Gold IRA Statistics:

Approximately 37% of American households possess an Individual Retirement Account (IRA).

Approximately 29% of American households hold a traditional IRA.

Roughly 30% of Americans have two retirement plans, often combining an IRA and an employer-sponsored plan.

Over 60% of American households have at least one retirement plan, illustrating a significant portion of the population engaged in retirement savings.

Self-directed IRA accounts, encompassing various types, represent only 3-5% of the total IRA accounts in the United States.

Approximately 12% of the American population owns gold. Whether this ownership is within an IRA or in physical form is uncertain.

About 14.3% of males in the 45-54 age group own both gold and silver.

5.1% of males aged 35-54 own gold exclusively, without holding silver.

7.8% of females aged 35-44 own only silver without possessing gold.

1.8% of men in the same age range exclusively own silver.

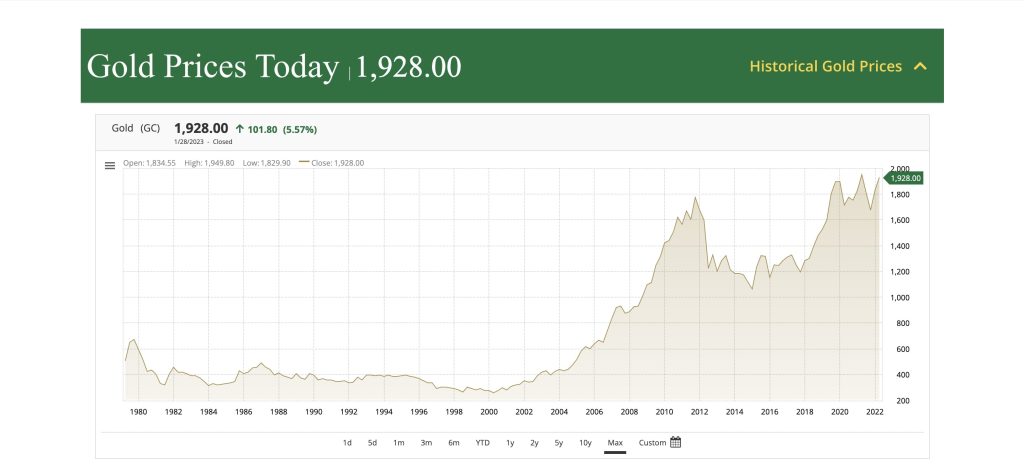

The price of gold experienced a substantial 360% increase between 1990 and 2020.

The Dow Jones stock index witnessed a remarkable 991% increase over the same period, indicating significant stock market growth.

The value of the U.S. dollar appreciated by 198% from 1990 to 2020.

In the financial ecosystem today, individuals with earned income typically look for ways to save a certain percentage of their income as retirement funds. Individual Retirement Accounts (IRAs) are a unique form of retirement investment scheme that preserves investors’ funds for a long period. These IRAs come in various forms, including the Gold IRA. Here are the 13 best Gold IRA companies that I recommend. Number one will surprise you!

Since immemorial, gold has been utilized as a general store of value as it does not significantly depreciate regardless of the financial market. Individuals utilize gold via IRAs because of the economic security it provides. This article will explore more details about how this investment scheme benefits its users and its Gold IRA statistics. Let’s get started:

Gold Statistics (Gold IRA Statistics)

Why does Gold bullion cost more than the spot price?

The ‘spot’ price of gold is a theoretical price upon which all gold holdings are based. It is a base price before any commissions or fees and does not include costs such as minting, insuring, and shipping.

How are the prices of Gold set in the market? – Who sets the price?

Every day, gold trades in dozens of markets around the world- France, Turkey, Tokyo, Hong Kong, New York, Chicago, Sydney, and so forth. Each market reacts to news, and gold price is always updated. The prices are ‘set’ and constantly ‘re-adjusted’ by the ever-changing supply and demand factors, input by millions of investors, governments, central banks, jewelers, miners, dealers, and other individuals who trade in gold daily. The gold market amounts to billions of dollars daily, and no one can ‘set’ the price. It changes constantly due to hundreds of factors, ranging from the opening of a new gold mine to the changes in interest rates of one currency or another. The gold market is the largest and most free market in all the commodity markets.

Is 24-karat Gold the best?

24-karat gold is the purest form (99.9%), but it is not necessarily the ‘best.’ The gold coin has traditionally been 22 karats because adding a small percentage of alloy metal, usually copper, strengthens it tremendously and makes it less susceptible to wear and damage. Pure gold would be a poor choice for a coin that has to pass hand to hand in commercial use – it would wear with time and usage.

What is an Individual Retirement Account (IRA)? (Gold IRA Statistics)

An Individual Retirement Account, an IRA, is a unique long-term savings account that allows individuals to save up for their retirement and enjoy certain tax benefits. The advantages of an IRA mainly cater to self-employed individuals who do not have access to particular workplace retirement advantages such as a 401(k). IRAs are tax-advantaged accounts to which self-employed individuals can contribute their income before or after the tax deduction. This income grows in the IRA on a tax-free or tax-deferred basis.

Because IRAs are long-term savings accounts, money held in them withdrawn before the age of 59½ will incur a 10% tax penalty on the amount withdrawn.

Before we dive into what a Gold IRA is, let’s look at the general benefits of IRAs.

Benefits of Individual Retirement Account (IRA) (Gold IRA Statistics)

Individual Retirement Accounts (IRAs) serve as a means of providing a tax-advantaged opportunity for individuals saving up for their retirement. Here are several benefits associated with IRAs and how they can contribute to a healthy retirement plan for their investors:

- Enables True Diversity in Investment: Individuals who utilize individual retirement accounts (IRAs) can invest in various properties apart from stocks, such as treasuries and precious metal assets. Thus, IRAs serve as a means of providing tax-advantaged ways for people to save for their retirement. IRAs generally operate on a tax-deferred or tax-free basis.

- Available for Self-employed Individuals: Unlike other retirement plans, such as the 401(k) plan, Individual Retirement Accounts (IRAs) are not tied to employers. They are available for self-employed individuals whose income is not covered by an employer plan.

- Insured by the Government: IRAs are typically insured by the Federal Deposit Insurance Corporation (FDIC). The FDIC is a government-run agency that protects users’ finances and investments when a financial institution, such as banks or lending systems, fails. The FDIC also covers customer deposits held in FDIC-insured institutions and loan associations. The deposit amount in these cases is usually up to 250,000 dollars per account.

What is a Gold IRA? (Gold IRA Statistics)

A Gold Individual Retirement Account, commonly known as a Gold IRA, is a unique individual retirement investment account that allocates a certain percentage of its investor’s income towards the Investment of gold. A Gold IRA holds physical metals and assets, including but not limited to gold bars, palladium bars, precious metals-related securities, and sovereign-minted coins. The Gold IRA not only holds physical bullion, but it also holds paper-based gold assets.

Gold IRAs are a unique form of self-directed IRAs. In these accounts, individuals and investors can direct their savings and investments into purchasing certain collectibles, such as art and gold.

Although it is regulated by the same rules that control the operation of a traditional IRA, such as distributions and contribution limits, a Gold IRA must be held separately from a conventional individual retirement account. Individuals looking to open a gold IRA can do so via a broker-dealer or other financial custodians. Gold IRAs, also known as Precious metals IRAs, can be set up using pre- or post-tax funds like a Roth IRA. Since Gold IRAs require the buying and storing of physical gold assets, financial custodians, such as a brokerage firm or a bank, are needed to manage the operation of the account.

Types of Gold IRAs (Gold IRA Statistics)

Like traditional individual retirement accounts, Gold IRAs come in different types and forms from which investors can choose. These types include:

- Traditional Gold IRAs: These types of IRAs are funded using pre-tax money. This means that contributions and earnings related to the account develop on a tax-deferred basis, and taxes are imposed on withdrawals when the individual retires.

- Simplified Employee Pension (SEP) Gold IRA: Like the traditional Simplified Employee Pension (SEP) IRAs, Simplified Employee Pension (SEP) Gold IRAs are special IRAs made available for self-employed individuals or employees of small businesses. Like its traditional counterpart, taxes are only imposed on the individual’s retirement of a Simplified Employee Pension (SEP) Gold IRA rather than on any contributions made to the account. The Internal Revenue Service (IRS) enforces certain limitations on contributions for Simplified Employee Pension (SEP) IRAs.

- Roth Gold IRAs: Roth Gold IRAs are funded by contributions made with after-tax money. This means that there is no immediate tax advantage attached to this type of Gold IRA. Individuals utilizing this type of IRA pay taxes when the time comes for them to begin to receive distributions when they retire.

General Advantages of Gold IRAs (Gold IRA Statistics)

One primary merit of possessing a Gold IRA is that it helps to diversify the retirement portfolio of its users and thereby enables them to enjoy tax-preferential treatment.

- Serves as a Hedge against Deflation and Inflation: The current financial market is very volatile, which means that, over time, inflation erodes and negatively affects investments. Gold, as an asset, serves as a hedge against these factors as it renders its investors’ portfolios immune to their effects.

- Enables Investors to Control Their Finances: As a self-directed IRA, Gold IRAs enable their users to be sole custodians of their accounts by allowing them to make decisions concerning their account’s assets, the allocation of these assets, and their redistribution while also giving them particular tax advantages.

- Serves as a Better Store of Value than Fiat Currency: Gold assets are good investment options as they are profitable regardless of market volatility. This is because gold is a better store of value than currencies and stocks, as its value can never reach zero. The following is the value of gold compared to that of the Standard and Poor stock market (S&P 500) in past bear markets:

- Black Monday 1987: -22.6% (S&P), +4.2% (Gold)

- Aug. 1 to 14, 1990: -21% (S&P), +11.1% (Gold)

- Oct. 2, 2000, to Oct. 2, 2002: -38.5% (S&P), +18% (Gold)

- Oct. 9, 2007, to Oct. 1, 2010: -20.1% (S&P), +78.9% (Gold)

- Dec. 1, 2019, to March 1, 2020: -19.8% (S&P), +7.6% (Gold)

(Source: Due)

- Serves as a Means of Providing Profit: Gold and other primary precious metals have excellent profit potential based on their historical performance in the traditional financial market. For example, in 2000, Gold was priced at 200 dollars per ounce, which increased to 1,200 dollars in 2017. Gold, in the form of Gold IRAs, can be a potentially profitable means of earning passive income for investors.

(Source: Allegiance Gold)

Understanding Gold IRA Statistics

Analyzing the data from the IRA market can help investors assess the statistics of specific self-directed IRAs, which in this case is the Gold IRA. Below is the analytical data collected from a report on the general IRA market made by an investment company in 2021:

- 37% of American households own an IRA, of which only 35% made contributions in 2019.

- 29% of American households have a traditional IRA. Of this percentage, more than 8 in 10 households had an employee-assisted plan. This means that only roughly 30% of Americans have two retirement plans.

- More than 60% of American households have at least one retirement plan.

(Source: iBR)

Since Gold IRAs are self-directed IRAs, it can be challenging to determine which accounts, in particular, are holding gold and how much gold they possess. This is because demographic information on investors in Gold IRAs is complex, as those records are not made public. This means that the data provided in this article is not entirely accurate. However, it can be used to hypothesize who owns a Gold IRA. Below are some general statistics for context:

- Of the total number of IRAs in the financial market, only 3-5% are self-directed IRAs. This includes all forms of self-directed IRAs, not just gold.

- This survey did not specify if gold was owned in the IRAs or as physical bullion assets.

(Source: iBR)

It is also important to note that as of 2020, roughly 10.8% of U.S. adults held gold as an investment asset. This number is expected to increase yearly as the inflationary environment and economy currently favor physical and hard assets. (Source: Due)

Gold IRAs Versus the U.S. Dollar (Gold IRA Statistics)

In 2022, gold assets outperformed the U.S. dollar by almost two-to-one. The statistical data concerning the growth of gold and the growth of the U.S. dollar is stated below:

- From 1990-2020, Gold assets experienced a 360% increase in price.

- During this same period, there was a 991% increase in the Dow Jones industrial stock market index.

- The United States (U.S.) dollar also experienced a rise of 198% during this same period.

Typically, gold assets function better with low interest rates. In 2022, the interest rate for gold averaged between 0% and 4%.

(Source: iBR)

Gold IRAs Versus Traditional IRAs (Gold IRA Statistics)

Compared to traditional IRAs, Gold IRAs perform differently in the financial market, with a considerable difference in profit return on investment (ROI). For instance, an individual who takes a $1,000 investment in gold in the year 1990 and the same investment in the Dow Jones Stock Market Index in the same year would experience the following:

- A $4,419 return, as of 7/19/22, or $3,419 profit from the gold assets.

- 11,878 dollars in stock market gains.

- A loss of 2x purchasing power of the same amount of dollars if kept in savings.

(Source: iBR)

How is a Gold IRA Taxed? (Gold IRA Statistics)

The tax imposed on gold is based on whether the gold asset is held as a collectible or invested in an IRA. Below is data compiled by the Journal of Accounting that reflects tax rates on gold holdings at the time of compilation in 2022:

- For investors with an annual income of $60,000 and an investment of $10,000, ROI after tax would be;

- 5.85% for physical investments,

- 8.94% for a Traditional IRA, and

- 6.88% for a Roth IRA.

- For investors with $398,500 with higher taxes imposed, the ROI would be;

- 3.71% for physical investments

- 7.94% for a Traditional IRA, and

- 5.68% for a Roth IRA.

These return on investment (ROI), including tax implications, reflect a smaller benefit for low-income earners in lower tax brackets (i.e., a 25% tax bracket at the time of investment and a 15% tax bracket at retirement) than more for their wealthy and high-income-earning counterparts.

Final Thoughts (Gold IRA Statistics)

Although gold is a great profit option for users looking to make profits and secure their future by utilizing a Gold IRA, it is worth noting that investing in gold assets depends on the individual’s personal financial and investment profile. For users looking to invest in a Gold IRA, the amount that can be contributed in 2022 is $6,000 and $6,500 in 2023. However, users older than 50 years of age are allowed to contribute an additional amount of $1,000 for both 2022 and 2023. These monetary limits only apply to traditional and Roth Gold IRAs. Here are the 13 best Gold IRA companies that I recommend.