American Hartford Gold Prices

American Hartford Gold Prices

Gold has long been recognized as a

valuable physical asset that offers financial security and protection against inflation and economic downturns.

Gold IRA companies specialize in setting up and managing Individual Retirement Accounts (IRAs) that include

precious metals.

American Hartford Gold, a leading retailer of physical gold and silver assets in the United States, aims to provide personalized care and help clients secure their financial future by adding gold and silver to their investment or retirement portfolios.

Gold IRA companies provide their users with financial services and specialize in setting up, managing, and administrating precious metals via Individual Retirement Accounts (IRAs). In addition, companies that offer Gold IRA services often provide their clients with educational and professional advice on precious metals investments.

Here, you’ll find everything you need to know about American Hartford Gold prices, investments, and fees.

What is American HartFord Gold (American Hartford Gold Prices):

American Hartford Gold is a small investment company that is one of the leading retailers of physical gold and silver assets in the United States of America.

One of the primary goals of American Hartford Gold is to provide its investors and users with more personalized care options than its rival companies.

Overall Rating:

4.8/5 stars

SUPPORT:

TEAM:

SECURITY:

PRODUCTS:

PRICING:

The company also aims to help its clients secure their financial future by adding precious metals assets, such as gold and silver, to their investment or retirement portfolios.

Overview of American HartFord Gold Investments (American Hartford Gold Prices)

Due to its simplified operation mechanism, American Hartford Gold is suitable for both experienced and inexperienced investors looking to secure the value of their investment and retirement funds.

In addition, American Hartford Gold possesses Gold Investment Retirement Accounts (IRAs) designed to provide an extra layer of security for investors’ retirement savings. The company also includes a unique feature known as Buyback Commitment.

This

Buyback Commitment is an added layer of security that ensures that the company’s investors and clients have unrestricted access to funds when needed. It also allows investors to sell back their gold and silver assets at the current market price. This feature also gives the company’s investors peace of mind, as they are allowed to liquidate their assets in times of need.

One notable characteristic of the American Hartford Gold company is it prioritizes its values, including trust, transparency, and integrity.

American Hartford Gold believes these are vital to building long-term relationships with their investors and ensuring they receive unparalleled customer service. To achieve this, the company ensures precious metals specialists are always available to provide guidance and answer customer inquiries.

Why Invest In American Hartford Gold? (American Hartford Gold Prices)

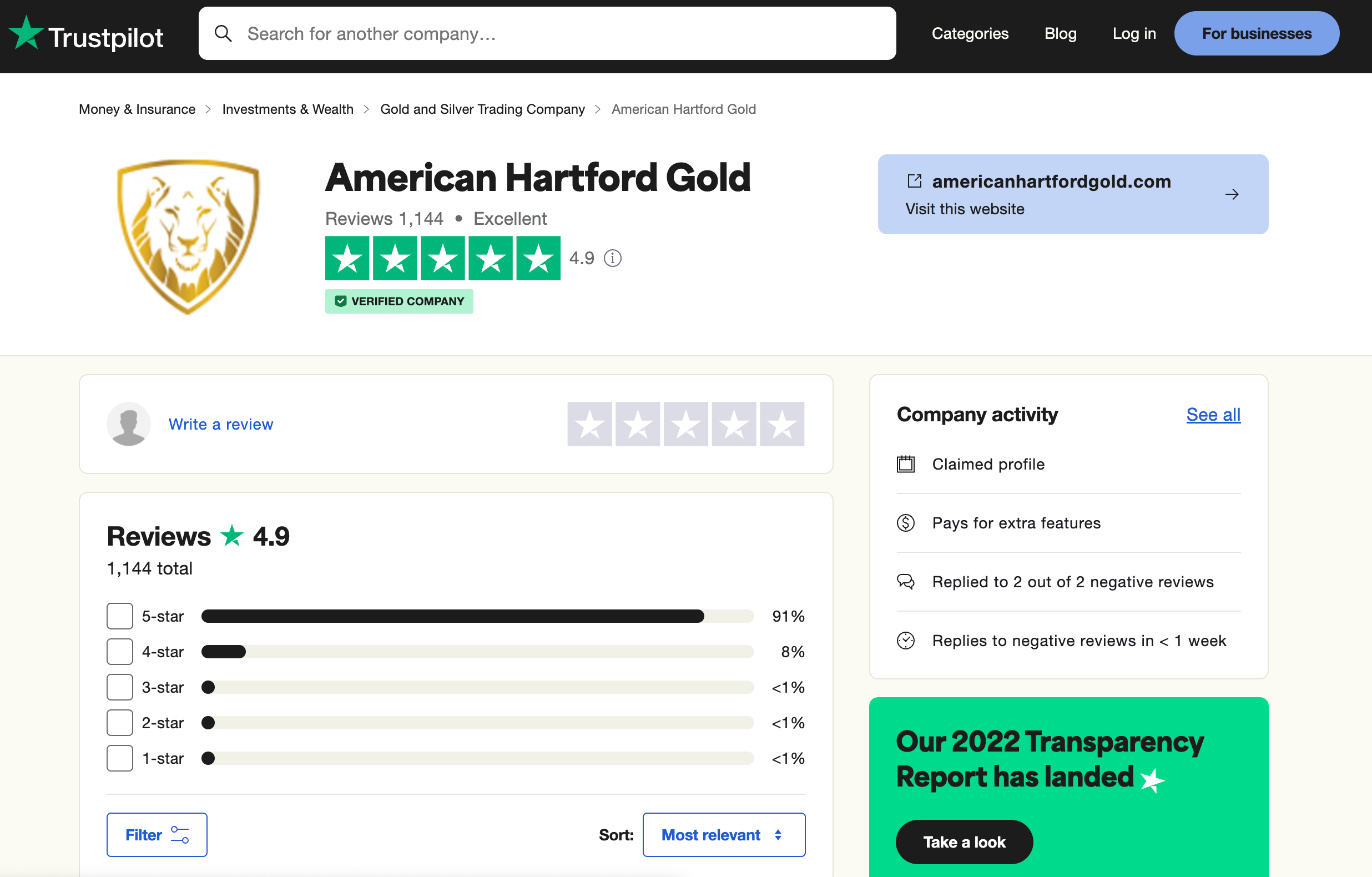

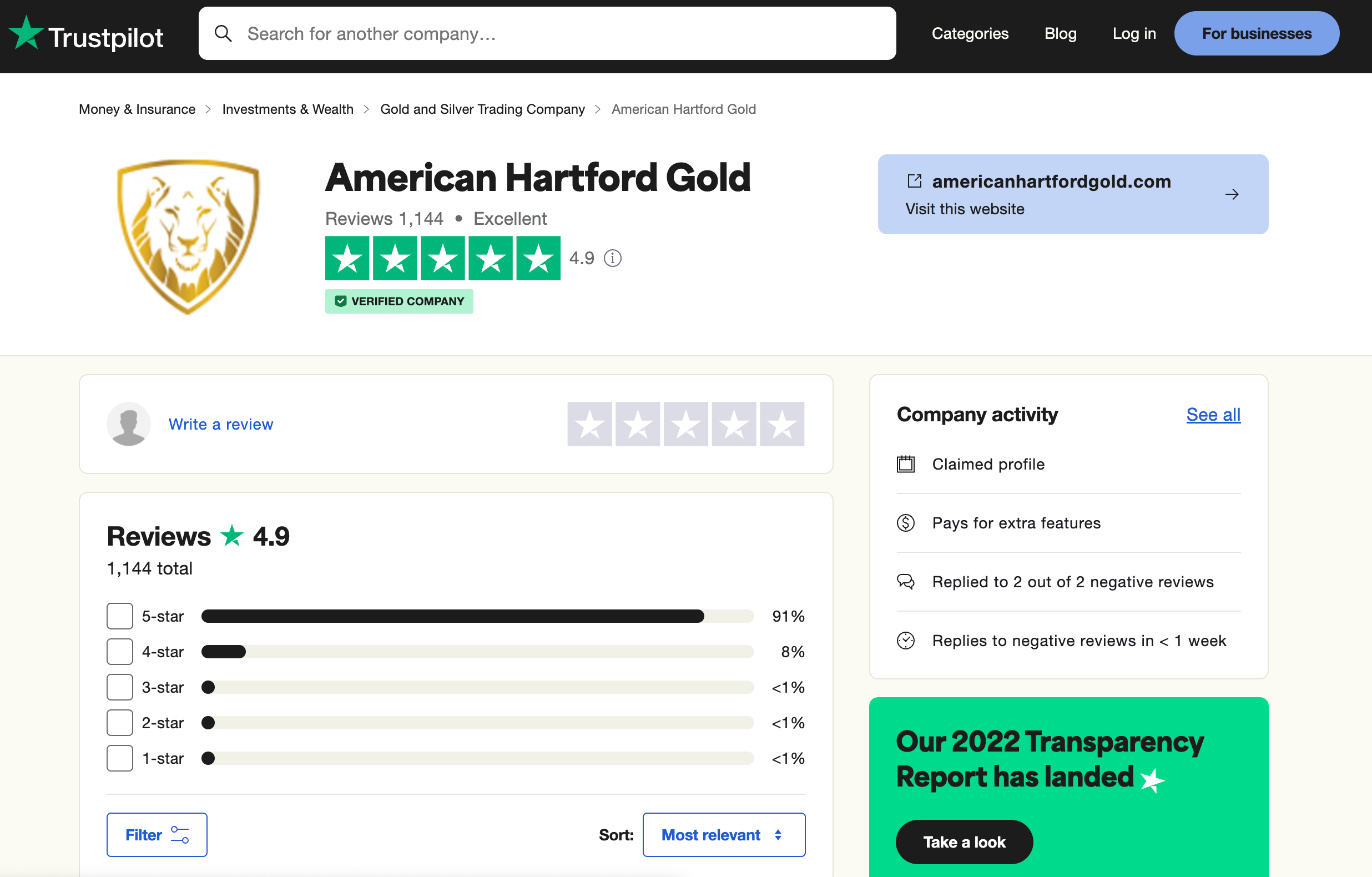

With over 60% of American households having at least one retirement plan, American Hartford Gold has provided its investors numerous benefits based on the thousands of 5-star ratings it has received on

Trustpilot and

Consumer Affairs.

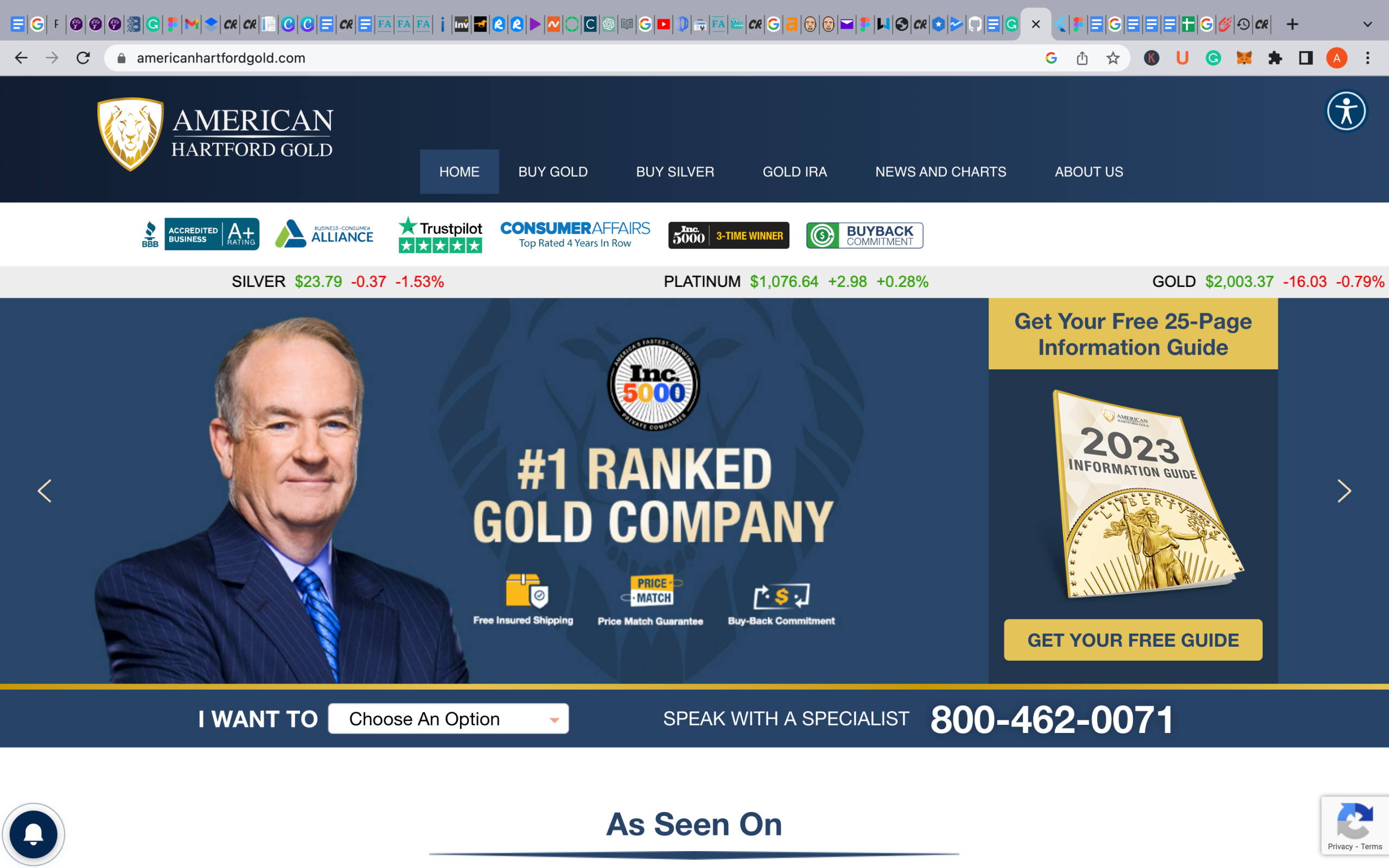

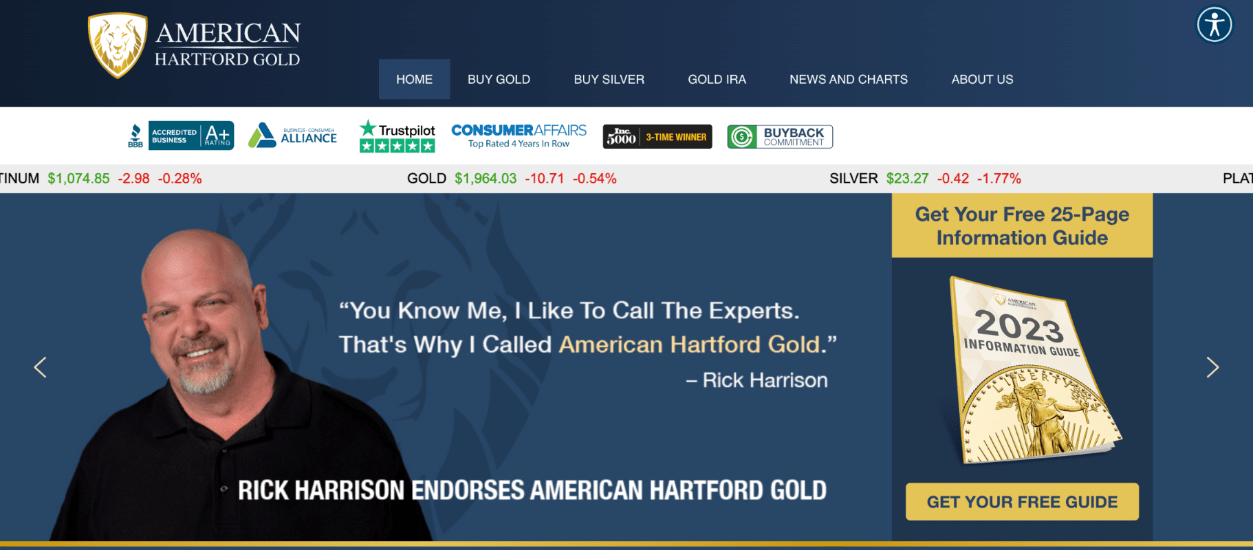

Despite its relatively short existence, American Hartford Gold has emerged as a trailblazer in precious metals investment. Renowned for its innovative approach, this company has garnered widespread recognition, securing endorsements from esteemed celebrities and influential politicians. Their commitment to excellence is further exemplified by their role as a prominent sponsor within the exciting world of NASCAR.

Despite its relatively short existence, American Hartford Gold has emerged as a trailblazer in precious metals investment. Renowned for its innovative approach, this company has garnered widespread recognition, securing endorsements from esteemed celebrities and influential politicians. Their commitment to excellence is further exemplified by their role as a prominent sponsor within the exciting world of NASCAR.

Notably, American Hartford Gold achieved a remarkable feat in 2021 when it was ranked as the top Gold company by Inc. 5000, a prestigious compilation that celebrates the achievements of privately owned businesses in the United States of America.

The following are some of the advantages of investing in American Hartford Gold:

- Consultation with a Precious Metals Specialist at Low Cost (American Hartford Gold Prices): American Hartford Gold offers individualized services to precious metals investors almost unheard of in the gold individual retirement account (IRA) industry. Account managers contact clients during the startup and transfer processes to address questions. These managers also ensure that each client has unrestricted access to specialist trend charts and information that will enable them to make the best choices when making Gold IRA investments.

- Excellent Selection of Investment Depository Locations (American Hartford Gold Prices): When purchasing physical gold assets, buyers must keep them in an authorized depository until they are ready to sell or liquidate them. American Hartford Gold offers its clients immediate access to their investments when needed. These depository sites are in cities like Los Angeles, New York, and others.

- Flexibility to Purchase and Own Physical Gold (American Hartford Gold Prices): Investors can diversify their portfolio beyond equities, bonds, and other traditional investment tools by using American Hartford Gold to buy and store physical gold items, such as gold coins and bars. Alternatively, investors can purchase physical gold and deliver it to their homes. However, investors who withdraw from their IRAs before age 59.5 may have to pay specific fees.

- Minimized Investment Fees (American Hartford Gold Prices): In the gold individual retirement account (IRA) Industry, one of the few investment companies that do not charge a transfer or startup fee for new Gold IRA accounts is American Hartford Gold. By providing its clients with free shipping and the occasional free month of storage, the company also reduces the amount that investors pay to keep their accounts active. The company also offers its clients a unique feature known as the buyback commitment guarantee that seniors or advanced investors will never have to pay a liquidation fee.

Who Is American Hartford Gold Investment For? (American Hartford Gold Prices)

The services offered by American Hartford Gold are suitable for both new and old investors who intend to protect the value of their investment funds. The following are two categories of investors who should consider investing in American Hartford Gold:

- Investors looking to diversify their portfolio (American Hartford Gold Prices): A Gold individual retirement account (IRA) can be started through American Hartford Gold by investors who want to add a product that adds more excellent stability and value to their holdings to their investment portfolio. Clients can purchase physical gold (and other precious metals) and put them in one of the many depositories that American Hartford Gold possesses with the assurance that they will still be there if the economics falters.

- Investors are interested in a product with a stable yet variable rate (American Hartford Gold Prices). One of the benefits of buying precious metals is the steadiness they provide in unpredictable times. Precious metals, including but not limited to gold and silver, maintain their intrinsic value regardless of how the economy performs. With gold, investors may get returns they would be less likely to achieve with bonds or equities.

American Hartford Gold and Silver Products and Coins (American Hartford Gold prices)

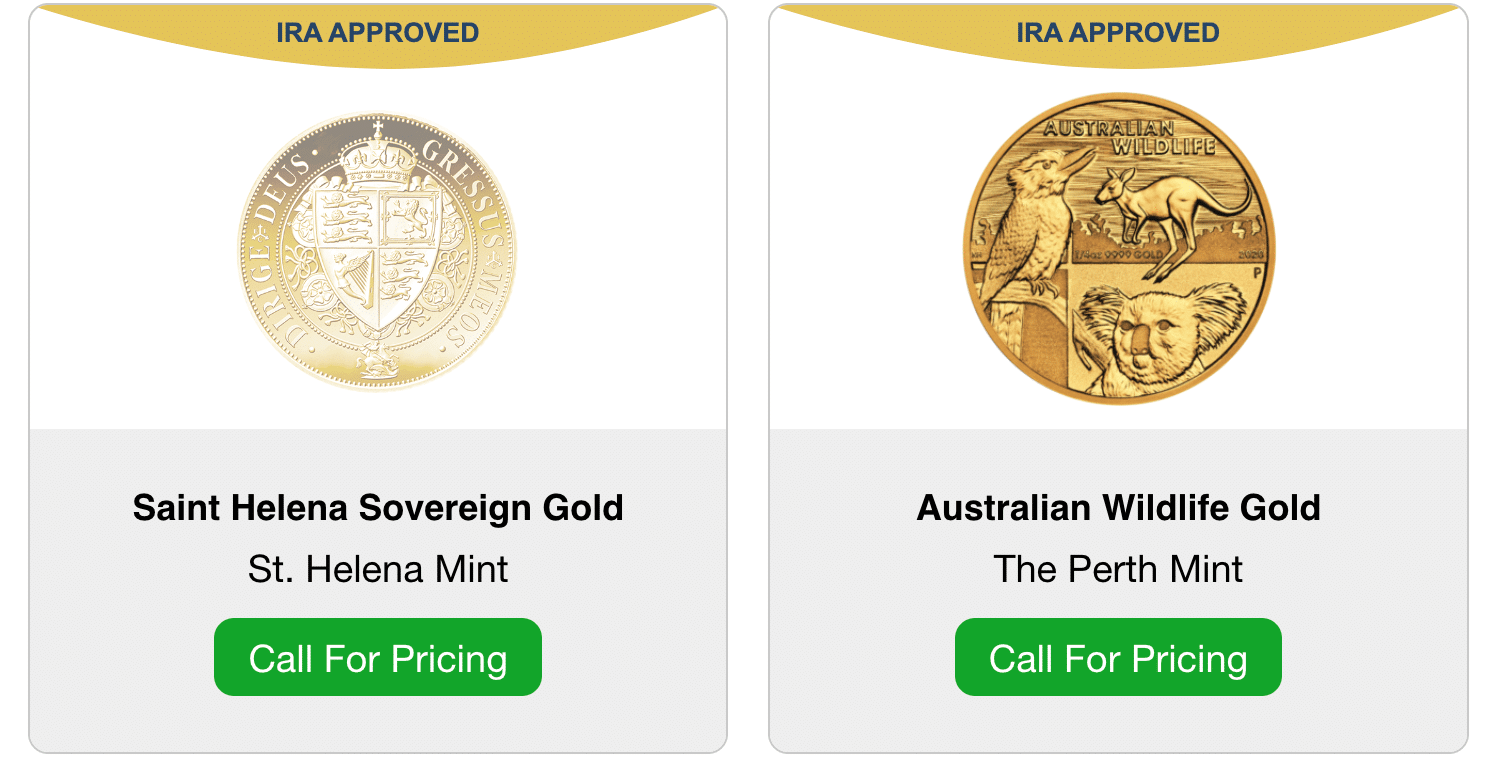

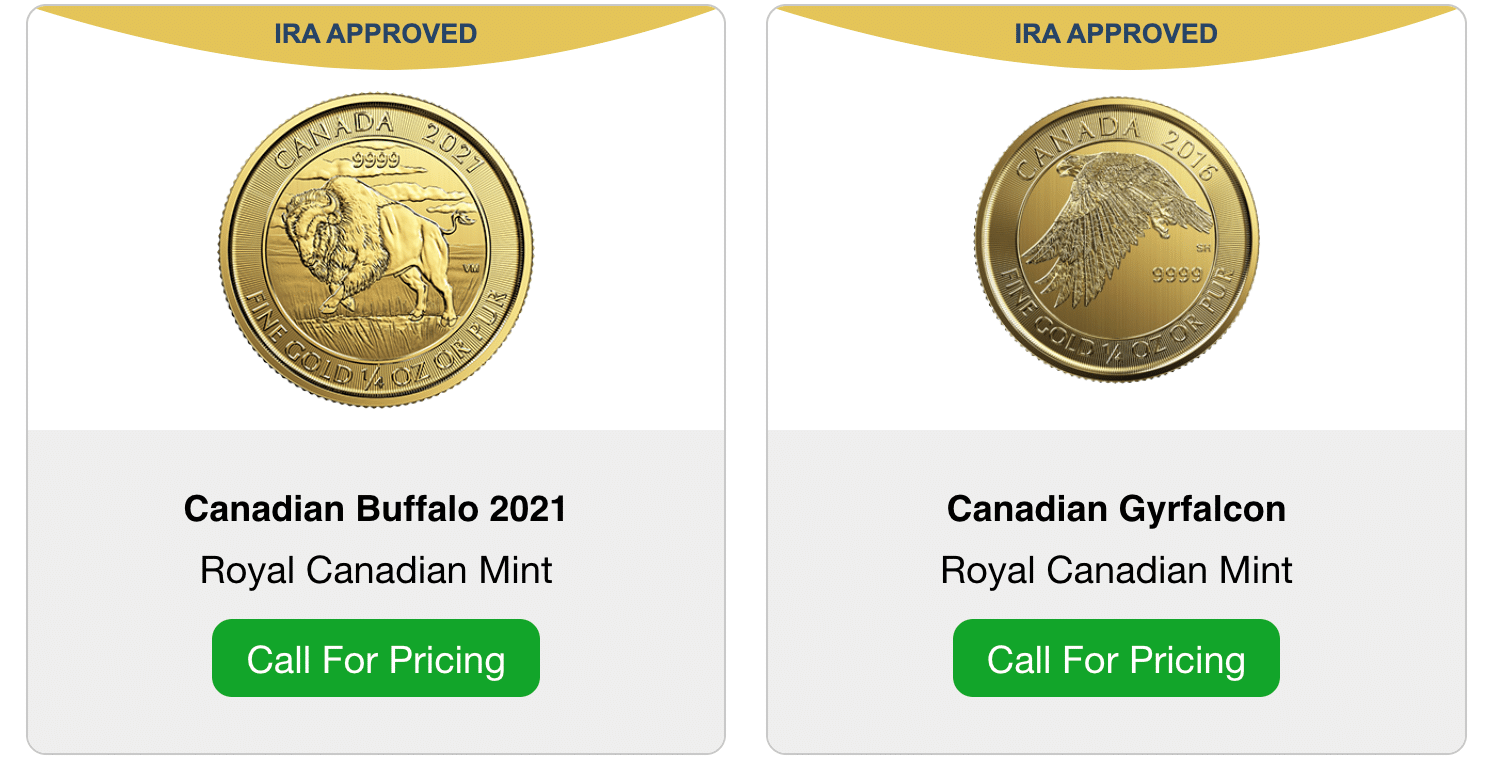

As featured on its website, the American Hartford Gold company sells 29 IRA-approved gold and silver products. These products include:

American Hartford Gold Account Types, Rates, and Minimum Investment (American Hartford Gold Prices)

The American Hartford Gold company offers clients that utilize any of their gold IRA services competitive Annual Percentage Rates (APRs) that range from 2.5% to 5.0%. The company also provides numerous term options, such as long-term and short-term investments.

Below are several account types and the annual percentage rates associated with them:

Single Precious Metals Account Types (American Hartford Gold prices)

The following are rates associated with account types whereby only a kind of precious metal is invested:

- Investors investing in the Gold IRA are provided with a percentage rate of up to 3.0%.

- Silver IRA investors are provided with a rate of 2.5%.

- For users who invest in IRAs for the platinum and palladium precious metals, percentage rates of 3.5% and 4.0% are provided, respectively.

Dual Precious Metals Account Types (American Hartford Gold Prices)

The following are rates associated with account types with two precious metals as investment options:

- Investors investing in Gold and Silver IRAs are provided a rate of 3.25%.

- For a Gold and Platinum IRA, a rate of 4.25% is provided.

- Gold and Palladium, IRA account types, have a rate of 4.5% associated with them.

- Investors of a Silver and Platinum IRA will receive a percentage rate of 3.75%.

- A percentage rate of 4.25% is associated with a Silver and Palladium IRA.

- Users who invest in Platinum and Palladium IRA account types will receive a 5.0% rate.

The prices of the different account types associated with American Hartford Gold range from $10,000 to $250,000, depending on the account type.

The minimum amount required for cash purchase is $5,000. This means that clients interested in opening a gold individual retirement account (IRA) can do so with a relatively low investment cost that can be gradually built up over time.

American Hartford Gold Prices and Fees

The prices associated with the coin provided by American Hartford Gold are not included on the company’s website. This is because the prices of Gold fluctuate daily, and it’s understandable. Investors and clients can find out the prices of American Hartford coins through a company representative when they sign up for a guide on the company website.

However, this section contains a typical range of costs for clients interested in investing in precious metals IRAs. This information is based on research and rates of other competitors in the market.

- Startup fees: There are no startup fees associated with American Hartford Gold.

- Annual fees: These fees typically range from $75 to $300.

- Storage fees: The fees usually range from 0.5% to 1% of the value of the precious metal stored.

- Shipping fees: There are no shipping fees associated with American Hartford Gold.

- Transaction fees: For buying or selling precious metals, transaction fees typically cost $40.

- Termination fees: Termination processes incur an amount of $150.

Price variations can occur for many reasons, including the number of gold assets bought, shipped, or stored.

Storage prices of these gold assets can vary depending on the depository. Likewise, the fees can vary depending on whether the gold asset is stored in aggregate or individually.

In some cases, American Hartford Gold may cover storage fees for specific clients for 1-3 years, depending on the account type. This enables clients to save on storage fees while ensuring their precious metals are securely stored.

Conclusion (American Hartford Gold prices)

In conclusion, American Hartford Gold provides comprehensive services and benefits for investors interested in precious metals, particularly gold and silver. With a focus on personalized care, the company aims to help clients secure their financial future by incorporating safe-haven assets into their investment or retirement portfolios.

Investing in American Hartford Gold offers several advantages. First, the company provides low-cost consultation with precious metals specialists, ensuring investors receive guidance and access to valuable information for making informed investment decisions. This personalized approach sets American Hartford Gold apart from other gold IRA companies.

Additionally, American Hartford Gold provides an excellent selection and accessibility of investment depository locations. With depository sites across the nation, clients have immediate access to their investments when needed, whether storing their precious metals or even having the option to deliver physical gold to their homes.

Unlike many other companies in the gold IRA industry, American Hartford Gold doesn’t charge transfers or startup fees for new Gold IRA accounts. They also provide free shipping and storage, reducing investors’ overall costs for maintaining their accounts. In addition, the company’s buyback guarantee ensures that investors can liquidate their assets at the current market price without incurring additional fees.

While the specific fees and prices associated with American Hartford Gold’s services are not readily available on their website, the estimated range of costs includes annual fees, storage fees based on the value of the stored precious metals, transaction fees for buying or selling, and termination fees for the account closure process. However, it’s important to note that these fees may vary depending on various factors, and clients are advised to consult with a company representative to obtain precise details.

Overall, American Hartford Gold is a reputable investment company offering various benefits and services for investors looking to diversify their portfolios with precious metals. With its commitment to trust, transparency, and integrity, the company prioritizes long-term relationships with its clients and strives to provide unparalleled customer service. Whether you’re an experienced investor or new to the world of precious metals, American Hartford Gold offers a platform to confidently secure and grow your investment and retirement funds.

American Hartford Gold Prices

Gold has long been recognized as a valuable physical asset that offers financial security and protection against inflation and economic downturns. Gold IRA companies specialize in setting up and managing Individual Retirement Accounts (IRAs) that include precious metals.

American Hartford Gold, a leading retailer of physical gold and silver assets in the United States, aims to provide personalized care and help clients secure their financial future by adding gold and silver to their investment or retirement portfolios.

Gold IRA companies provide their users with financial services and specialize in setting up, managing, and administrating precious metals via Individual Retirement Accounts (IRAs). In addition, companies that offer Gold IRA services often provide their clients with educational and professional advice on precious metals investments.

Here, you’ll find everything you need to know about American Hartford Gold prices, investments, and fees.

American Hartford Gold Prices

Gold has long been recognized as a valuable physical asset that offers financial security and protection against inflation and economic downturns. Gold IRA companies specialize in setting up and managing Individual Retirement Accounts (IRAs) that include precious metals.

American Hartford Gold, a leading retailer of physical gold and silver assets in the United States, aims to provide personalized care and help clients secure their financial future by adding gold and silver to their investment or retirement portfolios.

Gold IRA companies provide their users with financial services and specialize in setting up, managing, and administrating precious metals via Individual Retirement Accounts (IRAs). In addition, companies that offer Gold IRA services often provide their clients with educational and professional advice on precious metals investments.

Here, you’ll find everything you need to know about American Hartford Gold prices, investments, and fees.

Despite its relatively short existence, American Hartford Gold has emerged as a trailblazer in precious metals investment. Renowned for its innovative approach, this company has garnered widespread recognition, securing endorsements from esteemed celebrities and influential politicians. Their commitment to excellence is further exemplified by their role as a prominent sponsor within the exciting world of NASCAR.

Despite its relatively short existence, American Hartford Gold has emerged as a trailblazer in precious metals investment. Renowned for its innovative approach, this company has garnered widespread recognition, securing endorsements from esteemed celebrities and influential politicians. Their commitment to excellence is further exemplified by their role as a prominent sponsor within the exciting world of NASCAR.

Notably, American Hartford Gold achieved a remarkable feat in 2021 when it was ranked as the top Gold company by Inc. 5000, a prestigious compilation that celebrates the achievements of privately owned businesses in the United States of America.

The following are some of the advantages of investing in American Hartford Gold:

Despite its relatively short existence, American Hartford Gold has emerged as a trailblazer in precious metals investment. Renowned for its innovative approach, this company has garnered widespread recognition, securing endorsements from esteemed celebrities and influential politicians. Their commitment to excellence is further exemplified by their role as a prominent sponsor within the exciting world of NASCAR.

Despite its relatively short existence, American Hartford Gold has emerged as a trailblazer in precious metals investment. Renowned for its innovative approach, this company has garnered widespread recognition, securing endorsements from esteemed celebrities and influential politicians. Their commitment to excellence is further exemplified by their role as a prominent sponsor within the exciting world of NASCAR.

Notably, American Hartford Gold achieved a remarkable feat in 2021 when it was ranked as the top Gold company by Inc. 5000, a prestigious compilation that celebrates the achievements of privately owned businesses in the United States of America.

The following are some of the advantages of investing in American Hartford Gold:

Unlike many other companies in the gold IRA industry, American Hartford Gold doesn’t charge transfers or startup fees for new Gold IRA accounts. They also provide free shipping and storage, reducing investors’ overall costs for maintaining their accounts. In addition, the company’s buyback guarantee ensures that investors can liquidate their assets at the current market price without incurring additional fees.

While the specific fees and prices associated with American Hartford Gold’s services are not readily available on their website, the estimated range of costs includes annual fees, storage fees based on the value of the stored precious metals, transaction fees for buying or selling, and termination fees for the account closure process. However, it’s important to note that these fees may vary depending on various factors, and clients are advised to consult with a company representative to obtain precise details.

Overall, American Hartford Gold is a reputable investment company offering various benefits and services for investors looking to diversify their portfolios with precious metals. With its commitment to trust, transparency, and integrity, the company prioritizes long-term relationships with its clients and strives to provide unparalleled customer service. Whether you’re an experienced investor or new to the world of precious metals, American Hartford Gold offers a platform to confidently secure and grow your investment and retirement funds.

Unlike many other companies in the gold IRA industry, American Hartford Gold doesn’t charge transfers or startup fees for new Gold IRA accounts. They also provide free shipping and storage, reducing investors’ overall costs for maintaining their accounts. In addition, the company’s buyback guarantee ensures that investors can liquidate their assets at the current market price without incurring additional fees.

While the specific fees and prices associated with American Hartford Gold’s services are not readily available on their website, the estimated range of costs includes annual fees, storage fees based on the value of the stored precious metals, transaction fees for buying or selling, and termination fees for the account closure process. However, it’s important to note that these fees may vary depending on various factors, and clients are advised to consult with a company representative to obtain precise details.

Overall, American Hartford Gold is a reputable investment company offering various benefits and services for investors looking to diversify their portfolios with precious metals. With its commitment to trust, transparency, and integrity, the company prioritizes long-term relationships with its clients and strives to provide unparalleled customer service. Whether you’re an experienced investor or new to the world of precious metals, American Hartford Gold offers a platform to confidently secure and grow your investment and retirement funds.

Leave a Reply