Investors are looking for ways to protect their money against inflation and diversify their portfolios, and gold is often seen as a good choice.

There are different ways to invest in gold, and it’s essential to understand the advantages and disadvantages before making a decision.

In this article, we took our time, reviewed the options, and chose our favorite ways to invest in gold in 2023.

6 Ways To Invest In Gold (How To Invest In Gold)

According to the World Gold Council, it is essential to consider your investment goals, risk tolerance, and overall financial situation when deciding whether or not to invest in Gold. Gold is essential in any investment portfolio. To learn how to invest in Gold, you must buy gold first. You can buy gold in a few different ways.

Physical gold (How To Invest In Gold)

Investing in physical gold typically involves purchasing gold bullion, coins, or bars and holding them as a store of value or a hedge against inflation. Physical gold can be bought from reputable dealers and stored in a secure location such as a bank safety deposit box or a private vault.

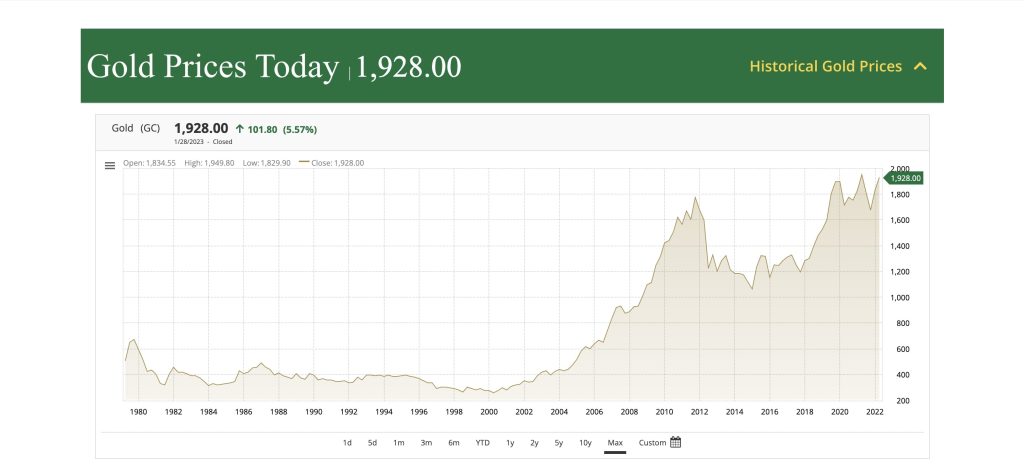

When learning to invest in physical gold, there are a few things to consider. First, the price of gold can be volatile, so investors should be prepared for fluctuations in the value of their investments. Second, investors may need to pay a premium above the spot price of gold to purchase physical gold, and they may also incur storage and insurance costs.

Physical gold can be an excellent addition to a diversified investment portfolio. Still, investors should consider their financial goals and risk tolerance before investing in gold or other assets.

Self-Directed Gold IRA (How To Invest In Gold)

This allows individuals to invest money directly in physical precious metals. To open a self-directed Gold IRA, you must find the right company to help you invest in gold or other precious metals, such as silver, platinum, and palladium.

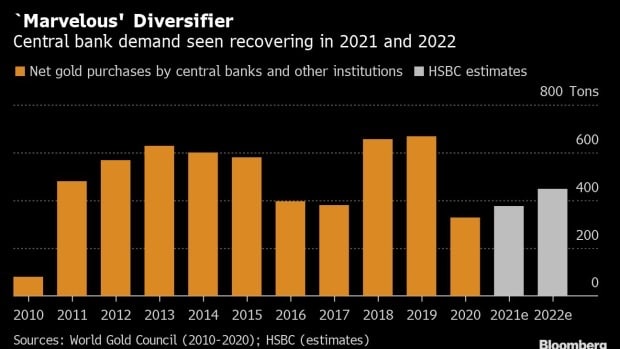

Diversification: Adding gold to your IRA can help diversify your portfolio and potentially reduce overall investment risk. Gold has a low correlation with other asset classes, meaning its value does not move in the same direction as stocks, bonds, and other investments. This can help protect your retirement savings if the stock market declines.

Inflation protection: Gold has historically been seen as a hedge against inflation because its value tends to rise when fiat currency’s purchasing power declines. Investing in a self-directed gold IRA can protect your retirement savings against inflation and ensure that you have purchasing power in the future.

Tax benefits: Self-directed IRAs offer tax benefits, just like traditional IRAs. This means you can reduce your tax bill by contributing to your IRA. Additionally, investing in a Roth IRA allows you to withdraw your funds tax-free in retirement.

Flexibility: With a self-directed IRA, you have more flexibility in your investments, including gold. You can choose the type of gold you want to invest in, such as physical gold, gold ETFs, or gold mining stocks.

Control: A self-directed IRA gives you more control over your investments. You don’t have to keep it at home. You can choose the custodian and the type of investment you want to make, and you can actively manage your assets.

In summary, this is another way to invest in gold. A self-directed Gold IRA can provide diversification, inflation protection, tax benefits, flexibility, and control. However, it’s essential to consider the costs and risks of this type of investment carefully and consult with a financial advisor before making any investment decisions.

Gold Exchange Traded Funds (ETFs) (How To Invest In Gold):

Gold Exchange-Traded Funds (ETFs) are investment funds traded on stock exchanges like individual stocks. They are designed to track the price of gold and expose investors to the underlying commodity.

Investing in Gold ETFs is relatively simple. Like any other stock, you can buy and sell Gold ETFs through a brokerage account. When you invest in a Gold ETF, you essentially buy a share in a fund holding physical or other gold-related assets.

One advantage of investing in Gold ETFs is that you don’t have to worry about the logistics and expenses of buying and storing physical gold. Additionally, Gold ETFs provide investors with a level of diversification, as the funds typically hold various gold assets.

However, like any investment, there are risks involved with investing in Gold ETFs. The value of the ETF can be affected by changes in the price of gold, market fluctuations, and other factors. As with any investment, conducting thorough research and considering your investment goals and risk tolerance before investing in Gold ETFs is essential.

Gold Mutual Funds (How To Invest In God)

Gold mutual funds invest primarily in gold-related assets, such as gold mining stocks, bullion, and futures contracts. These funds aim to expose investors to the gold market, which can help diversify their portfolios and potentially reduce risk.

Gold has historically been considered a safe-haven asset and a hedge against inflation. This means that gold prices may rise during economic uncertainty as investors seek to protect their investments from market volatility. Investing in gold mutual funds can expose investors to this potential upside.

Like any investment, gold mutual funds come with risks. Gold prices can be volatile, and investing in gold mutual funds can be risky if the fund’s performance is dependent on the performance of a single company or asset. Additionally, fees and expenses associated with mutual funds can eat into returns over time.

To invest in a gold mutual fund, you’ll need to open a brokerage account and select a fund that invests in gold-related assets. Look for funds with a strong track record of performance and low expense ratios. Before investing, be sure to review the fund’s prospectus to understand its investment strategy, risks, and fees.

Gold Futures and Options (How To Invest In Gold)

Investing in gold futures and options can potentially profit from changes in the price of gold. Futures and options contracts are agreements between buyers and sellers to buy or sell an underlying asset (in this case, gold) at a predetermined price and time.

Gold futures allow investors to lock in a price for the future purchase or sale of gold. If the price of gold rises above the agreed-upon price, the investor can profit by selling their contract at a higher price. However, if the price of gold falls below the agreed-upon price, the investor may suffer losses.

Options give investors the right, but not the obligation, to buy or sell gold at a predetermined price and time. If the price of gold moves in a favorable direction, the investor can exercise their option and potentially profit.

However, if the price of gold moves in an unfavorable direction, the investor can let their option expire and only lose the premium paid.

It’s important to remember that investing in futures and options can be risky, and investors should only invest money they can afford to lose. Before making any investment decisions, it’s also important to do thorough research and consult with a financial advisor.

Gold Jewelry (How To Invest In Gold)

Investing in gold jewelry can be a way to own a physical asset that will appreciate over time. Gold has been considered a store of value for centuries, and gold jewelry can be an attractive and portable way to own this precious metal.

When investing in gold jewelry, a few essential factors must be considered. The first is the purity of the gold. Gold is measured in karats, with 24-karat gold being pure gold. However, pure gold can be too soft for jewelry, so most gold jewelry is made from 14 or 18-karat gold, which contains other metals for strength. The higher the karat, the higher the gold content and potentially the higher the value.

The second factor to consider is the design and craftsmanship of the jewelry. Some pieces of gold jewelry may have additional value beyond the gold content due to their rarity, historical significance, or quality of workmanship.

Finally, it’s essential to consider the current market conditions for gold. Like any asset, the price of gold can be affected by supply and demand, economic conditions, and other factors. Investors should monitor gold prices and be prepared to sell their jewelry if they believe it is correct.

Overall, investing in gold jewelry can be a way to own a physical asset that may be appreciated over time. However, like any investment, it’s essential to research and consider all the factors before deciding.

Why is gold Valuable? (How To Invest In Gold)

Gold has been valued as a precious metal for centuries, and there are several reasons why it has retained its value over time.

Firstly, gold is a scarce and finite resource. The amount of gold globally is relatively limited, making it difficult and expensive to mine new gold. This scarcity makes gold valuable and desirable, as it cannot be easily replicated.

Secondly, gold is a durable and long-lasting material. It does not rust, corrode, or tarnish and can withstand exposure to air, water, and other environmental factors. This durability means that gold can retain its value over long periods of time and be easily passed down through generations.

Thirdly, gold is a universally recognized and accepted form of currency. It has been used as a form of payment and exchange for centuries and is still accepted in many parts of the world today. This universal acceptance and recognition make gold a valuable and liquid asset that can be easily bought, sold, or traded.

Finally, gold is often seen as a safe-haven investment during economic uncertainty or instability. When the stock market fluctuates, or geopolitical tensions erupt, investors may turn to gold as a hedge against inflation and a way to preserve their wealth.

Gold is valuable because of its scarcity, durability, universal recognition, and perceived safety during uncertain times.

Is Gold a Good Investment Idea? (How To Invest In Gold)

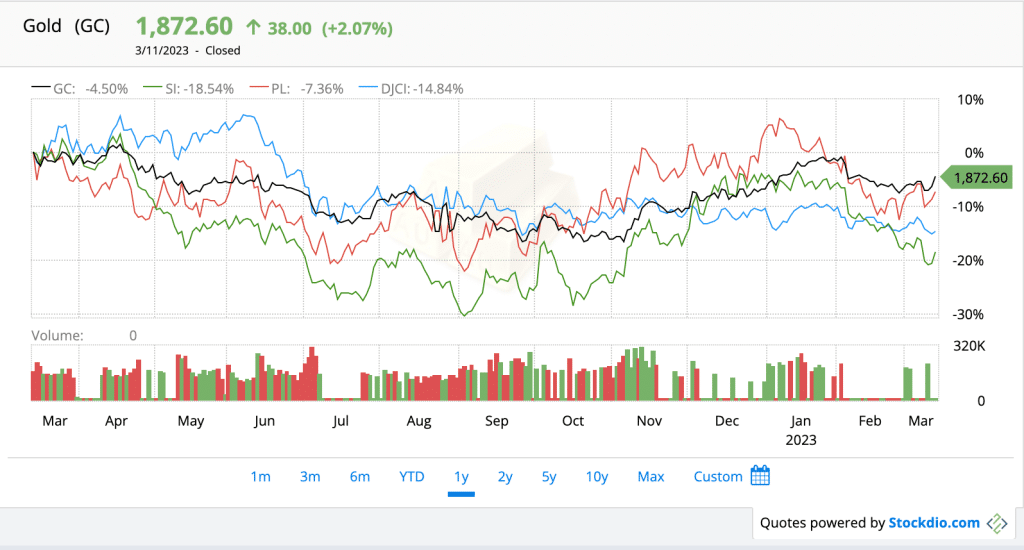

Whether or not gold is a good investment idea depends on a variety of factors, including an individual’s investment goals, risk tolerance, and current market conditions.

Gold can be a good investment for diversifying their portfolio and reducing overall investment risk. It can act as a hedge against inflation, as gold prices tend to rise during economic uncertainty or instability. Unlike other investments such as stocks or bonds, gold is a physical asset that can be held in tangible form.

However, like any investment, gold comes with its risks. Gold’s price can fluctuate rapidly in response to changes in global economic conditions, supply and demand factors, and other geopolitical events.

In addition, investing in physical gold can come with added costs, such as storage and insurance fees. Buying gold jewelry or coins may also involve additional markups beyond the market price of gold.

Gold can be a good investment for those looking to diversify their portfolio and hedge against inflation. However, it is essential to consider the risks and costs associated with investing in gold and consult a financial advisor before making any investment decisions.

Where can I buy Gold? (How To Invest In Gold)

There are several ways to buy gold, including:

Bullion Dealers: Bullion dealers specialize in selling gold bullion bars and coins, which are priced based on the weight and purity of the gold. These dealers can be found online or in person at coin shops or precious metals dealers.

Online Retailers: Several reputable online retailers, such as APMEX, JM Bullion, and Kitco, specialize in selling gold coins and bars.

Banks: Some offer gold coins and bars for sale, although availability and pricing vary.

Jewelry Stores: Jewelry stores may sell gold jewelry or other gold items, such as gold coins or bars.

Auctions: Gold can also be purchased at auctions, both in person and online.

When buying gold, it is essential to research the seller and their reputation to ensure they are reputable and trustworthy. It is also necessary to understand the pricing and fees associated with the purchase, such as premiums, taxes, and shipping and handling costs.

Additionally, it’s important to consider the form of gold you want to purchase, whether bullion, coins, jewelry, or another form, and the purity, weight, and authenticity of the gold you are purchasing.

How to sell Gold? (How To Invest In Gold)

There are several ways to sell gold, including

Bullion Dealers: If you own gold bullion bars or coins, you can sell them to a bullion dealer. These dealers specialize in buying and selling gold and may offer a fair price based on the current market conditions.

Online Retailers: Some online retailers that sell gold also buy back gold from customers. You can check with the retailer you purchased from to see if they offer a buyback program.

Local Coin Shops: Local coin shops may also buy gold coins and bars, although prices may vary based on the shop’s reputation and demand.

Jewelry Stores: If you have gold jewelry to sell, you can visit a local jewelry store to get an offer. Remember that jewelry stores may offer less than the current market value of the gold, as they may factor in the cost of melting down the gold and other expenses.

Online Marketplaces: There are also online marketplaces, such as eBay, where you can sell gold items directly to buyers. However, it is essential to be cautious when selling gold online and to ensure that the buyer is reputable and trustworthy.

When selling gold, it is essential to research the current market conditions to ensure you get a fair price. It is also essential to understand any fees or charges associated with selling the gold, such as shipping and handling costs or buyer fees. Finally, it is essential to consider the form of gold you are selling and ensure that it is authentic and properly authenticated.

How much should I invest in Gold? (How To Invest In Gold)

The amount you should invest in gold depends on several factors, including your investment goals, risk tolerance, and overall investment portfolio. Generally speaking, financial advisors recommend that investors allocate between 5% and 10% of their portfolio to gold or other precious metals.

If you are new to investing, starting with a small amount and gradually increasing your investment as you become more comfortable and knowledgeable about the market is important. You should also consider the form of gold you want to invest in, such as gold bullion, coins, or ETFs, and the fees and costs associated with the investment.

Ultimately, the amount you should invest in gold will depend on your financial situation and investment goals. It is essential to consult with a financial advisor to determine the appropriate allocation for your portfolio and to ensure that your investments are aligned with your long-term financial goals.

Final Thoughts

In conclusion, investing in gold can be an excellent way to diversify your investment portfolio and hedge against inflation. There are several ways to invest in gold, including purchasing physical gold such as bullion bars, coins, or jewelry or investing in gold ETFs or mining stocks. When investing in gold, it is essential to do your research and understand the risks and costs associated with each investment option.

To invest in physical gold, you can buy from reputable dealers, such as bullion dealers, online retailers, banks, or jewelry stores. When selling gold, you can also use these same channels, such as bullion dealers, online retailers, local coin shops, or jewelry stores.

When investing in gold ETFs or mining stocks, you can purchase them through a brokerage account or an online trading platform. Before investing, it is important to do your due diligence and research the performance and management of the ETF or mining company.

Overall, investing in gold can be an excellent way to diversify your portfolio, hedge against inflation, and protect your wealth. When deciding whether or not to invest in gold, it is important to consider your individual investment goals, risk tolerance, and overall financial situation and consult with a financial advisor if you are unsure about how to proceed.

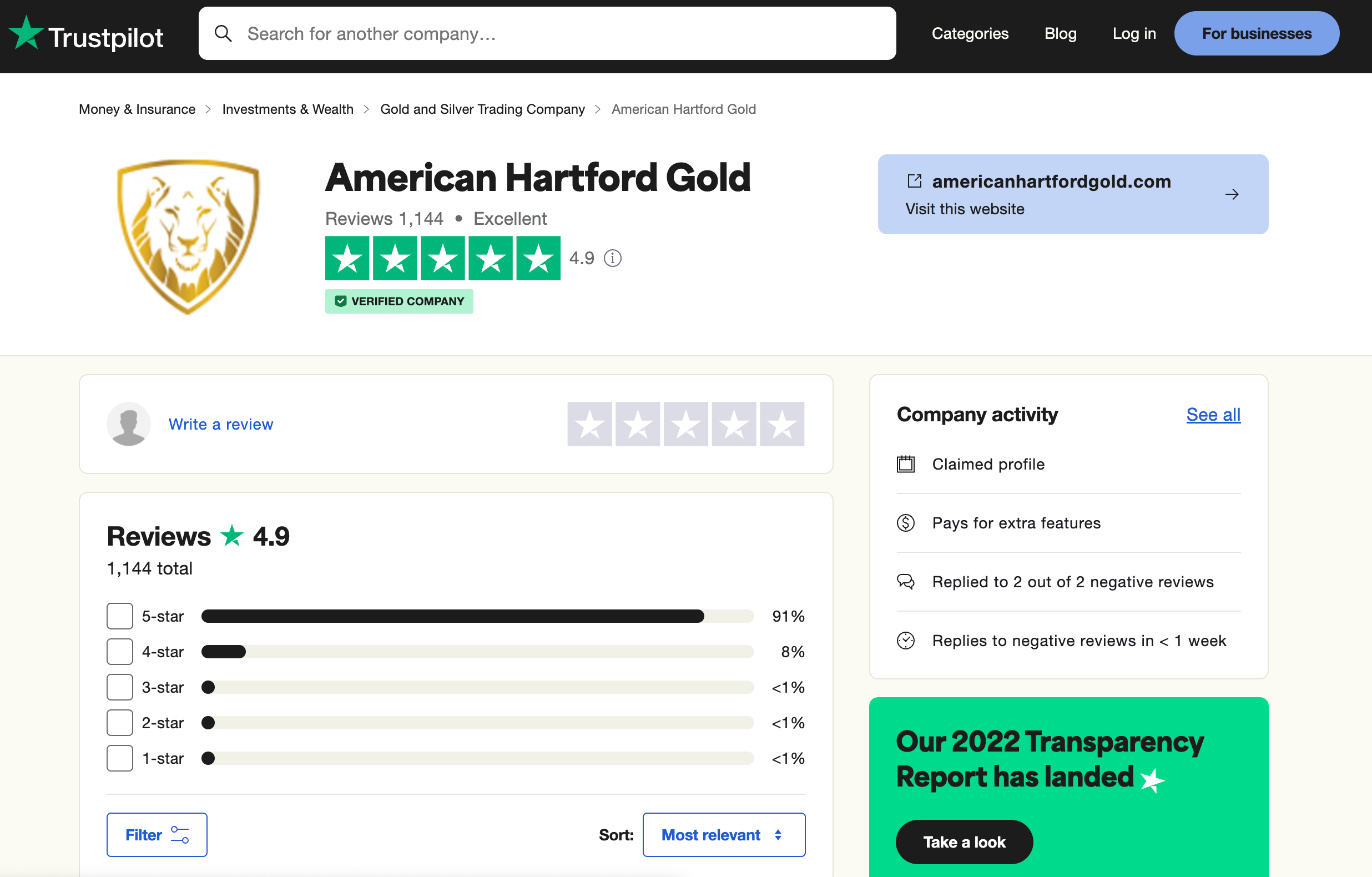

American Hartford Gold Prices

Gold has long been recognized as a valuable physical asset that offers financial security and protection against inflation and economic downturns. Gold IRA companies specialize in setting up and managing Individual Retirement Accounts (IRAs) that include precious metals.

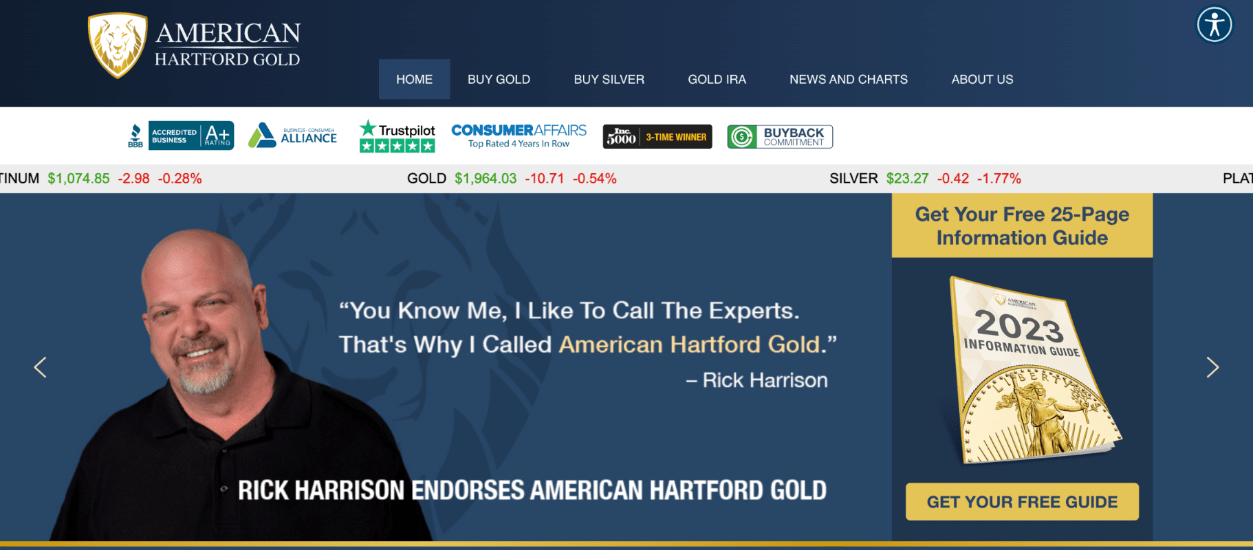

American Hartford Gold, a leading retailer of physical gold and silver assets in the United States, aims to provide personalized care and help clients secure their financial future by adding gold and silver to their investment or retirement portfolios.

Gold IRA companies provide their users with financial services and specialize in setting up, managing, and administrating precious metals via Individual Retirement Accounts (IRAs). In addition, companies that offer Gold IRA services often provide their clients with educational and professional advice on precious metals investments.

Here, you’ll find everything you need to know about American Hartford Gold prices, investments, and fees.

American Hartford Gold Prices

Gold has long been recognized as a valuable physical asset that offers financial security and protection against inflation and economic downturns. Gold IRA companies specialize in setting up and managing Individual Retirement Accounts (IRAs) that include precious metals.

American Hartford Gold, a leading retailer of physical gold and silver assets in the United States, aims to provide personalized care and help clients secure their financial future by adding gold and silver to their investment or retirement portfolios.

Gold IRA companies provide their users with financial services and specialize in setting up, managing, and administrating precious metals via Individual Retirement Accounts (IRAs). In addition, companies that offer Gold IRA services often provide their clients with educational and professional advice on precious metals investments.

Here, you’ll find everything you need to know about American Hartford Gold prices, investments, and fees.

Despite its relatively short existence, American Hartford Gold has emerged as a trailblazer in precious metals investment. Renowned for its innovative approach, this company has garnered widespread recognition, securing endorsements from esteemed celebrities and influential politicians. Their commitment to excellence is further exemplified by their role as a prominent sponsor within the exciting world of NASCAR.

Despite its relatively short existence, American Hartford Gold has emerged as a trailblazer in precious metals investment. Renowned for its innovative approach, this company has garnered widespread recognition, securing endorsements from esteemed celebrities and influential politicians. Their commitment to excellence is further exemplified by their role as a prominent sponsor within the exciting world of NASCAR.

Notably, American Hartford Gold achieved a remarkable feat in 2021 when it was ranked as the top Gold company by Inc. 5000, a prestigious compilation that celebrates the achievements of privately owned businesses in the United States of America.

The following are some of the advantages of investing in American Hartford Gold:

Despite its relatively short existence, American Hartford Gold has emerged as a trailblazer in precious metals investment. Renowned for its innovative approach, this company has garnered widespread recognition, securing endorsements from esteemed celebrities and influential politicians. Their commitment to excellence is further exemplified by their role as a prominent sponsor within the exciting world of NASCAR.

Despite its relatively short existence, American Hartford Gold has emerged as a trailblazer in precious metals investment. Renowned for its innovative approach, this company has garnered widespread recognition, securing endorsements from esteemed celebrities and influential politicians. Their commitment to excellence is further exemplified by their role as a prominent sponsor within the exciting world of NASCAR.

Notably, American Hartford Gold achieved a remarkable feat in 2021 when it was ranked as the top Gold company by Inc. 5000, a prestigious compilation that celebrates the achievements of privately owned businesses in the United States of America.

The following are some of the advantages of investing in American Hartford Gold:

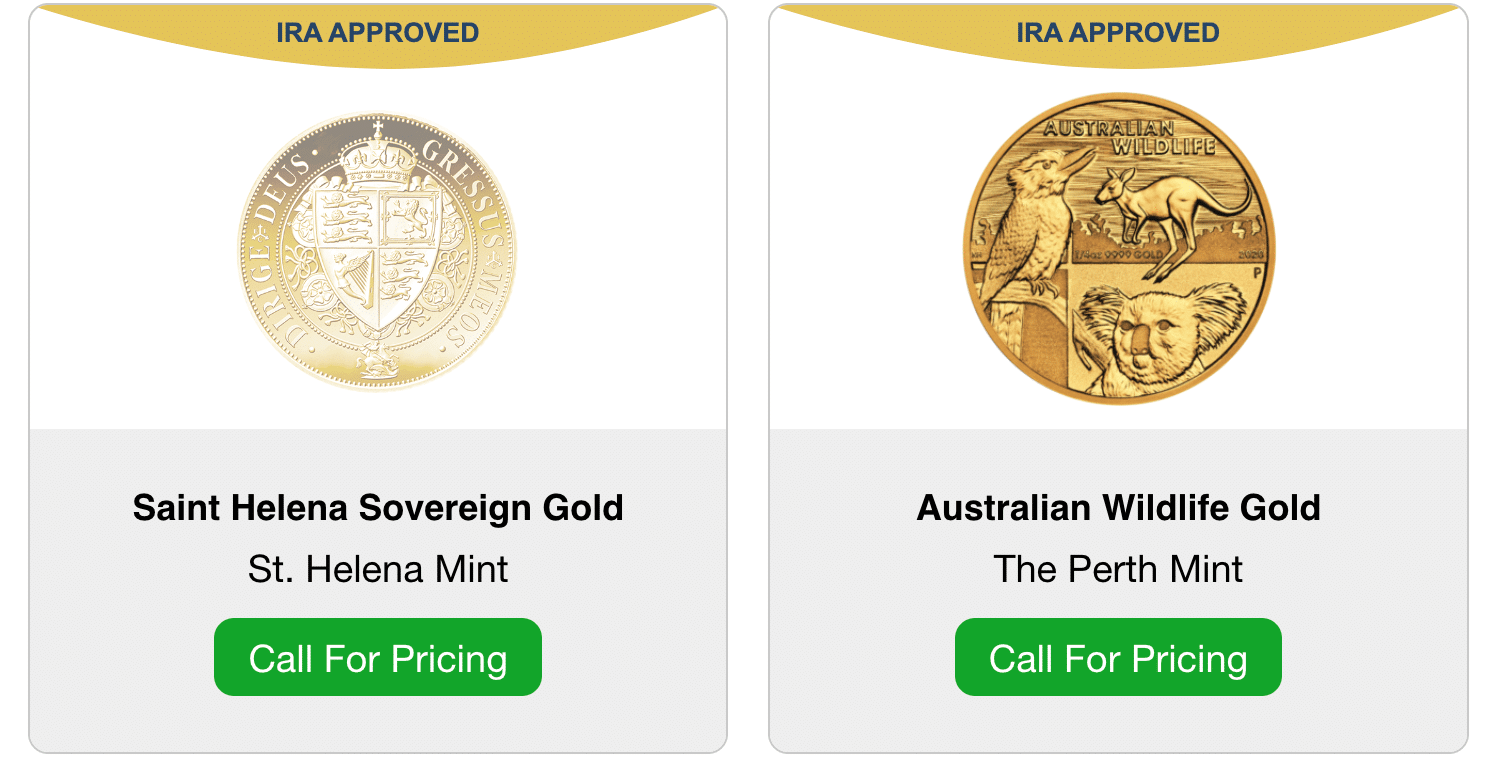

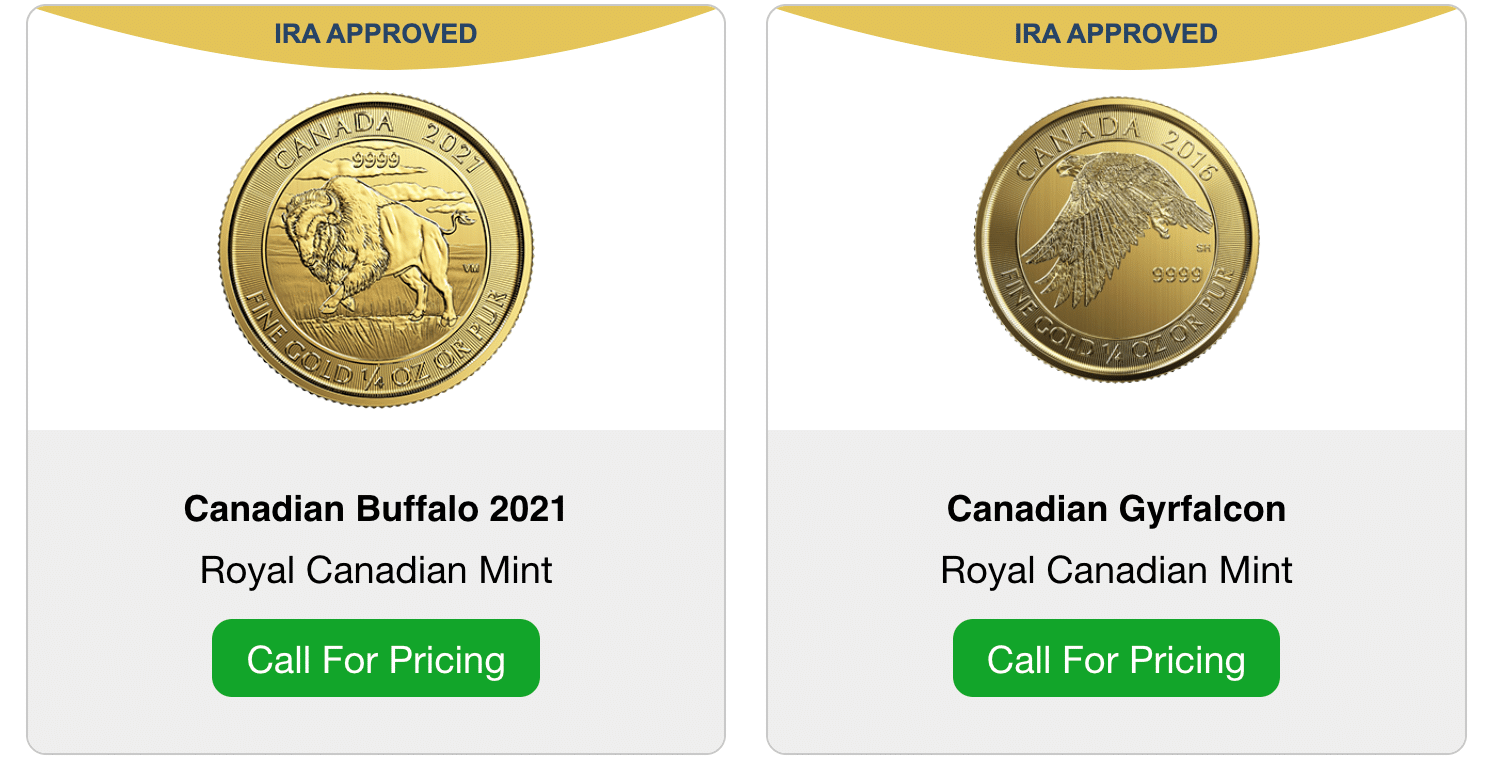

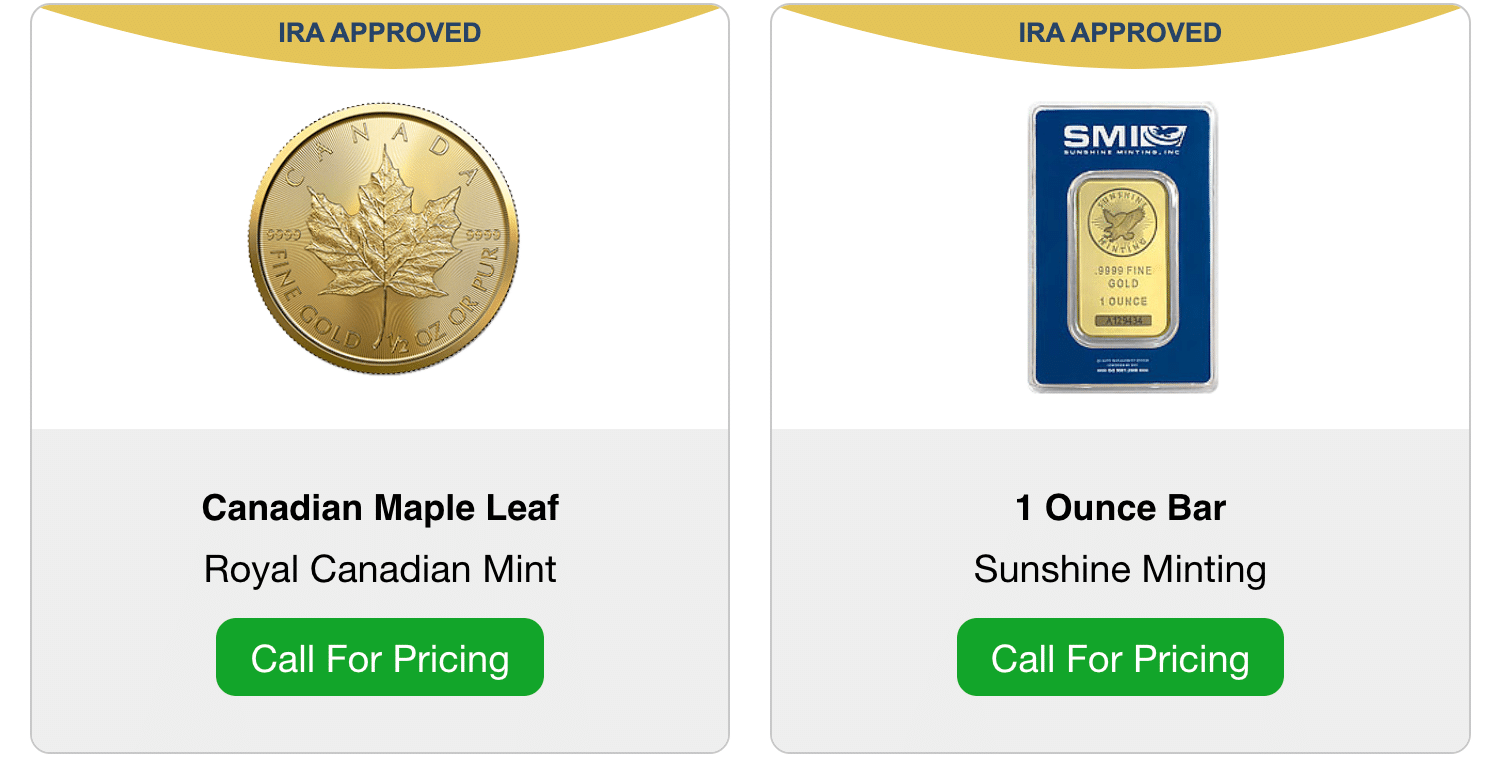

Unlike many other companies in the gold IRA industry, American Hartford Gold doesn’t charge transfers or startup fees for new Gold IRA accounts. They also provide free shipping and storage, reducing investors’ overall costs for maintaining their accounts. In addition, the company’s buyback guarantee ensures that investors can liquidate their assets at the current market price without incurring additional fees.

While the specific fees and prices associated with American Hartford Gold’s services are not readily available on their website, the estimated range of costs includes annual fees, storage fees based on the value of the stored precious metals, transaction fees for buying or selling, and termination fees for the account closure process. However, it’s important to note that these fees may vary depending on various factors, and clients are advised to consult with a company representative to obtain precise details.

Overall, American Hartford Gold is a reputable investment company offering various benefits and services for investors looking to diversify their portfolios with precious metals. With its commitment to trust, transparency, and integrity, the company prioritizes long-term relationships with its clients and strives to provide unparalleled customer service. Whether you’re an experienced investor or new to the world of precious metals, American Hartford Gold offers a platform to confidently secure and grow your investment and retirement funds.

Unlike many other companies in the gold IRA industry, American Hartford Gold doesn’t charge transfers or startup fees for new Gold IRA accounts. They also provide free shipping and storage, reducing investors’ overall costs for maintaining their accounts. In addition, the company’s buyback guarantee ensures that investors can liquidate their assets at the current market price without incurring additional fees.

While the specific fees and prices associated with American Hartford Gold’s services are not readily available on their website, the estimated range of costs includes annual fees, storage fees based on the value of the stored precious metals, transaction fees for buying or selling, and termination fees for the account closure process. However, it’s important to note that these fees may vary depending on various factors, and clients are advised to consult with a company representative to obtain precise details.

Overall, American Hartford Gold is a reputable investment company offering various benefits and services for investors looking to diversify their portfolios with precious metals. With its commitment to trust, transparency, and integrity, the company prioritizes long-term relationships with its clients and strives to provide unparalleled customer service. Whether you’re an experienced investor or new to the world of precious metals, American Hartford Gold offers a platform to confidently secure and grow your investment and retirement funds.