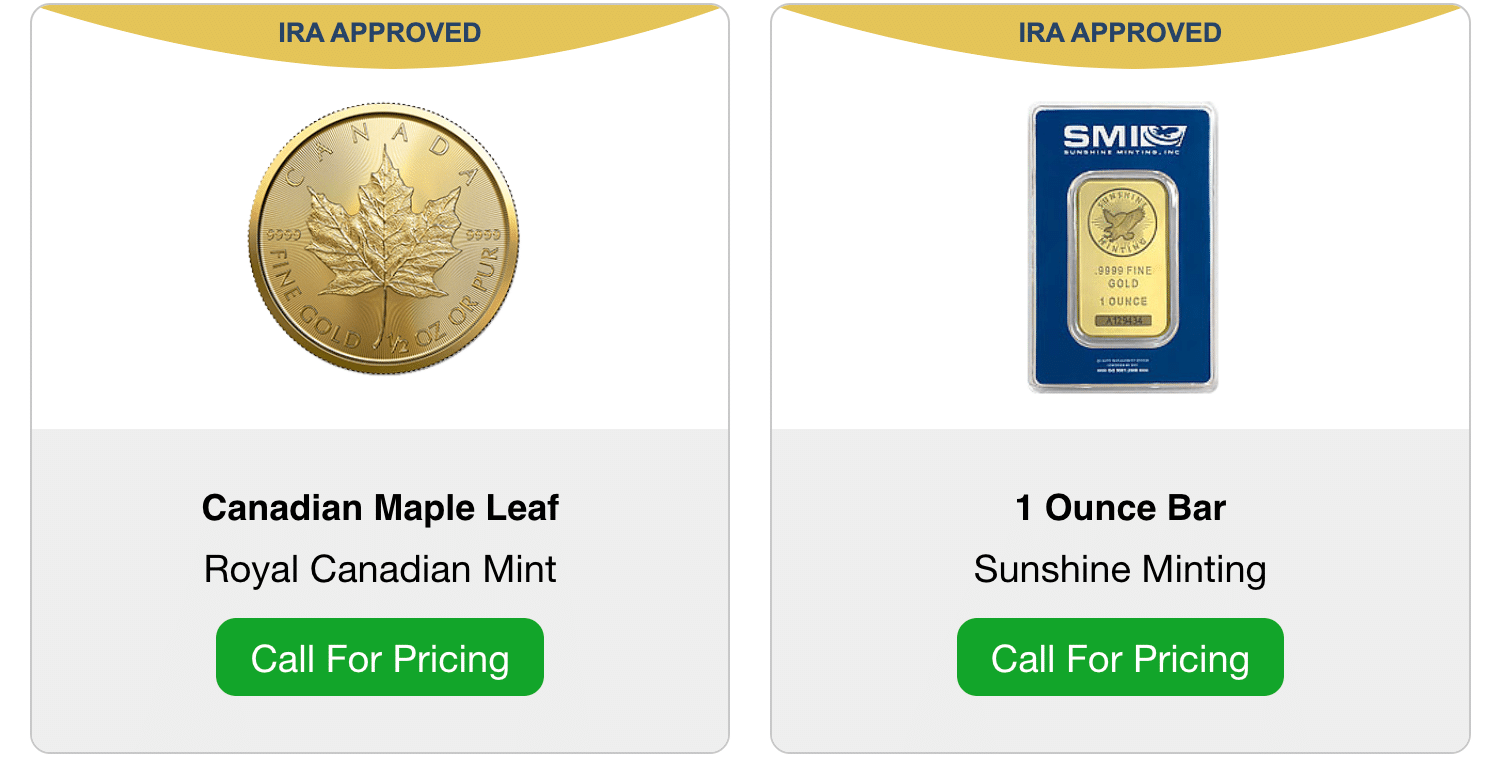

American Hartford Gold offers a comprehensive selection of gold bullion and coin products. Gold bullion typically consists of gold bars or ingots produced with a purity of .9999 fine gold. These bars are available in various weights, ranging from 1 gram to 1 kilogram or even more significant. Investors highly seek gold bullion bars due to their high purity and intrinsic value. They ensure the authenticity and quality of the products by sourcing gold bullion from reputable refineries and mints worldwide. Investing in gold bullion can be an effective means of preserving wealth and diversifying investment portfolios. In addition to gold bullion bars, AHG offers a diverse range of gold coins. Gold coins hold not only precious metal value but also possess historical, cultural, and numismatic significance. Recognized government or private mints mint these coins, which frequently have a face value in addition to their gold content. Their coin selection is more diverse than most competitors, and each product is described in intricate detail. We have American Eagles, American Buffalo, Canadian Maple Leaf, and Canadian Gyrfalcon. Gold coins like the American 1984 US Commemorative, IRA-eligible Canadian and Australian coins, and 18th and 19th-century numismatics pieces.

These coins appeal to collectors and investors, combining the beauty of gold with the artistic and historical appeal of the designs.

As for gold bars, the currently available options are the 1-ounce Bar and the Valcambi CombiBar.

These coins appeal to collectors and investors, combining the beauty of gold with the artistic and historical appeal of the designs.

As for gold bars, the currently available options are the 1-ounce Bar and the Valcambi CombiBar.

Silver

American Hartford Gold recognizes the value of diversification beyond gold and offers a range of silver and other precious metals products. Silver bullion bars and coins are among the options accessible for customers looking to explore investment opportunities beyond gold. The silver coins available in their inventory range in weight from 1oz to 5oz. They offer extensive selections of customizable silver products, including popular choices like The Guardian 2 oz Silver, Saint Helena Sovereign Silver, and more.

Silver, like gold, has long been recognized as a store of value and a hedge against economic uncertainties, making it an attractive investment choice for those seeking to broaden their portfolios.

Silver, like gold, has long been recognized as a store of value and a hedge against economic uncertainties, making it an attractive investment choice for those seeking to broaden their portfolios.

Customizable Gold and Silver Products (American Hartford Gold Products)

American Hartford Gold also caters to customer preferences by offering customizable gold and silver products. These can include personalized gold or silver bars or coins featuring custom engravings or unique designs. Customization allows individuals to create memorable and meaningful gifts, commemorate special occasions, or add a personal touch to their precious metals holdings. AHG offers an extensive selection of customizable gold and silver products, including popular choices like Austrian Philharmonic, American Eagle Proof, and more.

AHG ensures that the customization process meets the highest quality standards and maintains the authenticity and integrity of the precious metals. By offering customizable products, they aim to provide a tailored and personalized experience for its customers.

AHG ensures that the customization process meets the highest quality standards and maintains the authenticity and integrity of the precious metals. By offering customizable products, they aim to provide a tailored and personalized experience for its customers.

Rate of Return, Fees, and Commissions (American Hartford Gold Products)

The American Hartford Gold company offers clients that utilize any of their gold IRA services competitive Annual Percentage Rates (APRs) that range from 2.5% to 5.0%. The company also provides numerous term options, such as long-term and short-term investments. Below are several account types and the annual percentage rates associated with them:Single Precious Metals Account Types (American Hartford Gold Products)

The following are rates related to the single account type.- Gold IRA investors are given a percentage rate of up to 3.0%.

- Silver IRA investors get a rate of 2.5%.

- For users who invest in IRAs for the platinum and palladium precious metals, percentage rates of 3.5% and 4.0% are provided, respectively.

Dual Precious Metals Account Types (American Hartford Gold Products)

The following are rates associated with account types with two precious metals as investment options:- Investors investing in Gold and Silver IRAs are provided a rate of 3.25%. For a Gold and Platinum IRA, a rate of 4.25% is provided.

- Gold and Palladium, IRA account types, have a rate of 4.5% associated with them.

- Investors of a Silver and Platinum IRA will receive a percentage rate of 3.75%.

- A percentage rate of 4.25% is associated with a Silver and Palladium IRA.

- Users who invest in Platinum and Palladium IRA account types will receive a 5.0% rate.

American Hartford Gold Prices and Fees (American Hartford Gold Products)

The prices associated with the coin provided by American Hartford Gold are not included on the company’s website. This is because the prices of gold fluctuate daily, and it’s understandable. Investors and clients can find out the prices of American Hartford coins through a company representative when they sign up for a guide on the company website. However, this section contains a typical range of costs for clients interested in investing in precious metals IRAs. This information is based on research and rates of other competitors in the market.- Startup fees: There are no startup fees associated with American Hartford Gold.

- Annual fees: These fees typically range from $75 to $300.

- Storage fees: The fees usually range from 0.5% to 1% of the value of the precious metal stored.

- Shipping fees: There are no shipping fees associated with American Hartford Gold.

- Transaction fees: For buying or selling precious metals, transaction fees typically cost $40.

- Termination fees: Termination processes incur an amount of $150.

How to Invest in American Hartford Gold Products

#1. Contacting American Hartford Gold

The first step to investing in American Hartford Gold Products is contacting the company directly. Individuals can accomplish this by visiting their official website. Potential investors may also contact their customer service team via phone or email. Their representatives can provide information, answer questions, and guide investors through the investment processes.#2. Consultation and Guidance

Once in contact with AHG, investors can request a consultation for personalized guidance on their investment needs and goals. Their knowledgeable representatives can provide insights into the various products offered, explain the potential benefits, and help investors make informed decisions based on their circumstances.#3. Opening a Gold IRA

For individuals interested in a Gold IRA, AHG can assist in opening and establishing the account. This process typically involves completing necessary paperwork and complying with the directives regulated by the Internal Revenue Service (IRS) for self-directed IRAs. The company can provide investors with a guide on IRA custodians, storage options, and the steps essential to transfer or rollover existing retirement funds into a Gold IRA.#4. Purchasing Gold Bullion, Coins, and Other Products

Investors can buy gold bullion, coins, and other products offered by AHG. After selecting the desired precious metals, investors can proceed with the purchase. The company will provide instructions on payment methods, secure storage options, and shipping arrangements. It is essential to review the pricing, terms, and conditions associated with the purchase before finalizing the transaction. Throughout the investment process, AHG aims to provide a seamless and transparent experience for investors who wish to invest in their precious metals offering. They can offer expert guidance, assistance with paperwork and account setup, and ensure the secure delivery or storage of the purchased products. Investors are encouraged to consult with financial advisors or tax professionals to assess the suitability of investing in precious metals and understand the potential tax implications associated with specific investment choices.Benefits of Investing in American Hartford Gold Products

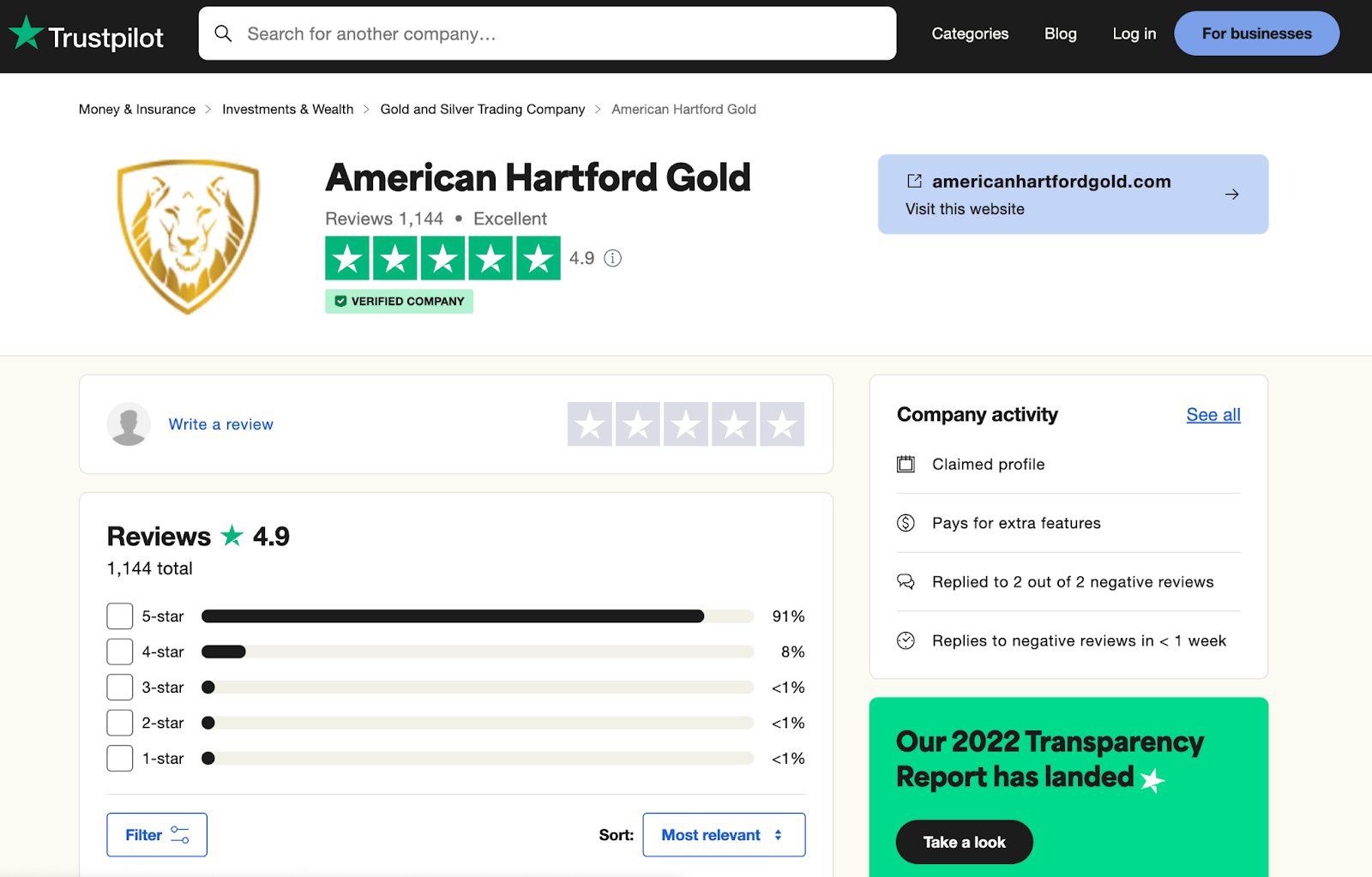

With over 60% of American households having at least one retirement plan, American Hartford Gold has provided its investors numerous benefits based on the thousands of 5-star ratings it has received on Trustpilot and Consumer Affairs. Here are some of the benefits of Investing in American Hartford Gold Products.#1. Diversification of Investment Portfolio

Investing in AHG Products offers the benefit of portfolio diversification. Adding physical gold, silver, and other precious metals to an investment portfolio can help reduce overall risk by providing an alternative asset class with a performance pattern different from that of traditional stocks, bonds, and real estate. Diversification can enhance portfolio stability and protect against market volatility.#2. Protection against Inflation

Precious metals, particularly gold, have historically been recognized as a store of value and a hedge against inflation. Investing in these precious metals allows individuals to safeguard their wealth by holding tangible assets that may retain their purchasing power over time. In times of rising inflation, the value of gold and other precious metals may increase, providing a potential shield against the erosion of purchasing power.#3. Hedge against Economic Uncertainty

During phases of economic uncertainty, investors often seek gold and other precious metals as a hedge against geopolitical tensions, market turbulence, and financial meltdowns. Investing in precious metals provides a safeguard against these factors. Precious metals have historically shown resilience in challenging economic environments, offering a haven for investors looking to protect their wealth from potential downturns.#4. Potential for Long-Term Growth

Over the long term, gold and other precious metals have demonstrated the potential for growth and appreciation in value. Investing in precious metals provides individuals with exposure to a market showing a historical track record of long-term price appreciation. As global demand for precious metals continues to rise, the value of gold and other precious metals may increase, potentially generating returns for investors. It is important to note that investing in precious metals, including those offered by AHG, carries risks and market fluctuations. It is advisable to consult with financial professionals and conduct thorough research before making investment decisions. However, the benefits mentioned highlight some advantages investors may consider when diversifying their portfolios with precious metals through AHG Products.Client Testimonials and Reviews of American Hartford Gold Products

Client testimonials and reviews play a crucial role in evaluating the reputation and quality of a company. Here is a few general feedback that clients have expressed about their products in the past from TrustPilot:

Client testimonials and reviews play a crucial role in evaluating the reputation and quality of a company. Here is a few general feedback that clients have expressed about their products in the past from TrustPilot:

- “I love not being pressured into getting something I did not want. My questions and concerns were taken seriously and used to guide me into my purchase” – Chris DeBakey.

- “Jack Oliver of AHG took the time to explain the processes involved in purchasing precious metals to fund my IRA. He is knowledgeable and was careful to ensure I understood everything he explained regarding a subject with which I needed more familiarity.

- “During several phone conversations over the last few weeks, he was very professional, thorough, and personable. As a bonus, he is a Brit, and I am the son of a Brit!! Cheerio then” – Gary Phillips.

- “Joseph Coles was my representative. He walked me through the process and explained the difference in the options available. This was my first time working with AHG, and I feel confident recommending their services.I look forward to working with them in the future” – Melissa H.

- “My interaction was with Jack Oliver… I’ve never had a more thorough and informative consultation. Jack was EXTREMELY knowledgeable about what my inquiry was about. He took his time to explain the entire process, which made my purchase extremely smooth. His callbacks were very timely, and there were no lengthy wait times. Nice job, Jack, and thank you for lowering my concerns about this purchase! American Hartford Gold is the best!” – Tim Gregory.