This review of American Hartford Gold (AHG) will give potential customers an in-depth analysis of its offerings, services, and reputation.

By examining key factors such as the history, pricing, customer service, and delivery options, we will also consider the advantages and disadvantages of working with the company and provide a final verdict on whether American Hartford Gold is a good choice for investors looking to purchase precious metals.

American Hartford Gold (AHG) is a leading precious metals dealer in the United States that specializes in selling gold, silver, platinum, and palladium. With its headquarters in Los Angeles, California, the company has quickly established itself as a trusted provider of precious metals for investors looking to diversify their portfolios and protect their wealth.

One of the unique features of this company is its commitment to educating its customers about the precious metals market. AHG provides a wealth of resources on its website, including a blog, market updates, and a comprehensive guide. This dedication to transparency and education sets it apart from other dealers and reinforces its reputation as a reliable and trustworthy provider of precious metals.

What is the American Hartford Gold Group (American Hartford Gold Review):

American Hartford Gold (AHG) is a relatively new company in the precious metals industry, founded in 2015. However, the company has quickly established itself as a reputable and reliable gold and silver investment products provider. Overall Rating: 4.8/5 stars SUPPORT: TEAM: SECURITY: PRODUCTS: PRICING:Sanford Mann and Scott Gerlis established the company, sharing a commitment to customer service and ethical standards and creating an excellent place to do business and work.

Max Baecker is the company’s president, overseeing the day-to-day operations and building and leading the team of account executives.

Sanford Mann serves as the Chief Executive Officer. He is responsible for the company’s overall strategic direction in the gold industry, attracting the most ethical and knowledgeable talent and maintaining the highest levels of customer satisfaction. Scott Gerlis is the Executive Chairman, responsible for promoting the use of precious metals as safe-haven assets and educating the public on protecting their retirement savings.

Since its founding, the company has experienced rapid growth. In just a few short years, the company has become one of the leading providers of gold and silver investment products in the United States. This growth is due to the company’s commitment to providing investors with high-quality products and exceptional customer service.

One of the company’s primary products is Gold IRA accounts. These accounts allow investors to hold physical gold in their retirement accounts to diversify their portfolios and protect against economic instability. The company has helped thousands of investors set up gold IRA accounts and purchase gold to hold in those accounts.

In addition to gold IRA accounts, they offer a range of gold and silver coins and bullion products. These products are available in various sizes and weights, allowing investors to purchase the amount of gold or silver that best suits their investment needs.

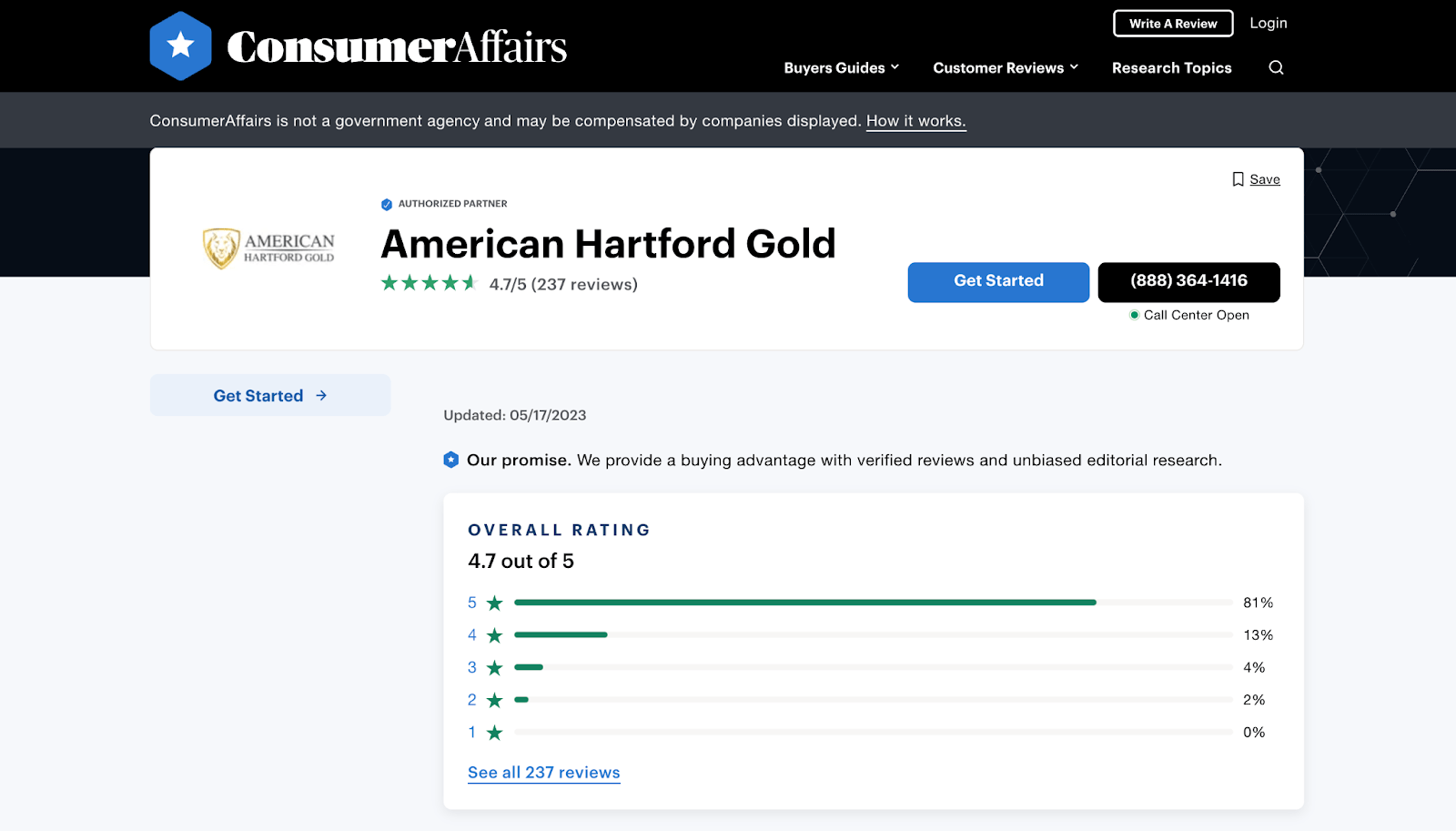

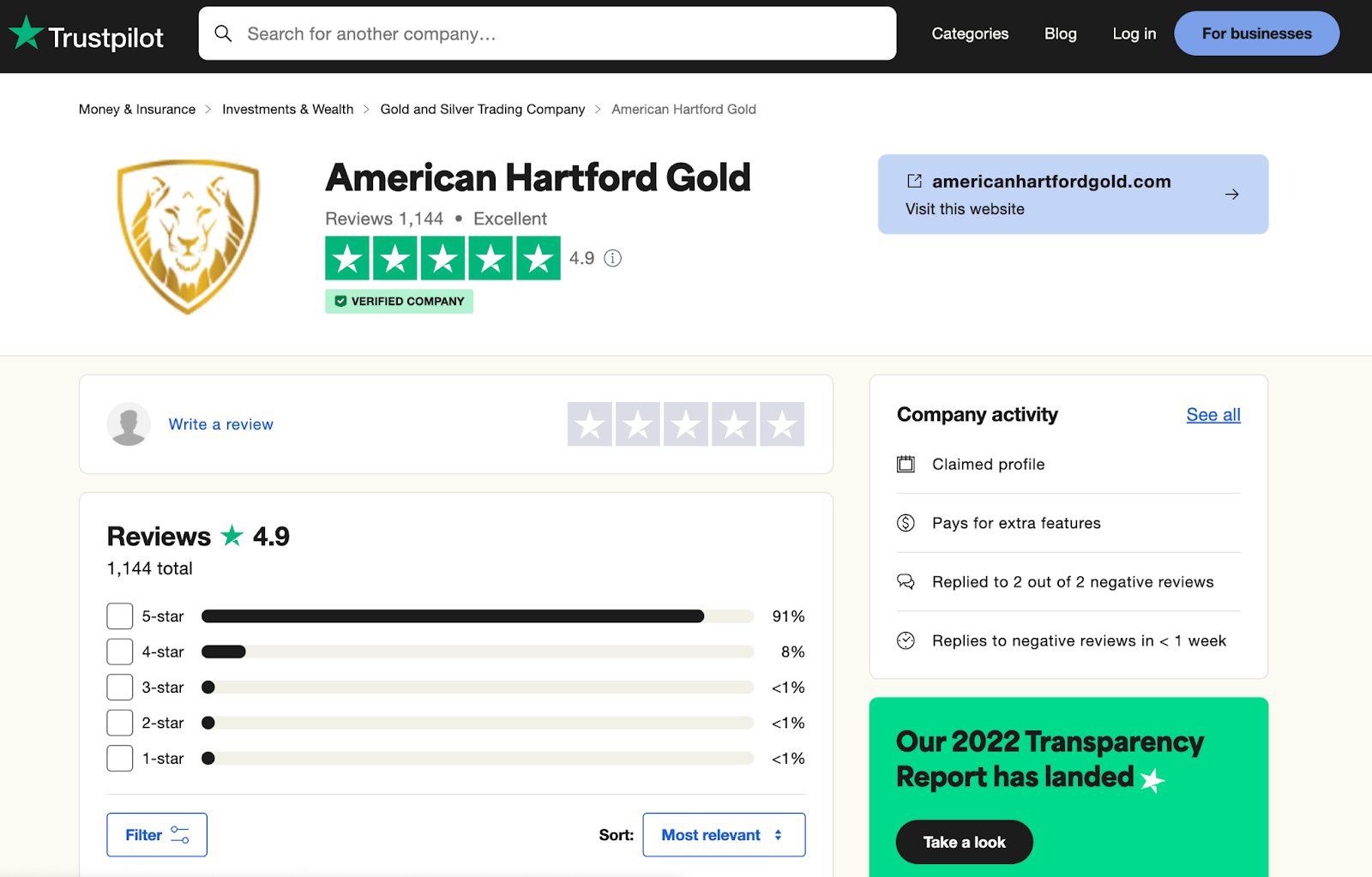

Despite being relatively new, AHG has already received several awards and accolades. With an AA company rating and a 5-star review from Business Consumer Alliance, American Hartford Gold Group is on the list as one of the best Gold IRA companies. They also have a 5-star review from Consumer Affairs, Trustpilot, and the Better Business Bureau, earning them a credible reputation.

What are the Benefits of Investing in American Hartford Gold? (American Hartford Gold review)

With over 60% of American households having at least one retirement plan, American Hartford Gold has provided its investors numerous benefits based on the thousands of 5-star ratings it has received on Trustpilot and Consumer Affairs.

Despite its relatively short existence, American Hartford Gold has emerged as a trailblazer in precious metals investment. Renowned for its innovative approach, this company has garnered widespread recognition, securing endorsements from esteemed celebrities and influential politicians.

Their commitment to excellence is further exemplified by their role as a prominent sponsor within the exciting world of NASCAR. Notably, American Hartford Gold achieved a remarkable feat in 2021 when it was ranked as the top Gold company by Inc. 5000, a prestigious compilation that celebrates the achievements of privately owned businesses in the United States of America.

The following are some of the advantages of investing in American Hartford Gold (American Hartford Gold Review):

-

Consultation with a Precious Metals Specialist at Low Cost (American Hartford Gold review): American Hartford Gold offers individualized services to precious metals investors that are almost unheard of in the gold individual retirement account (IRA) industry. Account managers contact clients during the startup and transfer processes to address questions. These managers also ensure that each client has unrestricted access to specialist trend charts and information that will enable them to make the best choices when making Gold IRA investments.

-

Excellent Selection of Investment Depository Locations (American Hartford Gold Review): When purchasing physical gold assets, buyers must keep them in an authorized depository until they are ready to sell or liquidate them. American Hartford Gold offers its clients immediate access to their investments when needed. These depository sites are in cities like Los Angeles, New York, and others.

-

Flexibility to Purchase and Own Physical Gold (American Hartford Gold Review): Investors can diversify their portfolio beyond equities, bonds, and other traditional investment tools by using American Hartford Gold to buy and store physical gold items, such as gold coins and bars. Alternatively, investors can purchase physical gold and deliver it to their homes. However, investors who withdraw from their IRAs before age 59.5 may have to pay specific fees.

-

Minimized Investment Fees (American Hartford Growth Review): In the gold individual retirement account (IRA) Industry, American Hartford Gold is one of the few investment companies that does not charge a transfer or startup fee for new Gold IRA accounts. By providing its clients with free shipping and the occasional free month of storage, the company also reduces the amount that investors pay to keep their accounts active. The company also offers its clients a unique feature known as the buyback commitment guarantee that seniors or advanced investors will never have to pay a liquidation fee.

With its commitment to innovation and its team of experienced professionals, there are no doubts that this company is positioned for continued success in the years to come.

American Hartford Gold Review – Products and Services

American Hartford Gold (AHG) is a leading precious metals dealer in the United States, offering a wide range of products to help investors diversify their portfolios and protect their wealth. The company specializes in gold, silver, platinum, and palladium products, including coins, bars, and rounds. These include:

-

Gold and Silver IRAs

-

Storage and depository services

-

Gold and Silver bullion and investment coins

-

IRA rollovers and transfers

One key advantage of investing with them is their competitive pricing. AHG offers transparent pricing on its website, ensuring customers know what they pay for each product. Furthermore, the Price Shield program guarantees customers buy their products at the lowest possible price.

In the following sections, we will delve deeper into these offerings.

Gold and Silver IRAs (American Hartford Gold Review)

A gold IRA, also known as a precious metals IRA, allows investors to hold physical gold, silver, and other precious metals within a tax-advantaged self-directed individual retirement account (SDIRA).

With an SDIRA, you can hold alternative assets like real estate, art, cryptocurrencies, and precious metals. American Hartford Gold simplifies the process of opening a gold or silver IRA, making it easy for investors to diversify their portfolios with precious metals.

Their gold options include;

Their silver options include;

AHG partners with third-party custodians and storage companies to make opening a gold or silver IRA as smooth as possible. Their gold IRAs provide tax-deferred gains, diversification, and total control over investments, with free rollovers for accounts over $10,000.

AHG also allows individuals to purchase physical bullion and premium coins and have them shipped straight to their door. Their selection of gold coins includes staples like the American Gold Eagle, Canadian Gold Maple Leaf, and American Buffalo, as well as top-tier gold bullion and proof coins, such as the Canadian Polar Bear and Canadian Arctic Fox.

They also offer collectors various issues of 19th-century rare US gold coins. Their silver coin selection has a wide range of IRA-eligible bullion and junk silver coins for purchase. AHG offers storage and depository services with the Delaware Depository or Brinks Global Services. They offer free shipping on physical gold and silver and will deliver it directly to your front door, registered and insured, with no additional cost incurred.

Compared to other gold IRA companies, AHG ranks among the best in the business, with highly trustworthy and affordable services. Their website contains a catalog of products, although their prices are not listed. Interested clients and customers must speak to an online representative for comprehensive information on current pricing.

American Hartford Gold Account Types and Rates

The American Hartford Gold company offers clients that utilize any of their gold IRA services competitive Annual Percentage Rates (APRs) that range from 2.5% to 5.0%. The company also provides numerous term options, such as long-term and short-term investments.

Below are several account types and the annual percentage rates associated with them:

Single Precious Metals Account Types (American Hartford Gold Review)

The following are rates associated with account types whereby only a kind of precious metal is invested:

- Investors investing in the Gold IRA are provided with a percentage rate of up to 3.0%.

- Silver IRA investors are provided with a rate of 2.5%.

- For users who invest in IRAs for the platinum and palladium precious metals, percentage rates of 3.5% and 4.0% are provided, respectively.

Dual Precious Metals Account Types (American Hartford Gold Review)

The following are rates associated with account types with two precious metals as investment options:

- Investors investing in Gold and Silver IRAs are provided a rate of 3.25%.

- For a Gold and Platinum IRA, a rate of 4.25% is provided.

- Gold and Palladium, IRA account types, have a rate of 4.5% associated with them.

- Investors of a Silver and Platinum IRA will receive a percentage rate of 3.75%.

- A percentage rate of 4.25% is associated with a Silver and Palladium IRA.

- Users who invest in Platinum and Palladium IRA account types will receive a 5.0% rate.

The prices of the different account types associated with American Hartford Gold typically range from $10,000 to up to $250,000, depending on the account type.

However, the minimum amount required for cash purchase is $5,000. This means that clients interested in opening a gold individual retirement account (IRA) can do so with a relatively low cost of investment, which can be gradually built up over time.

American Hartford Gold Fees and Prices (American Hartford Gold Review)

The fees and prices associated with the services provided by American Hartford Gold should be included on the company’s website. Investors and clients can also find out the fees of these services through a company representative.

However, this section contains a typical range of costs for clients interested in investing in precious metals IRAs. This information is based on research and rates of other competitors in the market.

- Startup fees: There are no startup fees associated with American Hartford Gold.

- Annual fees: These fees typically range from $75 to $300.

- Storage fees: The fees usually range from 0.5% to 1% of the value of the precious metal stored.

- Shipping fees: There are no shipping fees associated with American Hartford Gold.

- Transaction fees: For buying or selling precious metals, transaction fees typically cost $40.

- Termination fees: Termination processes incur an amount of $150.

There are many reasons for price variations. These price variations can be due to the number of gold assets bought, shipped, or stored.

Storage prices of these gold assets can vary depending on the depository. Likewise, the fees can vary depending on whether the gold asset is stored in aggregate or individually.

In some cases, American Hartford Gold may cover storage fees for specific clients for 1-3 years, depending on the account type. This enables clients to save on storage fees while ensuring their precious metals are securely stored.

Opening a Gold and Silver IRA (American Hartford Gold Review)

Opening a Gold and Silver IRA account is straightforward. These accounts allow you to roll over or transfer funds from an existing retirement account without incurring additional costs or fees.

Opening an IRA through this reputable company has benefits. The minimum purchase amount is $10,000, while the minimum for cash purchases is $5,000. Customers can open IRA accounts with low investments and gradually build them up over time.

Opening a Gold and Silver IRA account can be an excellent option if you’re interested in investing in precious metals to diversify your retirement portfolio. Here’s what you need to know about the process.

Choose a Custodian (American Hartford Gold Review)

The first step in opening a Gold and Silver IRA account with them is to choose a custodian. A custodian is a financial institution that holds and manages the assets in your IRA account.

Choose an IRS-approved custodian to hold precious metals in your IRA account. The custodian typically charges an annual fee of around $180, but it varies.

Equity Trust, International Depository Services Group, Brinks, and Delaware Depository are some popular IRA custodians working with AHG.

Open the IRA Account (American Hartford Gold Review)

Once you’ve chosen a custodian, the next step is to open the Gold and Silver IRA account. You’ll need to fill out an application form with the custodian with information about your personal and financial situation. You’ll also need to designate American Hartford Gold as your dealer for the account. IRA fees are waived for the first year for purchases over $50,000.

Fund the Account (American Hartford Gold Review)

After opening your Gold and Silver IRA account, you’ll need to fund it. You can do this by rolling over an existing IRA or 401(k) account or by contributing from your funds. The IRS sets annual and essential contribution limits for IRA accounts. Therefore, you should have this in mind when funding your account.

Choose Your Products (American Hartford Gold Review)

You can start purchasing precious metals products once you fund your Gold and Silver IRA account. American Hartford Gold offers a wide selection of gold and silver products, including bars, coins, and rounds. You can count on the company’s representatives to assist you in selecting products that align with your investment goals.

Purchase Your Products (American Hartford Gold Review)

Once you’ve selected the precious metals products you want to purchase, you can complete the transaction through American Hartford Gold. The company’s representatives will handle the purchase and delivery of the products to the custodian for safekeeping.

Store Your Products (American Hartford Gold Review)

The custodian will manage and store your precious metals products in a secure off-site vault. You can also choose to have your products delivered to your home or a third-party storage facility, although this may result in additional fees.

Manage Your Investments (American Hartford Gold Review)

If you have a self-directed IRA account, you are solely accountable for managing your investments and ensuring they comply with IRS regulations. However, the company’s representatives can offer expert advice and guidance whenever necessary.

Opening a Gold and Silver IRA account with AHG can diversify your retirement portfolio and protect your assets against inflation and market volatility. With a wide selection of products, expert guidance from knowledgeable representatives, and secure storage options, they are undoubtedly an excellent choice for investors looking to invest in the industry.

Customer Service and Support (American Hartford Gold Review)

American Hartford Gold is a highly reputable dealer that provides its customers with exceptional customer service and support. The company’s commitment to providing personalized assistance and expert advice sets it apart from other dealers in the industry.

One of the primary factors distinguishing its customer service from other companies is its focus on education. The company provides a wide range of resources on its website, including a blog, market updates, and a comprehensive precious metals guide.

These resources help customers make informed decisions about their investments and reinforce their reputation as reliable and trustworthy providers.

In addition to its educational resources, AHG offers personalized customer service to clients. Customers can rely on the company’s knowledgeable representatives to answer their questions and provide expert investment advice. Whether customers prefer to communicate via phone or email, they can expect a quick and helpful response from American Hartford Gold’s team.

Customers can expect a streamlined and straightforward process when purchasing their products. AHG’s website is easy to navigate, with transparent pricing listed for all products. Customers can also take advantage of the company’s Price Shield program, which ensures they receive the lowest possible price for their product purchases.

In addition, the company provides different delivery options to ensure customers receive their products securely and promptly. Insured shipping is available, and customers can also store their products in a secure off-site vault for added peace of mind.

In addition to their dedication to education and personalized customer service, they prioritize swift and effective resolution of any issues that may arise. The company has a team of experienced and dedicated customer service representatives available to assist customers with any concerns.

AHG’s exceptional customer service and support make it an ideal choice for investors wanting to procure precious metals. AHG is committed to education, a streamlined purchasing process, and customer satisfaction, ensuring customers receive only the best products and services.

Delivery Options (American Hartford Gold Review)

One critical aspect of investing in precious metals is the delivery process, which ensures that investors receive their purchased metals securely and promptly. AHG offers various delivery options to cater to its clients’ diverse needs.

One of the most popular delivery options offered by this reputable company is the home delivery option. This option allows investors to have their products delivered directly to their homes or preferred locations. The process starts by placing an order with the dealer, and once the payment is confirmed, the metals get shipped to the investor’s address via insured mail or courier service.

AHG uses trusted carriers like UPS, FedEx, and the United States Postal Service to ensure the safety and timely delivery of the metals. The delivery time may vary depending on the location, but most deliveries are within seven business days. For added security, they also use discreet packaging that does not reveal the contents of the package.

Another delivery option offered is the depository delivery option. This option is ideal for investors who do not want to store their precious metals at home or prefer a third party to save them on their behalf. AHG has partnered with various depositories across the United States, including the Delaware Depository, Brinks, and IDS of Canada, to provide storage options to its clients. Investors can choose their preferred depository and have the metals delivered there.

The company stores the metals in a segregated account under the investor’s name and provides a certificate of ownership to the investor. The depository option provides additional security and peace of mind since the metals are stored in a highly secure facility with around-the-clock monitoring and insurance coverage.

AHG also offers a self-directed IRA delivery option, allowing investors to purchase precious metals using their Individual Retirement Account (IRA) and store them in a depository. This option is ideal for investors who want to diversify their retirement portfolios and protect their wealth from inflation and economic uncertainties.

The process involves opening a self-directed IRA account with an IRA custodian for precious metals investment, such as New Direction IRA, IRA Services Trust Company, or Equity Trust Company. The investor then places an order with American Hartford Gold, and once the payment is confirmed, the metals get shipped to the depository of the investor’s choice.

The self-directed IRA delivery option offers tax advantages, as the metals are in an IRA account, and the investor does not pay taxes on the gains until they withdraw the funds.

Overall, AHG offers a range of delivery options to cater to the diverse needs of its clients. Investors can choose to have their products delivered to their homes, stored in a depository, or stored in a self-directed IRA account. Each delivery option offers unique benefits, including added security, peace of mind, and tax advantages. As with any investment, it is essential to research and consult with a financial advisor before investing in precious metals.

Tax Benefits (American Hartford Gold Review)

One of the key advantages of investing with American Hartford Gold is the tax benefits of investing in physical gold. Here are some of the tax advantages:

Tax-Deferred Growth (American Hartford Gold Review)

One of the main benefits of investing in physical gold with this reputable company is that the growth on your investment is tax-deferred. It means you do not have to pay taxes on gains until you sell your gold. It allows your investment to grow faster since you are not paying taxes on the growth each year.

No Capital Gains Tax (American Hartford Gold Review)

When you sell your physical gold with the company, you may be eligible for a tax treatment that exempts you from paying capital gains taxes on any profits you make. This is because physical gold is considered a collectible, and collectibles get taxed at a maximum rate of 28% rather than the standard capital gains tax rate, which can be as high as 37%.

Potential IRA Tax Benefits (American Hartford Gold review)

When you invest in physical gold through a self-directed IRA with American Hartford Gold, you may enjoy additional tax benefits. For example, you can invest in gold with pre-tax dollars, and you do not have to pay taxes on the money you use to purchase the gold. Additionally, gains investments will also be tax-deferred until you withdraw them from your IRA.

Hedge Against Inflation (American Hartford Gold Review)

Investing in physical gold can also help protect your wealth from the effects of inflation. Gold tends to hold its value over time, and its price typically rises during periods of high inflation. Investing in gold means it can potentially appreciate even when other investments, such as stocks and bonds, are losing value due to inflation.

Diversification (American Hartford Gold Review)

Another benefit of investing in physical gold with this reputable company is that it can help diversify your investment portfolio. Diversification is important because it can help reduce the overall risk of your portfolio. By investing in gold, you add an asset that has historically had a low correlation with other types of investments, such as stocks and bonds.

Investing with AHG provides investors with several tax advantages. These include tax-deferred growth, no capital gains tax, potential IRA tax benefits, protection against inflation, and diversification. It is crucial to consult a financial advisor or tax professional to know if investing in physical gold is right for your financial needs.

Pros & Cons (American Hartford Gold Review)

While investing in gold and other precious metals can be good for diversifying a portfolio, there are pros and cons to investing with American Hartford Gold.Pros (American Hartford Gold Review)

#1. Lowest Price Guarantee and No Buy-Back Fees

AHG guarantees the lowest prices and doesn’t charge any buy-back fees to its customers, making it a compelling choice for investors interested in precious metals. The Lowest Price Guarantee is a policy that ensures customers receive the best price possible when buying precious metals. If a customer finds a lower price for the same product from another company, American Hartford Gold will match or beat that price. This policy helps to ensure that customers get the best value for their investment and can feel confident that they are not overpaying for their products. It also demonstrates the company’s commitment to customer satisfaction and willingness to go the extra mile to ensure its customers are happy with their investments. In addition to the Lowest Price Guarantee, AHG also offers a No-Buy-Back Fee policy. This policy allows customers to sell back their precious metals to the company without incurring additional fees or charges. This is necessary because some companies charge fees when customers want to sell back, which can affect their profits. By offering a Buy-Back Fee policy, they make it easier for customers to sell their precious metals and realize the value of their investment. It also demonstrates their commitment to transparency and fairness, as they are not trying to nickel-and-dime their customers with hidden fees.#2. A+ Ratings and 5 Star Reviews from Past Customers

AHG has received numerous accolades for its exceptional customer service, competitive pricing, and trustworthy investment advice. One of the most notable achievements of this reputable company is its A+ rating from the Better Business Bureau (BBB) and five-star reviews from its past customers. The BBB is a nonprofit organization that rates businesses based on customer satisfaction, ethical business practices, and transparency. The company has consistently maintained an A+ rating with the BBB, which is the highest possible rating a business can achieve. This rating is a testament to the company’s commitment to providing top-notch service and ensuring that its customers are satisfied with their investments. In addition to its A+ rating, they have received numerous five-star reviews from past customers, as seen on various review sites such as Consumer Affairs, Business Consumer Alliance, and Trustpilot. These reviews highlight the company’s professionalism, expertise, and personalized service.#3. Diversification

American Hartford Gold offers a range of investment options in precious metals, including physical gold and silver coins, bars, and Individual Retirement Accounts (IRAs). These investment options allow investors to diversify their portfolios and reduce their exposure to traditional assets such as stocks and bonds. There are several benefits for investors seeking to diversify their portfolios by investing in precious metals. First, these metals perform well during economic uncertainty or market volatility. It is because they are considered safe-haven assets that investors flock to when other markets are experiencing turmoil. Second, these assets have a low correlation with other asset classes, such as stocks and bonds. It means that when other assets are performing poorly, precious metals may perform well, providing a buffer against losses in other parts of your portfolio. They design their investment options in precious metals to meet the needs of investors with different investment goals and risk tolerance levels. Whether you are looking to invest a small portion of your portfolio in precious metals or you are looking to use precious metals as a core part of your investment strategy, AHG can help you achieve your goals.#4. Tangible Asset

Gold and other precious metals are tangible assets that can be held and stored. They can provide investors with a sense of security and stability, knowing they have physical assets used as a store of value. The appeal of tangible assets like gold is their intrinsic value and physical nature, as they are a way to diversify your investment portfolio and protect your wealth against economic uncertainty. AHG provides a way for individuals to invest in tangible assets and take advantage of their benefits.#5. Inflation Hedge

One of the main advantages of investing in AHG is that it can serve as an inflation hedge. As an inflation hedge, they offer investors the potential to maintain the purchasing power of their money over time. By investing in tangible assets like gold, investors can diversify their portfolios and reduce their exposure to the risks associated with inflation. Investing with AHG may be an effective way to protect your wealth against the impact of inflation. By diversifying your portfolio with tangible assets like gold, you can reduce your exposure to the risks associated with traditional financial instruments and potentially benefit from the long-term stability of precious metals.#6. Tax Benefits

American Hartford Gold offers a variety of tax benefits for investors. For example, gold and other precious metals in an IRA can provide investors with tax-deferred growth and potentially lower tax rates when the assets get sold.Cons (American Hartford Gold Review)

#1. High Costs

Investing in gold and other precious metals can be expensive, and AHG is no exception. The company charges fees for buying and selling gold and storage fees for holding the assets. These costs can eat into investors’ returns and make it difficult to achieve their investment goals.#2. Long wait times

The processing times for orders may take time. Processing may take up to six weeks in some cases, which can be inconvenient for customers who need their products delivered immediately.#3. Volatility

While gold and other precious metals can be a way to diversify a portfolio, they are not immune to volatility. The value of gold and other precious metals can fluctuate widely, which can be challenging for investors looking for stability in their portfolios.#4. Counterparty Risk

When investing with American Hartford Gold, investors rely on the company to store and safeguard their assets. It can create counterparty risk, the risk that the company could go bankrupt or fail to deliver on its promises.#5. Limited Upside

While gold and other precious metals can provide a hedge against inflation and market volatility, they may not offer the same potential for growth as other assets like stocks and real estate. Investors who focus too heavily on gold and other precious metals may miss out on potential upside in different market areas.Final Thoughts (American Hartford Gold Review): Is American Hartford Gold Worth It?

American Hartford Gold is a legitimate and trustworthy platform that offers investors a unique opportunity to diversify their portfolios with tangible assets like gold, silver, and platinum. The company has a strong reputation for providing excellent customer service and offering a wide range of investment options to suit different needs and budgets.

One of the key advantages of investing in AHG is the potential for these precious metals to act as an inflation hedge. Gold and other precious metals have historically held their value well during economic uncertainty, making them a popular choice for investors looking to protect their wealth over the long term.

Another benefit of investing with them is the simplicity and accessibility of the process. Unlike some investments, investing in precious metals is straightforward, making it a good option for new investors or those looking to diversify their portfolios.

AHG provides a valuable service to investors looking to protect their wealth and diversify their portfolios. Whether you are a seasoned investor or just starting, American Hartford Gold is worth considering, as it can be a way to potentially benefit from the stability and long-term value of tangible assets like gold, silver, and platinum.

Leave a Reply