Latest 13 Best Gold IRA Companies You Must Know In 2025

Best Gold IRA Companies:

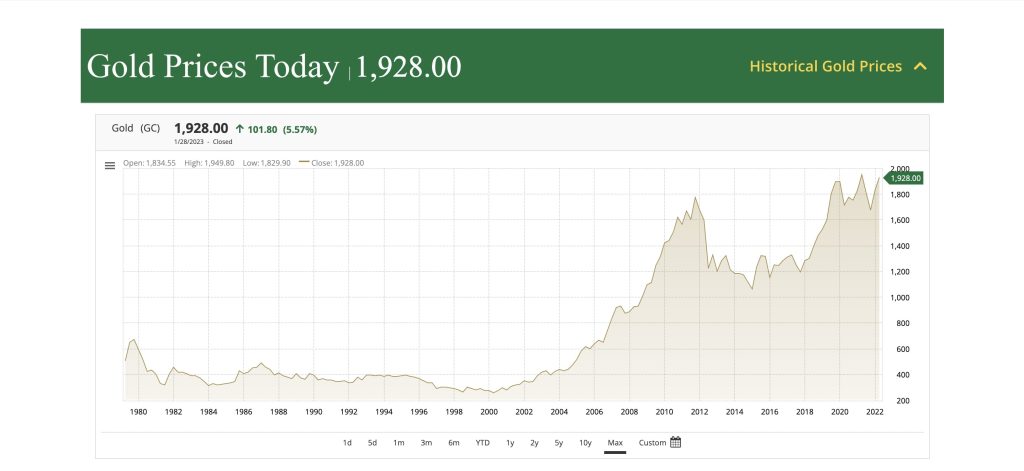

With the stock market’s ever-present volatility, most retirement investors are turning towards gold IRAs, which have continuously shown stable and steady market growth. Gold IRAs permit diversifying retirement portfolios through investing in precious metals.

Knowing that your future financial security may be at stake, there are various factors to consider when choosing a Gold IRA company. The most important considerations should be your chosen company’s integrity and reputation; researching and reading reviews from past clients is one good way to start.

This article will enlighten you on Gold IRAs and how to invest in gold and share some tips. We will also share our 13 top picks for the best gold IRA companies you can invest in based on their ratings from the Business Consumer Alliance (BCA) and Consumer Affairs.

What is a Gold IRA? (Best Gold IRA Companies)

Gold IRA is an individual self-directed retirement account for holding only precious metals. Unlike traditional IRAs designated to hold paper assets, Gold IRA accounts hold only approved precious metals like gold in a secured depository.

Unlike traditional IRAs, gold IRAs are usually self-directed. This means that they can be diversified into other investments, like real estate. Opening and managing a gold IRA account means sourcing the services of a Gold IRA company for proper management, purchase, and storage of the precious metals.

Some standards and guidelines exist to determine if bullion or coins will be accepted and deposited into a Gold IRA account. Only certain gold coins are approved for deposit. The Canadian Maple Leaf and the American Gold Eagle are examples of these gold coins accepted for account deposits.

How Does Gold IRA Investment Work? (Best Gold IRA Companies)

You can either buy gold bullion or sovereign coins as they are both valued and can be deposited as a Gold IRA. Although sovereign coins are more accessible to trade and sell at higher prices than bullion, you can get a beneficial buy-back policy if you choose a good company for your investment.

Gold IRA is like every other individual retirement account, except that the approved investment is gold or other precious metal. You can start a Gold IRA investment with as low as $5,000 or more. You can also open a Gold IRA retirement account with a rollover from an existing IRA. The metals for an IRA account are purchased through a Gold IRA company or any reputable gold dealer.

After opening an account and purchasing a precious metal of your choice, they store it in a secured depository where a custodian or trustee will be assigned to manage the account. These custodians may be credit unions, banks, loan associations, trust companies, or other approved organizations. Although Gold IRAs can be complicated, finding a credible and trustworthy company that matches your retirement goals would be a plus to help diversify your portfolio and start your journey into Gold IRA investments.

Best Gold IRA Companies (Best Gold IRA Companies)

After careful research and screening from customer reviews based on transparency, fees and price, ease of opening an account, and educational resources, here are our top 13 Gold IRA companies for investments.

#1. Augusta Precious Metals (Best Gold IRA Companies)

Opened in 2012, Augusta Precious Metals is a family-owned business in Beverly Hills, California, United States. Although they offer only gold and silver for purchase and IRA, they provide an attractive opportunity for easy IRA rollovers. They do not charge management fees because accounts are self-directed.

Augusta Precious Metals has earned top-notch ratings and reviews from reputable Consumer Rating Agencies, including the Business Consumer Alliance and Consumer Affairs. These reviews and ratings prove they are credible and undoubtedly one of the best Gold IRA companies.

They work in tandem with the Delaware Depository for their customer storage needs, offering top-notch services. Although purchases are not made online, they provide full customer support with the necessary paperwork.

Investment Costs (Best Gold IRA Companies)

Augusta Precious Metals accepts a minimum of $50,000 on investment. Alternatively, you can reduce this cost by transferring from an existing 401(k) or IRA. They also charge a one-time account opening fee of $50, an annual depository fee of $100, and a yearly custodian fee of $100.

This means that the total annual charge for the first year of investment is $250. Afterward, it will be reduced to $200.

Benefits of Investing with Augusta Precious Metals (Best Gold IRA Companies)

Here are some potential benefits of investing in this company.

- They offer fair pricing that comes with 7-day price protection.

- They have a vast selection of precious metals, and Gold IRAs are available.

- They offer extensive educational resources for their customers.

- They work with the Delaware Depository, which has gained IRS approval for their storage services.

- New customers are entitled to a 100% money-back guarantee.

- They offer a highly straightforward and transparent pricing scheme and fee structure.

- They also have an excellent buy-pack policy.

#2. Goldco Precious Metals (Best Gold IRA Companies)

Founded in 2006 with their office in Tarzana, California, United States, Goldco Precious Metals has built a profound reputation from its superior customer support. In addition to their top-notch customer support, they provide a wide range of educational resources for clients, such as ebooks and instructional videos.

Receiving a 5-star rating from Consumer Affairs and an AAA rating from Business Consumer Alliance, Goldco Precious Metals is one of the top picks for Gold IRA companies. Account opening is easy, and customers receive assistance from an assigned company representative throughout the process. They offer IRAs and 401(k) rollovers to transfer already-existing retirement funds.

Investment Costs (Best Gold IRA Companies)

Goldco charges a one-time account opening fee of $50 and an annual $80 storage fee. They also charge a segregated alternative storage fee of $150 and a non-segregated alternative storage fee of $100.

Benefits of Investing with Goldco Precious Metals (Best Gold IRA Companies)

Here are some potential benefits of investing in this company.

- Goldco Precious Metals offers its clients extensive educational resources.

- New accounts receive 10% free silver coins back.

- They work with Delaware Depositories, Brinks Salt Lake City, and International Depository Services Group for storage services.

- They offer a competitive pricing system.

- Silver and Gold IRAs are available.

#3. Birch Gold Group (Best Gold IRA Companies)

Located in Burbank, California, United States, Birch Gold Group is a privately owned company specializing in educating its customers on the benefits of diversifying their savings. Founded in 2003, it also assists customers in opening retirement accounts and offers private placement, consultancy, and asset management services.

With a 5-star rating and impressive reviews from Consumer Affairs and Business Consumer Alliance, Birch Gold Group is one of the finest gold IRA companies globally. With a team of professionals ready to assist customers through their investment process, this company prides itself on being an IRA specialist.

Investment Costs (Best Gold IRA Companies)

Birch Gold Group charges $80 annually for storage and $100 for insurance, making it a $180 annual fee. They charge $50 as an account opening fee plus a $30 wire transfer fee that you will incur. The minimum accepted IRA investment rate is $10,000.

Birch Gold Group will cover your first-year cost only for transfers above $50,000.

Benefits of Investing with Birch Gold Group (Best Gold IRA Companies)

Here are some potential benefits of investing in this company.

- They work with reputable companies like Delaware Depository and Brink’s Global Services for storage services.

- They offer transparent and straightforward pricing information.

- They offer a variety of IRS-approved metals for sale and investment.

- Gold IRAs are available.

- Educational resources for clients are made available.

- Clients can diversify their savings.

#4. Patriot Gold Group (Best Gold IRA Companies)

Founded in 2016, Patriot Gold Group is a private business and a precious metals dealer based in Los Angeles, California, United States of America. Offering over 25 different gold and silver coin options for sale, they have an outstanding history of helping retirement investors secure their investments through Gold IRA. These options include IRA-eligible coins, proof coins, bullion coins, and private coins.

Patriot Gold Group charges no extra commission as a direct dealer company when precious metals are bought through investor-direct pricing. Retirement IRA accounts can be set up in a day, and purchased precious metals are available for home delivery.

Patriot Gold Group is one of the best Gold IRA companies globally, with an AAA rating from Business Consumer Alliance, a five-star rating from Consumer Affairs, and other consumer rating agencies.

Investment Costs (Best Gold IRA Companies)

Although they do not list their sale prices online, you can find out more about the current value of their bars or coins by calling, emailing, or chatting with one of their representatives.

To start an investment with this reputable company, you must invest a minimum of $25,000. Accounts below the no-fee-for-life limits are charged a yearly fixed fee for storage, rollovers, and insurance.

Benefits of Investing with Patriot Gold Group (Best Gold IRA companies)

Here are some potential benefits of investing in this company.

- You can complete your investment application online through the help of an online representative.

- Gold IRAs are available.

- Although metals like silver and gold cannot be purchased online, you can add these products to your quote tool on their official website to ease the purchase process.

- When purchasing qualifying IRAs, no extra fees are charged. This means that the storage, rollover, and insurance fees for large Gold IRA investment accounts are reimbursed to the client.

#5. America Hartford Gold Group (Best Gold IRA Companies)

Located in Los Angeles, California, United States, the America Hartford Gold Group is a privately owned company that sells precious metals and helps customers set up IRA accounts. Their IRA investment options include Gold bars, American Gold Eagle coins, Silver Canadian Maple Leaf coins, American Gold Buffalo coins, and American Silver Eagle coins.

With an AA company rating and a 5-star review from Business Consumer Alliance, America Hartford Gold Group is on the list as one of the best Gold IRA companies. They also have a 5-star review from Consumer Affairs, earning them a credible reputation.

Investment Costs (Best Gold IRA Companies)

Opening a gold IRA account, rolling over a retirement account, and shipping precious metals are charge-free. The amount charged for deposits depends on the investment type.

For other investment costs, visit their website and contact an online customer representative.

Benefits of Investing with America Hartford Gold Group (Best Gold IRA Companies)

Here are some potential benefits of investing in this company.

- They offer an impressive buy-back policy with a guarantee.

- No shipping fee is charged for the purchase of precious metals.

- Gold IRAs are available.

#6. Noble Gold Investments (Best Gold IRA Companies)

Located in Pasadena, California, United States, Noble Gold Investments is a legitimate precious metals company with good customer satisfaction reviews from past clients. They offer a range of Gold IRA resources and work hard to maintain customer satisfaction. Young investors looking for a gold IRA company that accepts low investments can choose Noble Gold Investments.

With a 5-star rating from Consumer Affairs and an AA from Business Consumer Alliance, Noble Gold Investments is yet another reputation Gold IRA company. They offer charge-free consultations to clients and also provide extensive educational resources.

Investment Costs (Best Gold IRA Companies)

Noble Gold Investments charges an annual storage fee of $80 for Gold IRAs and an additional $150 annually for clients with Gold IRA accounts in Delaware and Texas.

Their minimum investment rate is $2,000, and the prices of their survival packs range from $10,000 to $500,000.

Benefits of Investing with Noble Gold Investments (Best Gold IRA Companies)

Here are some potential benefits of investing in this company.

- They offer transparency on their IRA fees.

- Precious metals are stored in secured Texas, Delaware, and Canada depositories.

- Their survival packs are open for home delivery.

- They offer numerous educational resources for their clients.

- They offer personalized but transparent services.

- Gold IRAs are available.

#7. Oxford Gold Group (Best Gold IRA Companies)

Located in Beverly Hills, California, Oxford Gold Group is a precious metals dealer that offers investment options like gold and silver IRAs. They offer competitive prices and a wide selection of self-directed retirement accounts.

Founded in 2018 and recognized by the Business Consumer Alliance and Consumer Affairs, Oxford Gold Group specializes in assisting clients in meeting their retirement goals by tailoring their investments strategically to meet their needs by purchasing precious metals.

Investment Costs (Best Gold IRA Companies)

Oxford Gold Group charges a $175 annual fee for accounts with less than $100,000 in savings and a $225 annual fee for accounts with over $100,000 in savings. No other fee is charged, although investors are responsible for paying for their gold or other precious metals purchased.

Benefits of Investing with Oxford Gold Group (Best Gold IRA Companies)

- No charge on account start-up

- Transparent fees

- Free Delivery of precious metals on purchase

- They offer rollovers from other retirement accounts into precious metal IRA accounts

- Gold IRA is available

- They offer a repurchase program with no extra fee charged

#8. Advantage Gold (Best Gold IRA Companies)

Founded in 2014, Advantage Gold is a rapidly growing company that has continuously earned its reputation, especially among first-time buyers. Located in Los Angeles, California, United States, Advantage Gold is widely known for its reliability, transparency, and top-notch customer support.

Having good reviews from other Consumer Rating Agencies, a 5-star rating from Consumer Affairs, and an AAA rating from Business Consumer Alliance, this young company has made its way to the top of the list as one of the best Gold IRA companies globally.

Although there is no specified amount for fees charged or investment costs, reviews from clients claim they offer welcoming amounts. They work in tandem with reputable companies like Delaware Depository and Brink’s Global Services USA, Inc., for their customer services, and their custodian is STRATA Trust Company.

Investment Costs (Best Gold IRA Companies)

There is also no specified amount for minimum investment, purchase fee, account opening fee, or annual storage fee. For more details on these values, contact the company or a representative.

Benefits of Investing with Advantage Gold (Best Gold IRA Companies)

Here are some potential benefits of investing in this company.

- They charge a low annual storage fee.

- They offer a straightforward fee structure.

- Gold IRAs are available.

- They offer extensive resources and educational materials that benefit first-time buyers.

- They also offer an excellent buy-pack policy, with opportunities for clients to make repurchases at the market price.

#9. Orion Metal Exchange (Best Gold IRA Companies)

Founded in 2017, Orion Metal Exchange is a full-service gold investment company and IRA group in Los Angeles, California, United States of America. Offering gold, silver, and palladium metals for sale and investment, they are among the best choices for small investors. They also provide storage options for any IRS-approved metal.

Although they charge an annual fee for storing and securing metals, no extra fee gets charged during purchase, transfer, or IRA account setup. You only get three years of fee-free storage on promotional offers and ongoing account management support.

With a 4.8 overall rating from over 168 reviews and Consumer Affairs, Orion Metal Exchange is one of the most reliable Gold IRA companies.

Investment Costs (Best Gold IRA Companies)

Although they do not release their online feed info, you can find out more about the current value of their bars or coins by calling, emailing, or chatting with one of their representatives.

To start an investment with this reputable company, you must invest at least $5,000. The minimum amount accepted for gold purchases is $268.

Benefits of Investing with Orion Metal Exchange (Best Gold IRA Companies)

Here are some potential benefits of investing in this company.

- You can complete your investment application online through the help of an online representative.

- Precious metals like gold, silver, and platinum can be bought online.

- Gold IRAs are available.

- Clients can physically possess and liquidate their metals.

- There is no extra fee charged for their buy-back policy.

#10. Red Rock Secured (Best Gold IRA Companies)

Founded in 2008, Red Rock Secured has an office in Southern California, United States. They specialize in self-directed IRAs and are known for their top-notch customer support and services.

Consumer Affairs and Business Consumer Alliance ranked Red Rock Secured as one of the best gold IRA companies. It offers only gold and silver IRA metals with a secured home delivery option. For approved home delivery, clients are expected to create an LLC and have an approved IRA storage facility for metal storage.

Investment Costs (Best Gold IRA Companies)

They accept a minimum investment of $10,000 on a Gold IRA. The annual storage fee charged ranges from $125 to $300.

Benefits of Investing with Red Rock Secured (Best Gold IRA Companies)

Here are some potential benefits of investing in this company.

- Clients can purchase precious metals for IRA investment or home storage with a home delivery option.

- Most purchases can be made online with customer support.

- Gold IRAs are available.

- They offer an available Thrift Savings Plan Option.

- Price protection is assured.

#11. Monetary Gold (Best Gold IRA Companies)

Founded in 2000 in Woodland Hills, California, United States, Monetary Gold specializes in silver and gold products. Clients can also open an IRA account with them, which will be funded with IRS-approved precious metals.

With good ratings from Consumer Affairs and an A rating from Business Consumer Alliance, Monetary Gold is one of the credible Gold IRA companies for investments. They also offer a variety of foreign coins, bullion coins, rare U.S. coins, and modern-proof coins.

Investment Costs (Best Gold IRA Companies)

They accept a minimum investment of $5,000 to $10,000 on a Gold IRA. Their annual insurance and storage fee starts at $100, and new clients get their precious metals shipped for free.

Benefits of Investing in Monetary Gold (Best Gold IRA Companies)

Here are some potential benefits of investing in this company.

- They work in tandem with the Delaware Depository for their depository storage.

- They offer charge-free shipping for new clients.

- They offer a variety of investment options.

- Silver and Gold IRAs are available.

#12. Freedom Shield Capital (Best Gold IRA Companies)

With its office in Santa Monica, California, United States, Freedom Shield Capital is a wealth preservation company founded in 2002. They specialize in alternative assets like silver and gold and offer self-directed silver and gold IRAs.

With good ratings and reviews from Consumer Affairs, Freedom Shield Capital is one of the best gold IRA companies for investments. Clients are then allowed to manage their accounts and are charged a one-time service fee with no extra commission.

Investment Costs (Best Gold IRA Companies)

Freedom Shield Capital charges a one-time service fee when an account gets opened and a free shipping fee for investments above $10,000.

Clients with $50,000 and above investments do not pay a storage fee. Investments below $50,000 will incur storage fees. Contact a company representative for more information on the minimum investment accepted.

Benefits of Investing with Freedom Shield Capital (Best Gold IRA companies)

Here are some potential benefits of investing in this company.

- They offer a charge-free virtual or in-person consultation.

- Investments from $50,000 and above are charge-free.

- Gold IRAs are available.

- They have an impressive buy-back policy with a guarantee.

- Shipping is charge-free.

#13. U.S Money Reserve (Best Gold IRA Companies)

The U.S. Money Reserve is a gold sales company offering self-directed gold IRAs in Austin, Texas, and the United States. They also assist customers in setting up new gold IRA accounts or transferring from existing ones.

Opened in 2002, U.S Money Reserve received credible ratings and reviews from Consumer Affairs and the Business Consumer Alliance. If you want to diversify your retirement portfolio and start a gold IRA investment, the U.S Money Reserve is one of the best picks. They offer a variety of gold coins and bars for sale and store them in IRS-approved facilities.

Investment Costs (Best Gold IRA Companies)

The U.S. Money Reserve offers a variety of gold products that can be purchased online on its website. Here are some of them.

- Certified coins ($199 – $1,965)

- Bullion ($244 – $2,056)

- Bars ($1,970 – $60,286)

- Coins ($247 – $2,097)

Gold IRA investments require a minimum of $25,000 for purchases, rollovers, or transfers. They also charge an annual storage fee of $250.

Benefits of Investing with the U.S Money Reserve (Best Gold IRA Companies)

Here are some potential benefits of investing in this company.

- They provide an impressive buy-back policy with a guarantee.

- Precious metal purchases can be made online or over the phone.

- A home-delivery option is available.

- Gold IRAs are available.

- They offer rollover options for existing 401(k).

- Extensive educational resources for clients are available.

General Benefits of Investing in Gold IRA (Best Gold IRA Companies)

Gold IRA retirement accounts offer many benefits, including tax benefits, portfolio diversification, and stability.

Tax Benefits (Best Gold IRA Companies)

Just like traditional IRAs, gold IRAs also provide tax benefits. Although conventional self-directed IRAs are tax-charged, eligible withdrawals are tax-free.

The IRS maintains an annual contribution limit of $5,500 for individuals under 50 and $6,500 for individuals above 50. If you have a pre-tax IRA, you will pay taxes on your distributions during retirement.

Portfolio Diversification (Best Gold IRA Companies)

Since gold IRA investments are self-directed, clients can decide to diversify their accounts to other areas. It means that you control your investment and make choices independently.

When the price of other assets decreases, gold may increase. It helps maintain a portfolio’s value, especially during crises.

Stability (Best Gold IRA Companies)

Compared to other assets, gold is a stablecoin. It can even be said to be everlasting, with less market volatility, unlike other stocks or investments. Therefore, adding a gold IRA to your retirement portfolio offers investment stability.

The key is selecting a reputable company that has its clients’ interests at heart. Although you can store other precious metals like silver and palladium in IRAs, the market is more dominated by gold because of its ease of access and popularity.

Tips for Selecting a Gold IRA Company (Best Gold IRA Statistics)

Here are some tips to guide your selection of a reputable IRA provider.

Business History (Best Gold IRA Statistics)

The first step before choosing a company for investment should be running a background check on it. Review its customer service history and find out the number of clients who expressed satisfaction with its services.

If most of their past clients express satisfaction with their services, you may proceed with your investment plans.

Research (Best Gold IRA Statistics)

After reviewing their business history, you should conduct further research. Using the internet services available, take your time to evaluate and compare different companies to find the best.

Always read the reviews from past clients. They can help you make a better decision.

Check for Credentials (Best Gold IRA Statistics)

Although you can always rely on reviews from past clients, you can also source credentials to check company validity. Companies like these should have some valid licenses to prove their validity and competency.

One of these credentials is the IRS certification. Check for certifications before investing to avoid being entangled with a company battling unresolved lawsuits or claims.

Marketing Techniques (Best Gold IRA Statistics)

The next thing to check for is the marketing techniques because most companies make alleged and extravagant claims. Some even promise huge earnings to attract clients.

Be sure to carefully review their marketing techniques and choose a company that educates its clients on the disadvantages and advantages of investing in precious metals. After this, take your time to ensure you make a good decision.

Compare Investment Costs (Best Gold IRA Statistics)

Although gold IRA companies profit from the fees they charge, some hike these charges to ridiculous levels. Some of the regular fees paid for gold IRAs are for account opening, management, investment, and annual storage.

Compare the investment costs of different companies to know the one that provides the best deals and ensure you make a good decision.

Take Your Research Offline (Best Gold IRA Companies)

You can take your research offline by asking for the opinion of your family or friends. This strategy can help you make a good decision, especially if they share your interests in Gold IRA investments.

You can also ask for the opinion of your colleagues who share similar interests or own Gold IRA investments.

Final Thoughts (Best Gold IRA Companies)

When choosing a gold IRA company for your retirement investment, you should consider many factors. Knowing that your financial stability may be at stake if you make a wrong decision, ensure you take your time to confirm a company’s integrity and reputation before making investments.

After reviewing 20 companies offering gold IRA services based on their ratings and reviews from Business Consumer Alliance and Consumer Affairs, the 13 companies listed above are undoubtedly the best. They provide top-notch customer services, extensive educational resources, and several gold IRA investment options.