Noble Gold IRA FEES (Complete Pricing Guide)

What is Noble Gold Investment:

Noble Gold Investments is a precious metals investment company based in Pasadena, California, USA. The company was founded in 2017 by Collin Plume, a veteran in the precious metals industry with over two decades of experience.

Noble Gold Investments specializes in helping investors diversify their portfolios by investing in precious metals such as gold, silver, platinum, and palladium. Below is all you need to know about Noble Gold IRA Fees.

SUPPORT:

TEAM:

SECURITY:

PRODUCTS:

PRICING:

In addition to its investment services, Noble Gold Investments also provides educational resources for investors, including a blog and podcasts, to help them understand the benefits and risks of investing in precious metals.

The company has quickly gained a reputation for its exceptional customer service, transparency, and competitive pricing. It has been recognized as one of the fastest-growing companies in America by Inc. 5000 and has received numerous awards for its performance and customer satisfaction.

Noble Gold Investments has established itself as a reputable and trustworthy precious metals investment company that provides its clients with a personalized investment experience.

Noble Gold IRA Ratings and Trustworthiness

Noble Gold Investments has a reputation for trustworthiness and transparency in the precious metals investment industry. The company has an A+ rating with the Better Business Bureau (BBB) and has received numerous positive reviews from customers on various review platforms such as Trustpilot and Google.

Noble Gold Investments has also received recognition for its performance and customer satisfaction. In 2020, the company was named one of America's fastest-growing private companies by Inc. 5000, and it has received multiple awards from various organizations, including the 2021 American Business Awards and the 2020 Stevie Awards for Sales and Customer Service.

Additionally, Noble Gold Investments is a member of several industry organizations, including the Industry Council for Tangible Assets (ICTA) and the Professional Coin Grading Service (PCGS).

Overall, Noble Gold Investments is considered a trustworthy and reputable precious metals investment company with a strong focus on customer satisfaction and transparency.

Noble Gold Investments Pro and Cons

Pros:

Diversification: Noble Gold Investments offers a range of investment options that can help diversify an investor's portfolio, including physical bullion, IRA accounts, and cryptocurrency investments.

Customer Service: The company has a reputation for exceptional customer service, with many customers reporting positive experiences with their representatives.

Educational Resources: Noble Gold Investments provides educational resources for investors, including a blog and podcasts, to help them understand the benefits and risks of investing in precious metals.

Trustworthiness: The company has an A+ rating with the Better Business Bureau (BBB), and it has received recognition and awards for its performance and customer satisfaction.

Cons:

Higher Fees: Some investors may find that Noble Gold Investments' fees are higher compared to other precious metals investment companies.

Limited Availability: Noble Gold Investments is currently only available in the United States, which may limit its accessibility for international investors.

Potential for Losses: As with any investment, there is always a risk of losses, and investing in precious metals or cryptocurrencies can be volatile and subject to market fluctuations.

Noble Gold IRA FEES (complete pricing guide)

Physical Bullion

Pricing: Noble Gold Investments offers competitive pricing on physical bullion, including gold, silver, platinum, and palladium, based on the current market value of the metal.

Minimum Investment: The minimum investment for physical bullion purchases is $2,500.

IRA Accounts

Pricing: Noble Gold Investments charges a one-time fee of $225 for setting up a self-directed IRA account with their preferred custodian. Annual fees for the custodian of $80.

Minimum Investment: The minimum investment for an IRA account with Noble Gold Investments is $5,000.

Storage Fees: Storage fees vary depending on the type of metal being stored and how much metal is being stored. For example, keeping 1 ounce of gold would cost around $20 per year, while storing 10 ounces would cost around $60 per year. Silver storage fees are slightly lower than those for gold at around $15-$30 per year for 1-10 ounces, respectively. Platinum and palladium storage fees are also available but may be higher due to limited availability in some regions.

Transaction fees are charged whenever you buy or sell precious metals through Noble Gold's platform. They do not charge additional markups or commissions on top of spot prices, so you know exactly what you're paying for your investments upfront before committing funds into your account balance.

Noble Gold offers competitive fees and pricing for its services, making them an attractive option for investing in precious metals. Moving on, let's explore the benefits of investing with Noble Gold.

On the IRA side, they have one of the best fee structures in town. On the dealership side, we are left wanting with no price listing for any of their products. The Royal Packs are the only exception, but a complex one because this product doesn't reveal the products inside them. More on that later.

Here are the Noble Gold IRA Fees:

No charges to open the IRA - some sources say $2,000

$80 annual custodial fee

$150 annual fee to store gold in either the Delaware Depository or Texas Bullion Depository

Some sources say that the silver IRA has an annual fee of $225 and a $250 fee for Texas storage

There is no markup listing when it comes to transactions made inside or outside of an IRA. Browsing through the company's many varied products only makes us wonder more how much of a premium they charge.

Noble Gold Investments Products and Services

Noble Gold Investments offers a wide range of investment options for those looking to diversify their portfolio. From gold bars and coins, silver bars and coins, palladium bars and coins, platinum bars and coins, 401(k) rollovers, and Gold IRA.

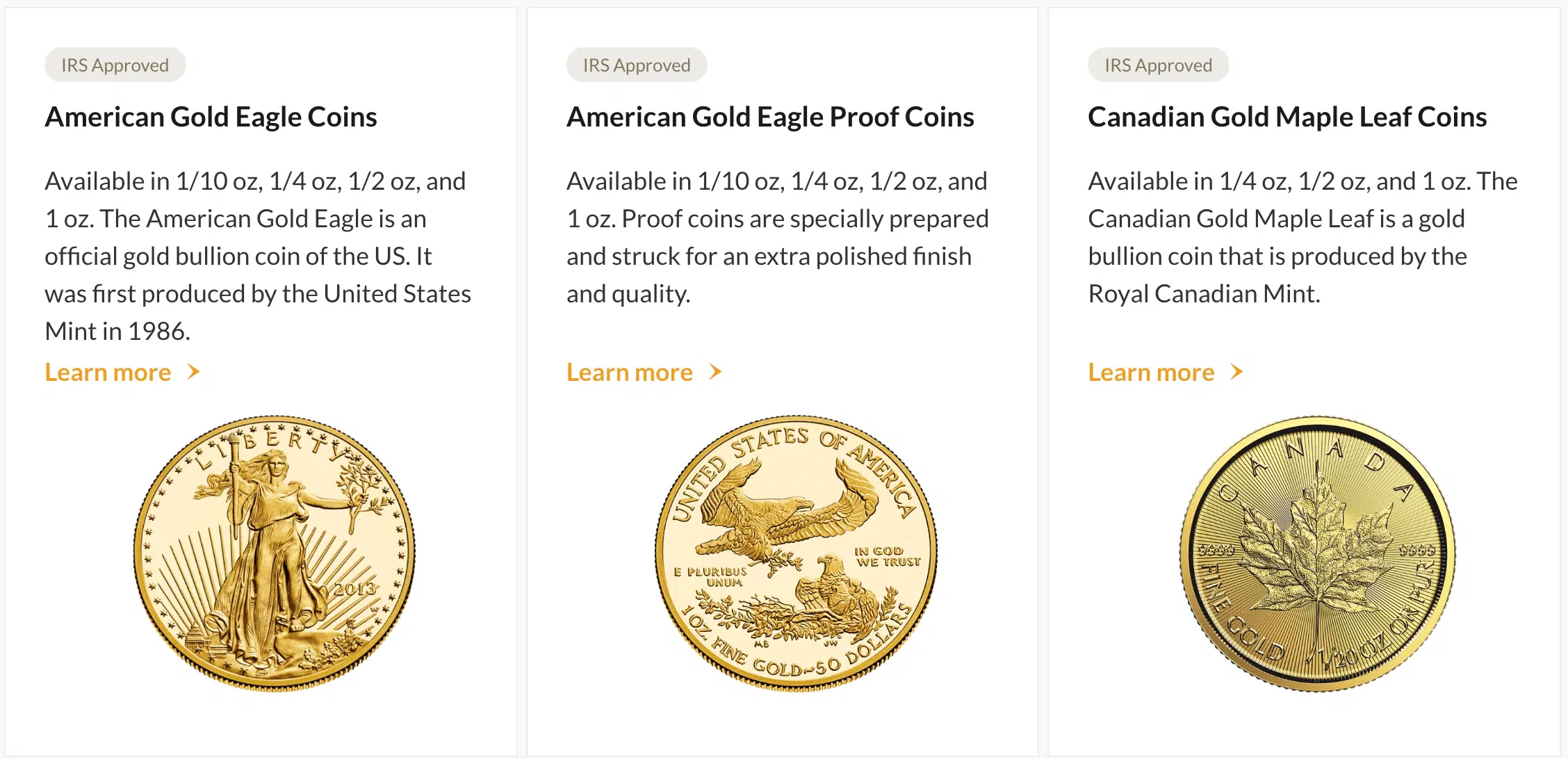

Noble Gold Investments provides a chance to purchase gold coins and bars, which are allowed in a precious metal IRA. When it comes to Noble Gold bars and coins, IRA eligibility is a primary goal. All of the gold coins currently available on the website have an “IRS Approved” tag on them.

Opening one of these accounts is now more accessible, with their precious metals custodian helping you every step, from creating an account to funding it and completing any rollovers needed. They even teach you how to buy gold for your IRA with their free gold ira guide.

They even assist you with the gold ira rollover process, making it easy to purchase precious metals and all of the tax benefits you get when you work with this Gold IRA service.

It seems that, when it comes to Noble Gold coins, IRA eligibility is a primary goal. All of the gold coins currently available on the website have an “IRS Approved” tag on them.

While some will find this convenient, it does exclude a few prominent gold bullion coins from the roster.

Those wanting to buy gold coins can start with American Eagle Gold coins in bullion and proof versions, each available in: 1 oz, 1/2oz, 1/4oz, and 1/10 oz denominations

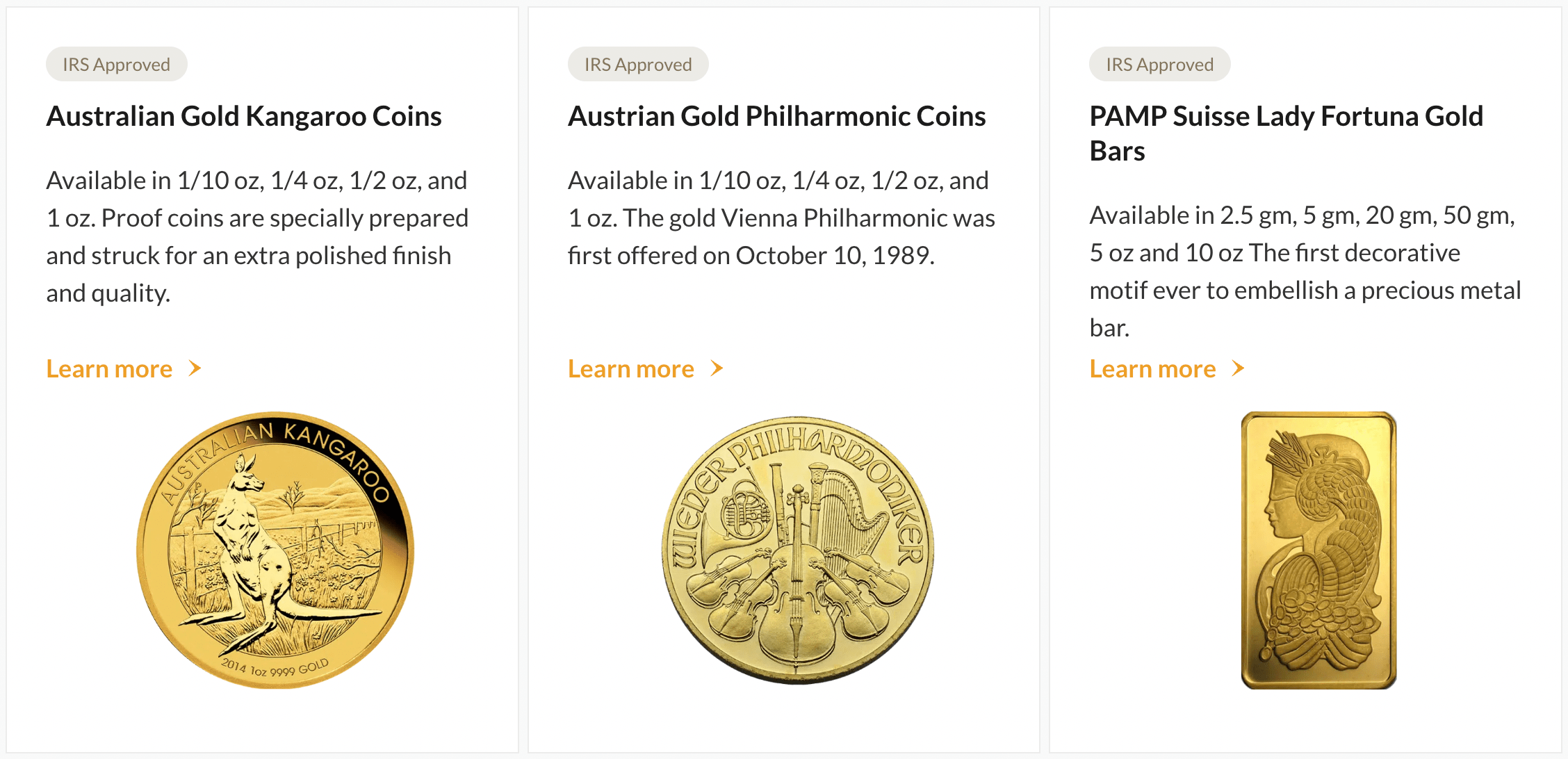

Plus, the Australian Gold Kangaroo coins in: 1 oz, 1/2oz, 1/4oz, and 1/10 oz

There are also the Canadian Gold Maple Leaf coins in: 1 oz, 1/2oz, and 1/4 oz

And the Australian Gold Philharmonic coins in: 1 oz, 1/2oz, 1/4oz, and 1/10 oz

As we said, a solid selection.

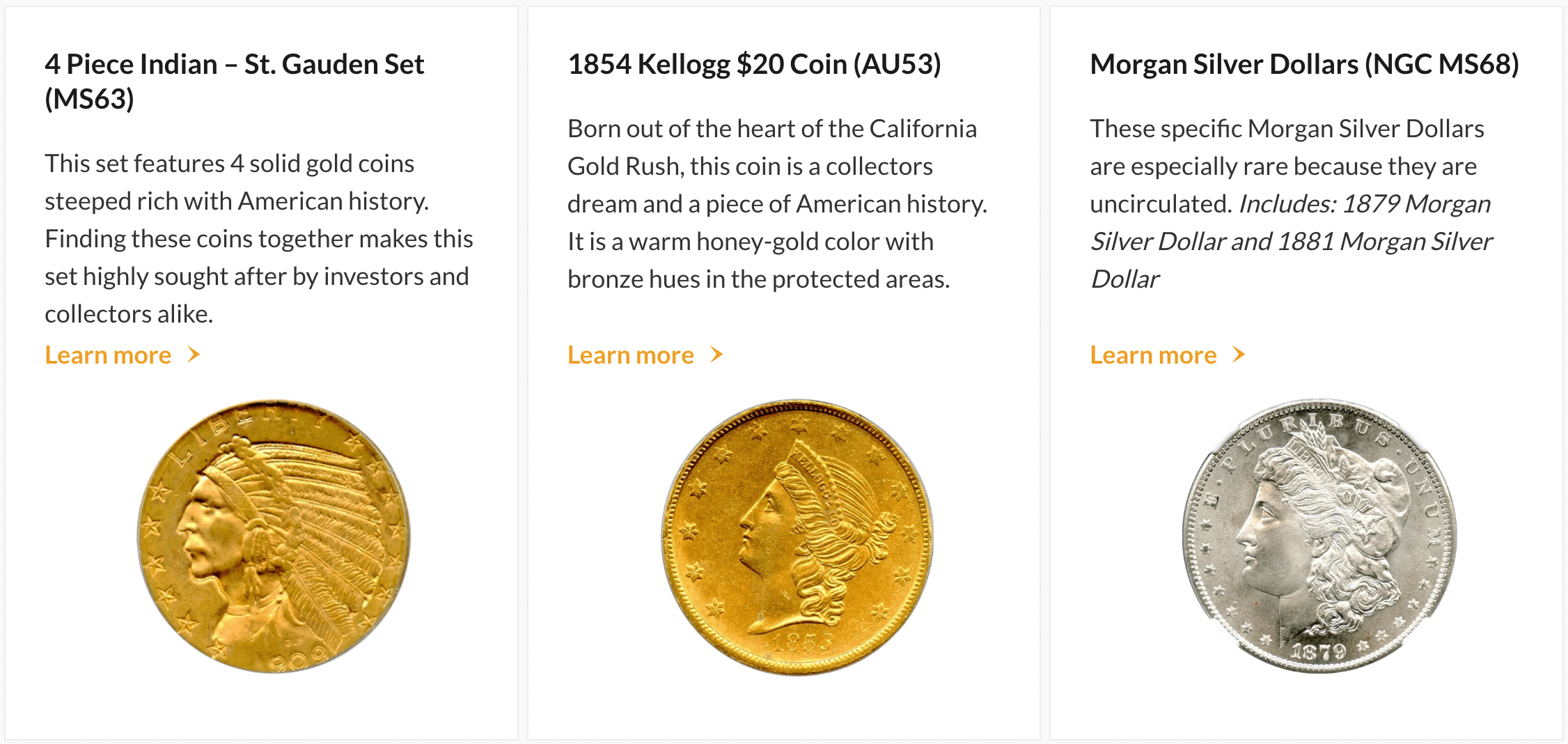

Noble Gold coins are also available in a 4-set American Gold Eagle Proof product option, which is likewise IRA-eligible. This is a fairly common offering for proof coins and coins that are considered collectibles in general.

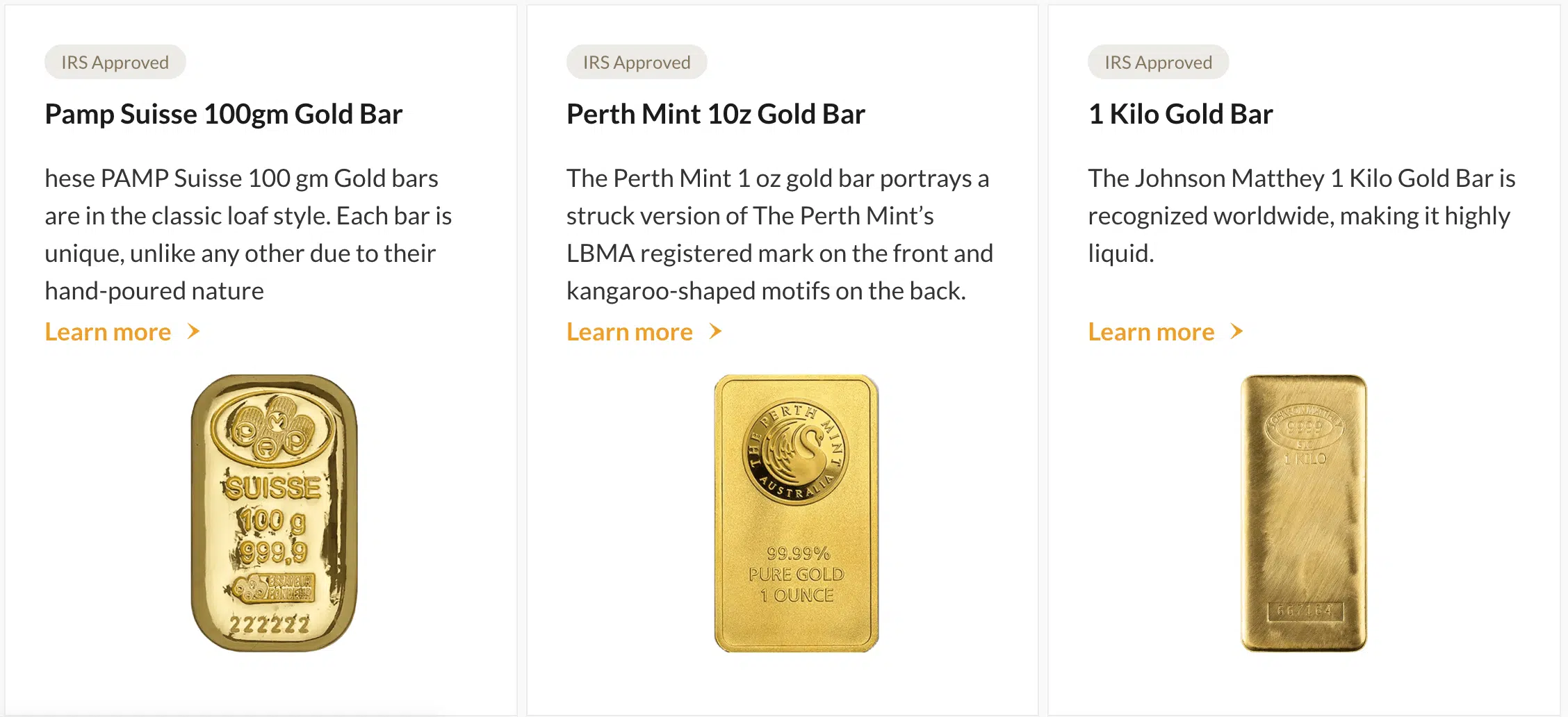

Gold bars available for purchase are the following: Perth Mint 10oz gold bar, Pamp Suisse 100-gram gold bar, and the PAMP Suisse Lady Fortuna gold bar in 2.5-gram, 5-gram, 20-gram, 50-gram, 5oz, and 10oz.

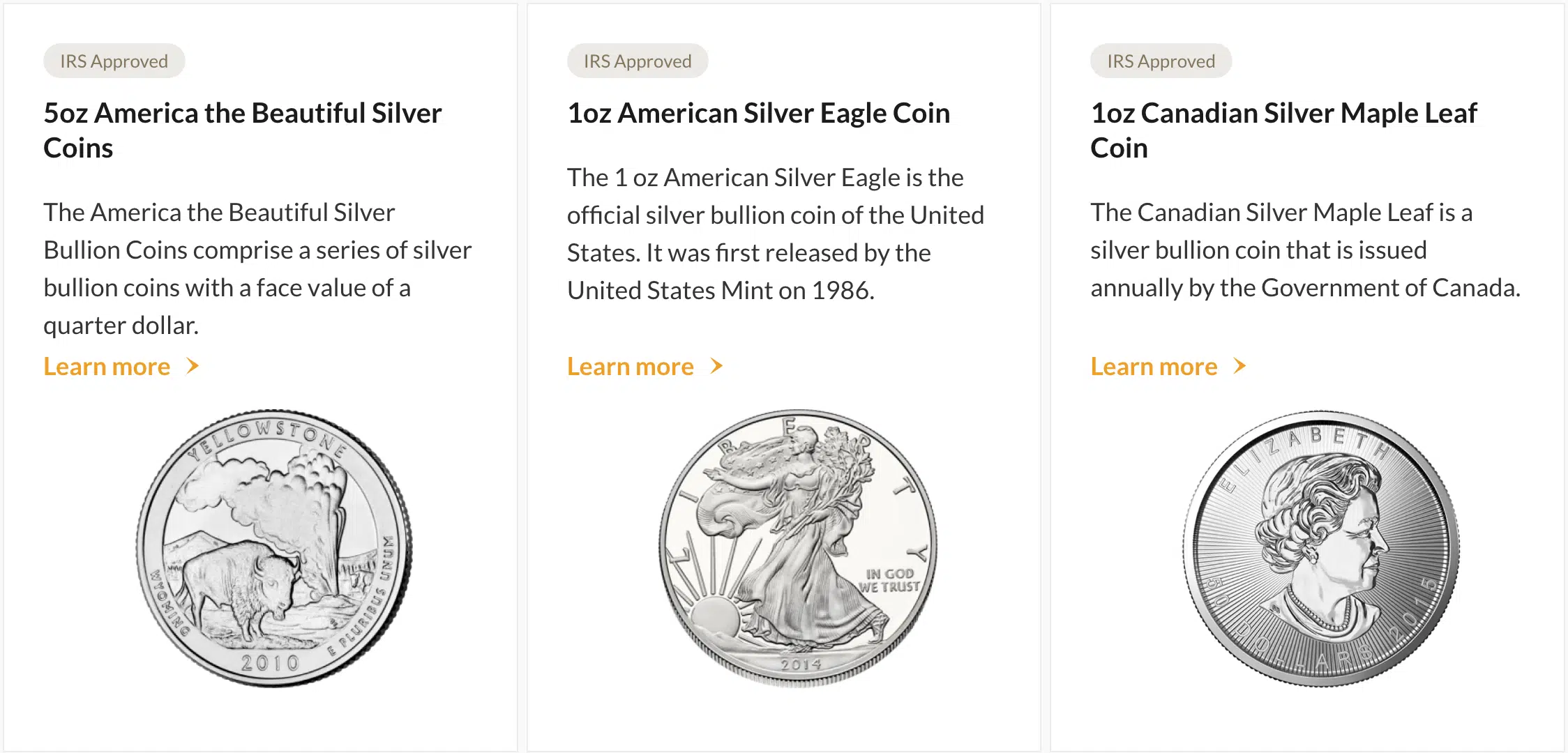

Silver IRA

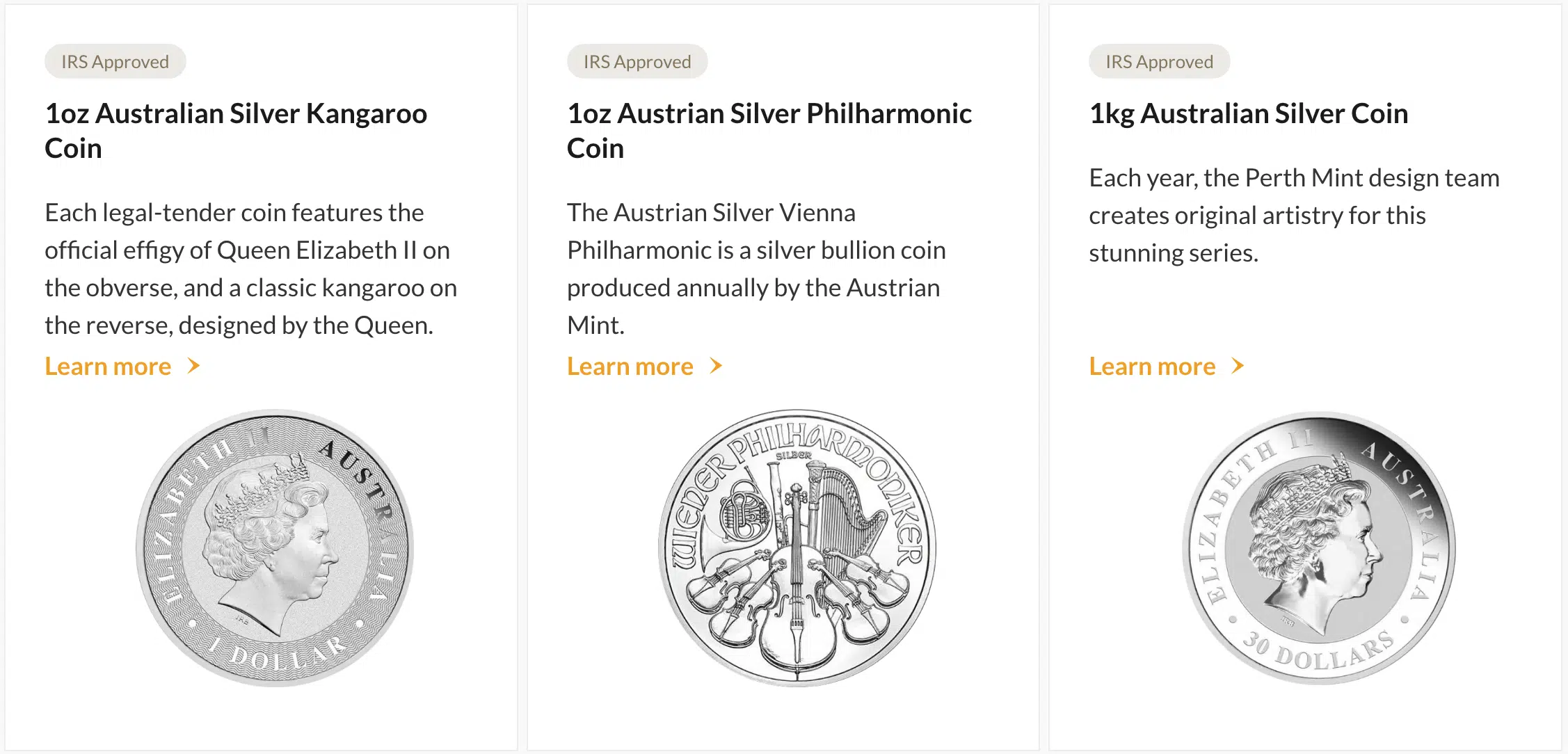

Noble Gold Investments does not disappoint when it comes to silver coins, either. Though it is not the strongest selection we have seen, it is far from limited.

In their silver collection, you can find silver coins such as:

1 oz American Silver Eagle Silver Coins, 5 oz America the Beautiful Silver Bullion Coins, 1 oz Canadian Maple Leaf Silver Coins, Australian Silver Kangaroo Silver Coins, And the 1 oz Austrian Silver Philharmonic Silver Coins

Buyers of silver Noble Gold coins can also opt for the proof version of the American Silver Eagle, which comes in special packaging and a special price tag to boost.

A very curious addition to the coin selection is the 1-kilo Australian Silver Coin. While this coin is indeed part of Perth Mint’s standard mintage, you will rarely see it in a domestic bullion vendor’s inventory, as it is quite massive. Curiously, there are not that many rounds available, with only the 1oz Highland Mint Silver Round listed.

Additionally, Noble Gold offers the 5 oz Silver Bar, the 10oz and 100 oz Republic Metals Silver Bar, and the 1oz Rand Refinery Silver Bar in the silver category.

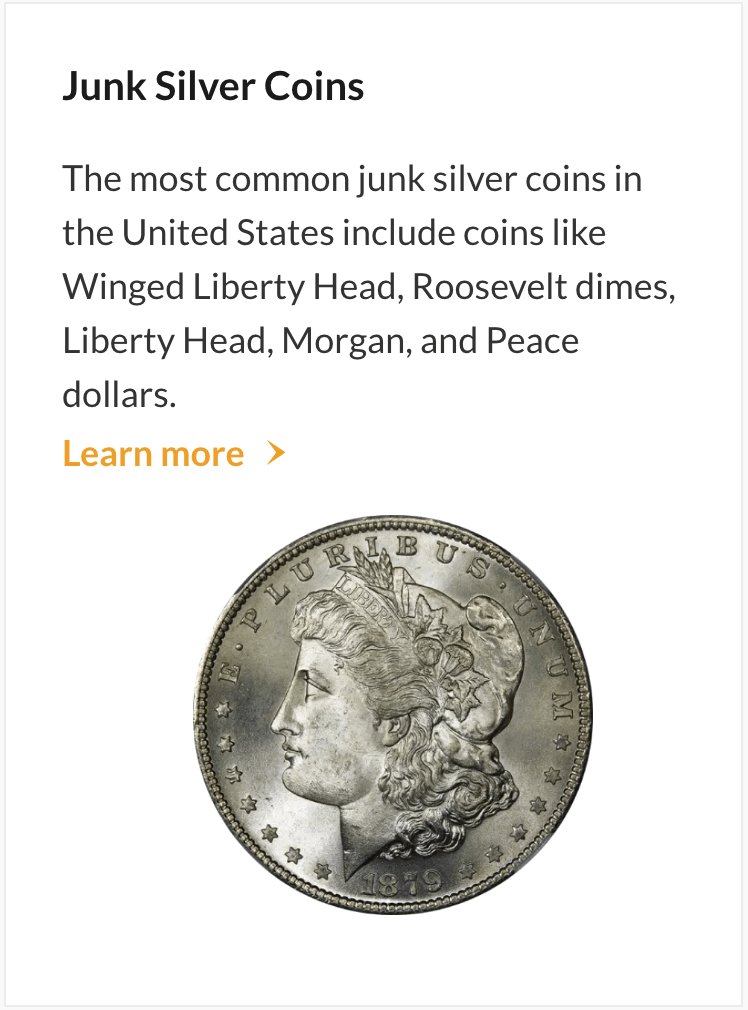

Noble Gold also sells plenty of so-called “junk silver” coins, labeled that because they do not meet the purity requirements for IRA placement. Nonetheless, they are very popular among coin enthusiasts and can often fetch high prices.

Noble Gold Platinum Coins And Bars

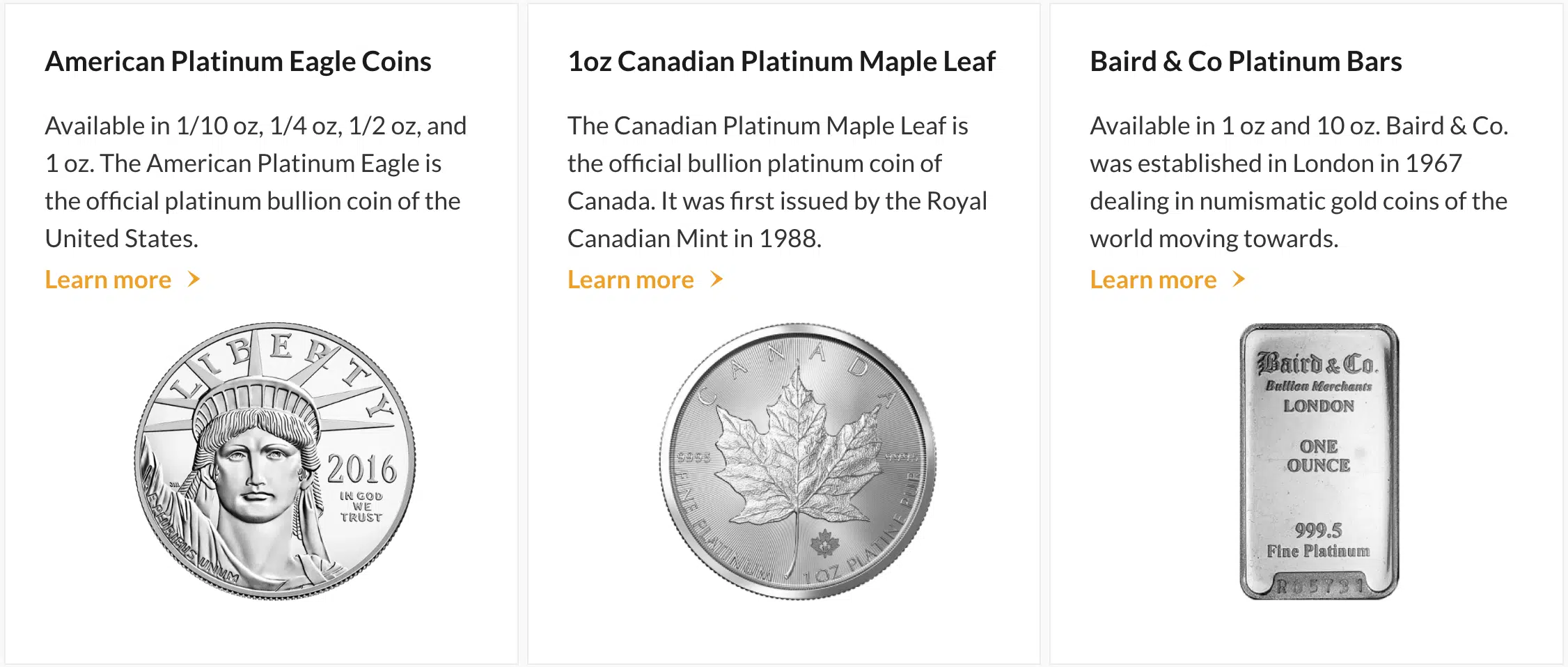

It would be fair to say that the offering of Noble Gold coins of the platinum variety is as strong as it can be, given that platinum group metals are a fairly recent addition to coin mintage.

American Platinum Eagle coins are available in:

1 oz, 1/2oz, 1/4 oz And 1/10 oz denominations

Once again, showcasing the strength of the product offering. Furthermore, buyers can opt to purchase the 1 oz Palladium Maple Leaf coin.

For platinum, customers can choose between the 1oz and 10oz Baird & Co Platinum Bar.

For some reason, neither of these is listed as IRA-eligible despite being that. Is that an oversight, or do Noble Gold retirement accounts not accept these coins?

We will let their representatives demystify this.

Noble Gold Palladium Coins And Bars

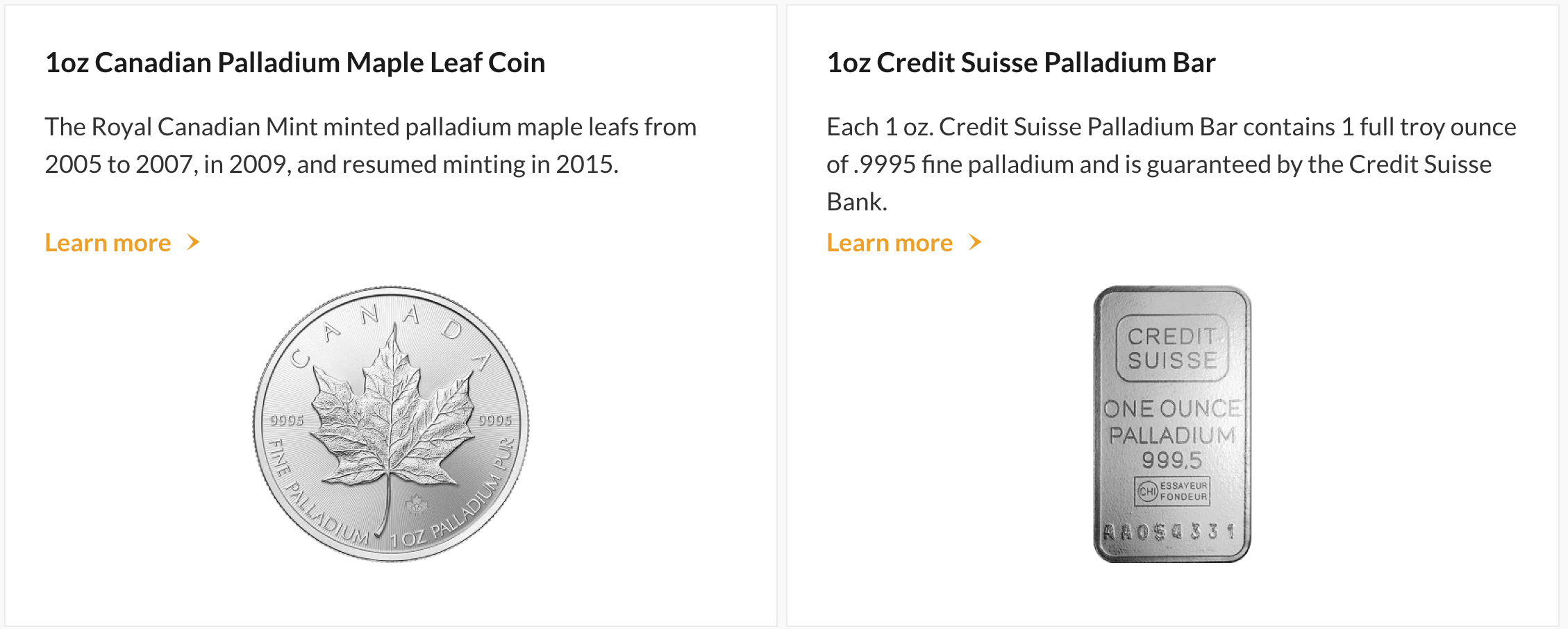

Though it is not the only palladium coin available generally, the 1 oz Canadian Palladium Maple Leaf coin stands as the sole entry in this category.

The only palladium bar available is the 1 oz Credit Suisse Palladium Bar.

Again, there is no note listing this coin as IRA-eligible, even though, like the platinum ones, it does meet the purity requirements.

Noble Gold Rare Coins And Bullion Bars

One area where IRA-centered precious metals dealers can disappoint is bullion bars. If and when they are available, they will usually be made in a single weight and only from sovereign mints.

Noble Gold Survival Pack

An undoubtedly quirky part of the company’s operations is the Noble Gold Survival Packs. This product offering seems to be almost as prominent as gold IRAs and individual bullion purchases.

So, what is it?

In short, it is a selection of high-quality bullion meant for “disaster scenarios.” The website makes it very clear that you should be prepared if disaster strikes, even citing war as one of the options. It is a bit of a novelty approach when most competitors are focusing on things like inflation and economic crashes.

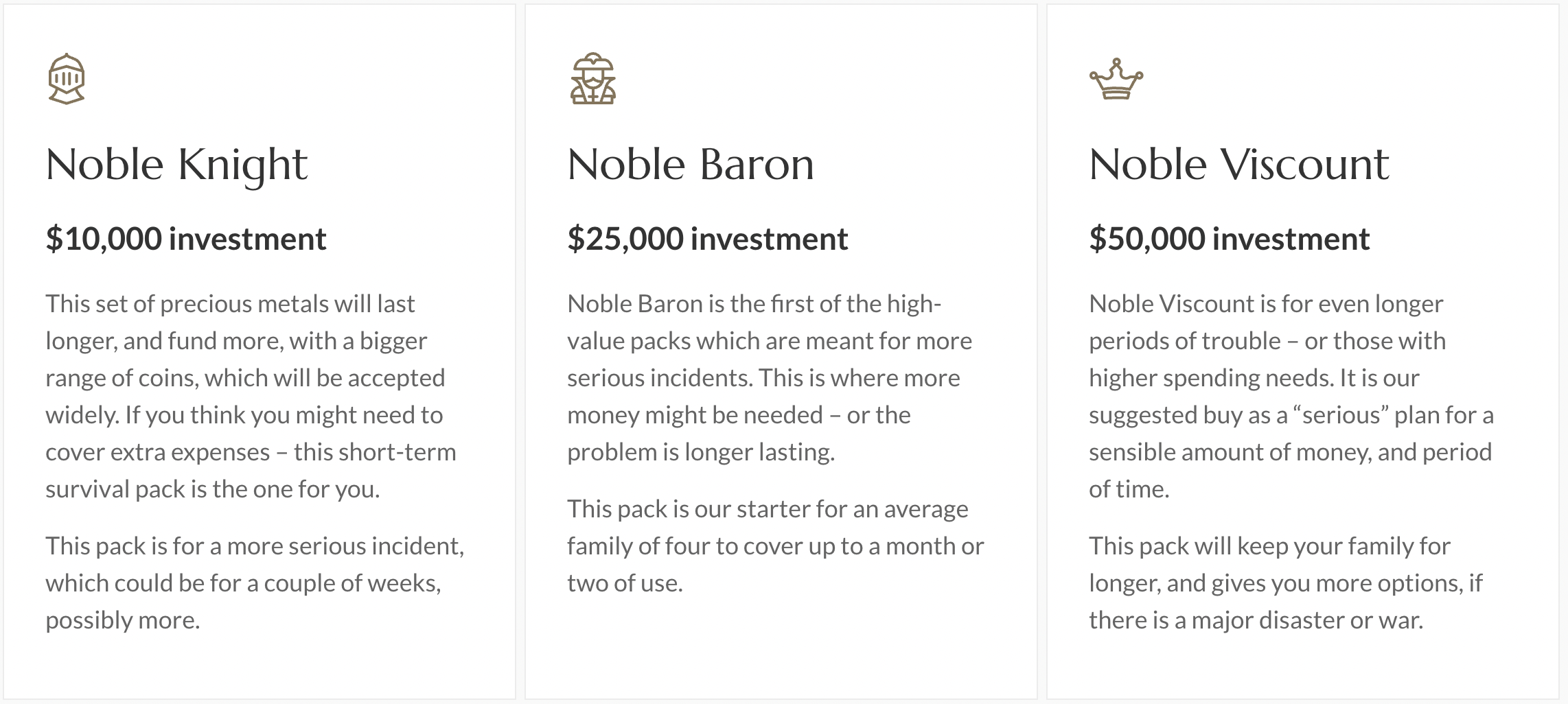

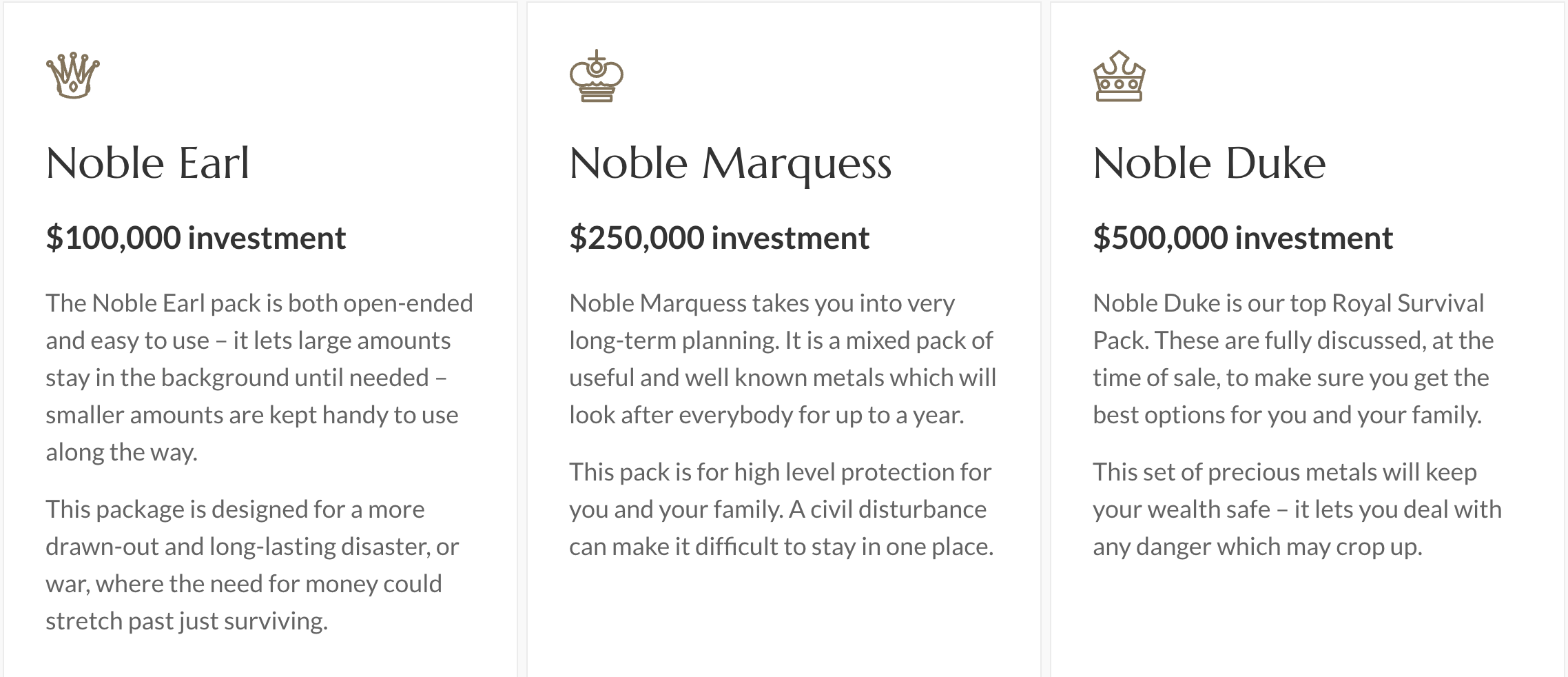

The packs are as follows:

$10,000 Noble Knight, $25,000 Noble Baron, $50,000 Noble Viscount, $100,000 Noble Earl, $250,000 Marquess, $500,000 Noble Duke.

Noble Ambassador an option for offshore clients that want to safely hold precious metals in the US and payable with cryptocurrency alongside standard methods

If nothing, these serve to educate us on the titles of so-called royalty. Did you know Earl is higher than Baron? We did not.

The website does not tell us which precious metals are included but rather instructs us to reach out to them for details. Presumably, it is a combination of either just gold and silver or all four precious metals with a focus on bullion as opposed to collectibles that have a markup.

After all, if disaster strikes, you might not be able to explain to the buyer that your rare silver coin has more value than its precious metals content. While the lack of disclosure is not ideal, we do not doubt that the metals in these packs are of high quality.

The Noble Gold Survival Packs are the most curious product listing that the company has, and that says a lot since they have a 1-kilo coin in their inventory.

These are also the only products that have an upfront price listing:

$10,000 Knight, $25,000 Baron, $50,000 Viscount, $100,000 Earl, $250,000 Marquess, and $500,000 Duke.

What are they? It seems they're an assortment of quality bullion, both coins and bars but perhaps rounds as well. That's where our certainty ends. What's in each of the packages?

Noble Gold assures us that the bullion is high-quality, and we don't doubt it, but with such price tags, customers might want a better idea of what's under the hood.

All of these, except the Duke, seem predetermined; that is to say, Noble Gold chooses the bullion inside and not the customer. It's also unclear whether some contain platinum and palladium or if it's just gold and silver.

As for the product appeal, these are meant to act as a kind of disaster fund.

Noble Gold offers to either ship them to you or have them stored in a third-party facility (depository). While the choice is good to have, is there really a point to having your bullion stored in another state once the bombs start falling, a scenario Noble Gold is quick to outline?

There is also the Noble Ambassador pack for foreign customers presumably wanting to seek refuge in the U.S. if their own nation experiences some sort of calamity. Although gold investing always appeals to people expecting the worst, we have to think that something below $10,000 would be more alluring to this customer base.

Noble Gold Investment Verdict?

Based on the information available, Noble Gold Investments appears to be a trustworthy company. They have an A+ rating with the Better Business Bureau and have positive customer reviews on various platforms.

They also have a transparent approach to fees and charges and offer educational resources to help customers make informed investment decisions. However, as with any investment company, it is important to do your own research and due diligence before investing your money.

You should review the company's history, reputation, and track record, as well as the fees and charges associated with their services. It is also important to understand the risks and potential rewards of investing in precious metals, as the value of these assets can fluctuate greatly depending on market conditions.

In summary, while we cannot definitively determine whether any company is 100% trustworthy, Noble Gold Investments appears to have a good reputation and a transparent approach to doing business, which are positive indicators of trustworthiness.