Latest Precious Metals Review You Should Know (2025)

What are Precious Metals?

Precious metals are rare metals with high economic value, such as gold, silver, and platinum, and also resistant to corrosion and oxidation.

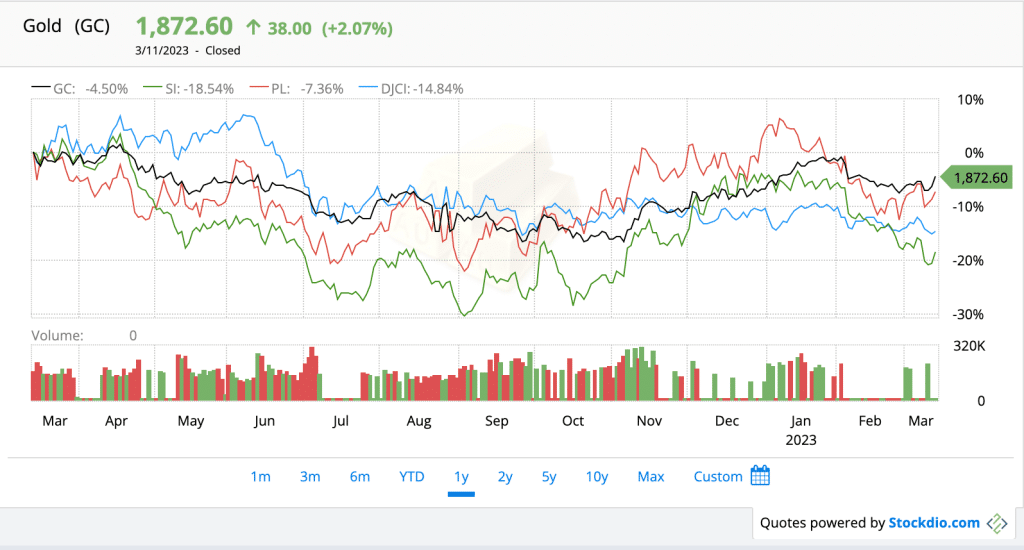

Historic Precious Metals Price Chart Vs. Dow Jones Commodity Index

Investing In Precious Metals

This article provides a complete guideline for investing in precious metals. It explains the different types of precious metal investments, why you should invest in them, how to get started, and anything else crucial to investing in precious metals.

Why Invest In Precious Metals?

Precious Metals offers many rewards for investment. When the stock market is down, precious metals still appreciate.

Benefits Of Precious Metals Investment

1) Inflation hedge: Precious metals are an excellent inflation hedge. Their prices rise along with rising inflation.

2) Liquidity: Precious metals can be bought and liquidated easily.

3) Diversification: Precious metals are a great way to diversify your portfolio beyond stocks and real estate.

4) High Demand: The industrial sector has a high demand for gold, silver, and other precious metals, leading to increased investment in these metals.

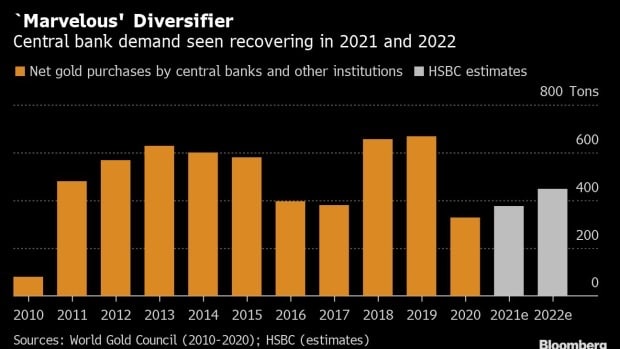

5) World central banks can buy unprecedented amounts of gold and other commodities. Over the past 10 years (2010-2020), they have been net buyers. Demand from major players, such as central banks, can undoubtedly support prices.

6) Insurance against economic and political risks such as financial collapse, military and commercial conflicts, natural disasters, global pandemics, etc.

For a chart of net gold purchases by central banks around the world, along with HSBC’s forecast for 2020 and 2021, see the chart below:

Source: Bloomberg

The best way to invest in gold, silver, and other precious metals is the method that best suits your financial goal.

For example, if you’re preparing for retirement and seeking more stability, consider looking at precious metal IRAs.

List Of Precious Metals.

1: Gold (Precious Metals)

Gold is a natural resource that has existed for centuries. It is naturally abundant but also scarce enough to be valuable. The market determines the price of gold, but it tends to increase during political turmoil or economic instability.

Ways to invest in gold include Retirement accounts like gold IRAs, precious physical metals, and gold ETFs. Read up on more Gold statistics.

2: Silver (PreciousMetals)

Silver is another natural resource like gold, which has existed for many centuries. Although silver is more common than gold, it is still valuable. The market also determines the price of silver, which is much more volatile than gold.

Ways to invest in silver include Retirement accounts like silver IRAs, precious physical metals, silver ETF, and more.

3: Palladium (Precious Metals)

Palladium is a naturally occurring element used in jewelry. It is made use of in the industrial sector. The palladium supply can not meet demand, making it more scarce than gold, silver, and platinum, and hence, more valuable. The value of palladium changes depending on supply and demand. You can invest in palladium by purchasing palladium bars or coins.

Ways to invest in Palladiums include Retirement accounts (IRAs), precious physical metals, palladium ETF, and more.

4: Platinum (Precious Metals)

Platinum is a naturally occurring element used in jewelry. The industrial sector uses it a lot. Platinum is more scarce than gold and silver, making it more valuable. The value of platinum varies depending on supply and demand. You can invest in platinum by purchasing platinum bars and coins.

Ways to invest in Platinum products include Platinum bars and coins, Platinum stock mining companies, retirement accounts (IRAs), Platinum ETF, and more.

Different Types Of Precious Metal Investment Products

Which type of precious metal investment is ideal for you? It depends on your investment goals and objectives. There are several ways to invest in precious metals, each with advantages and disadvantages. You can invest in physical metals, precious metals, ETFs, or stocks. You can also invest in precious metals through a retirement account (IRA).

Let’s go over a few types of precious metals investing products.

- Physical bars and coins (bullion)

- Retirement accounts (IRAs)

- ETFs (exchange-traded funds)

- Jewelry

- Stock mining companies

Physical Bars and Coins (Bullion) (Precious Metals)

Physical bars and coins like bullion may be the oldest form of investing in precious metals. You can purchase gold, silver, palladium, and platinum bars and coins worldwide. The spot price, which is the price market for precious metals, determines the value of the precious metal. Supply and demand affect the spot price, which is a good sign of the value of gold.

After purchasing precious metals, it would be best to remember about storage costs. Your physical bars and coins should be kept in a safe place, such as a vault or safe at home or in a bank safety deposit box. Providing insurance coverage for your precious metals is advisable against damage and theft.

Gold, silver, and several precious metals are suitable investments. Like every other investment, it is risky. Metal prices can go up or down, and you could lose money if you sell when the price is low.

Precious Metals Retirement Account

Gold IRAs let you invest in gold and hold it in a tax-advantaged retirement account. It’s a popular option for diversifying a retirement portfolio.

Several retirement accounts allow you to invest in precious metals, and you can roll over your current retirement account into precious metals IRAs. These include traditional IRA accounts, Roth IRA accounts, and SEP IRA accounts. You can also invest in precious metals through your 401(k) or 403(b) retirement account.

Precious metals retirement accounts are typically self-directed gold IRAs (SDIRA). Gold IRA companies, in partnership with a custodian, manage these accounts.

With an SDIRA, you are in charge of personalizing your portfolio. You can support many alternative investments like cryptocurrency, real estate, and more. Your account will grow over time, and you can withdraw the money when you retire.

The benefits of investing in precious metals through a retirement account include tax breaks and the ability to invest for the long term. However, you will still be subject to fluctuations in the market price of precious metals.

Gold and Silver ETFs (Precious Metals)

Exchange-traded funds (ETFs) are investment products that allow you to invest in a basket of assets without purchasing each asset individually. ETFs trade on stock exchanges and can be bought and sold like stocks.

Many ETFs allow you to invest in precious metals without purchasing physical bullion or coins. Gold and silver ETFs are famous for investing in these precious metals.

Gold and silver ETFs track the spot price of these metals, so you will not have to worry about storage costs. However, you will still be subject to fluctuations in the market price of gold and silver.

Stocks, Bonds, Mutual Funds (Precious Metals)

Many investors invest in precious metals by purchasing stocks in mining companies. It is an indirect way to invest in precious metals, as the value of these stocks is directly proportional to the metal’s price.

Precious metals stocks can be a volatile investment, as the metal price can increase. However, over the long term, these stocks have the potential to provide a good return on investment.

If you are interested in precious metals stocks, you can purchase shares of mining companies through a brokerage account. Research the best companies to make a good decision.

How To Get Started With Investing In Precious Metals

If you’re interested in investing in precious metals, there are a few ways to get started. You can purchase stocks in mining companies, invest in a precious metals IRA, or purchase a gold and silver ETF (exchange-traded fund).

Start with these three steps:

Step 1 – Consult your financial advisor.

Step 2 – Carefully research each investment vehicle and weigh the pros and cons. What are the spot prices? What’s suitable for your family? What’s a good percentage of your portfolio to allocate? Each of these questions will inform your decision.

Step 3 – Consider all the risks of your chosen type of investment.

Step 4 – Take action and pick your broker or precious metals investing company.

Investing in precious metals – What does the price depend on?

Precious metal prices are important not only to producers but also to end users. They have long been used as tools for monitoring economic and market conditions. But you can see what they depend on here:

- Supply and demand, and expectations for future supply and demand: Increased demand and expectations of increased demand drive up metal prices and vice versa.

- Dollar Price: Precious metals are traded in US dollars, so a weakening US dollar can increase their prices. A strong dollar can, therefore, affect their prices.

- Interest Rates and Monetary Policy. As interest rates fall and significant central banks ease policy worldwide, bullion prices are expected to rise as inflation potential and yields on other assets, such as bonds, decline. The opposite is also true—economic data. Weak global economic data could increase demand for safe-haven assets like gold and reduce demand for riskier metals like palladium that depend on economic growth. Strong.

- Economic data could undermine shelters and support riskier assets—Political Uncertainty.

- Political uncertainty reduces investor appetite, and market participants seek more risk and security. In addition, political uncertainty in the regions where precious metals are mined could disrupt supply chains, reduce supply, and increase prices accordingly. Of course, other factors affect the price of precious metals, but these are the main ones.

Risks Associated With Investing In Precious Metals

When investing in precious metals, there is always the risk that the price could go down if the global economy weakens or there is less demand for industrial metals.

The principal risks of investing in precious metals are:

- Periods of high price volatility: Political instability in areas where precious metals are mined.

- Decrease in demand as demand for certain precious metals replaces others.

- New Regulations on the Environment (Removal of Old Regulations) with investment in precious metals and the right strategies for correct funding and risk management, these risks are mitigated and actively managed.

However, over the long term, precious metals have historically maintained their value and even increased in price during periods of inflation. So, while there is risk involved with investing in precious metals, it is essential to remember that there is also the potential for a good return on investment.

Final Thoughts (Precious Metals)

Is investing in precious metals worth it?

The decision depends on your investment goals. It could be long-term or short-term.

Suppose you’re interested in investing in gold. Here are the 13 best Gold IRA companies that I recommend. However, if you’re looking for a long-term investment with the potential for good returns, precious metals could be a good option.