Below are some top Talent Management Statistics;

In today’s fast-paced and competitive business landscape, organizations are constantly seeking ways to stay ahead of the curve. One crucial aspect that has gained significant attention in recent years is talent management. Effective talent management is no longer just a nicety, but a necessity for driving business success. In this article, we’ll delve into the world of talent management statistics, exploring the latest trends, challenges, and best practices that can help you unlock the full potential of your workforce.

What Is Talent Management (Talent Management Statistics)

Talent management is the process of identifying, developing, and retaining top performers within an organization. It involves creating a strategic approach to attract, engage, and retain the best talent, aligning their skills and abilities with the company’s goals and objectives.

Key Talent Management Statistics (Editor’s Pick)

- 80% of organizations believe that talent management is a critical component of their business strategy.

- 75% of companies struggle to attract and retain top talent, resulting in significant financial losses.

- 40% of employees are likely to leave their jobs within the first year if they don’t receive adequate training and development opportunities.

- High-performing employees are 25% more likely to stay with their current employer if they have opportunities for growth and development.

- Companies with effective talent management strategies experience 26% higher revenue growth compared to those without.

- The global talent management market is estimated to have been worth $1922.96 million in 2022 and it is anticipated to grow to $2178.26 million by 2028.

- The majority of advertisers, agencies, publishers, platforms, and ad tech companies (76%) identified inadequate training and development as a major factor contributing to the shortage of talent in the industry.

General Talent Management Statistics

- The global talent management market’s value was $1922.96 million in 2022, and it is expected to increase to $2178.26 million by 2028, growing at a rate of 2.1% annually. (Source)

- Nearly 40% of respondents prefer purchasing from well-known HR and talent management software providers. (Source)

- Approximately 85% of surveyed business leaders utilize HR and talent management software, with the highest adoption rates in Spain, Norway, Finland, France, Italy, Colombia, and Brazil. (Source)

- About 54% of companies have implemented a Talent Management Program (TMP). 46% of employers lack a TMP. (Source)

- Among those with a TMP, 34% are focusing on development opportunities for their staff more than a year in advance, and an additional 25% are planning over two years in advance. (Source)

- 42% of candidates won’t apply for roles without their preferred working model. (Source)

- Apart from formal TMPs, 94% of companies provide training to their staff, with only 6% not offering any training. Of those without training outside a TMP, 3% have a formal strategy elsewhere. (Source)

- The primary reason for having a TMP, cited by 83% of companies with one, is to retain existing staff, believing it crucial to prevent losing top talent. (Source)

- Companies with a TMP are 18% less likely to lose junior managers. (Source)

- Beyond retention, 79% of organizations with a TMP emphasize developing their people as a core organizational value. Their strategies include offering career progression opportunities, structured support for career growth, and linking performance to clear objectives and culture. (Source)

- In 2022, the BFSI sector had the largest market share in talent management applications. (Source)

- The global celebrity talent management market’s value was $15,905.84 million in 2022, and it is expected to reach $25,931.83 million by 2031, with a CAGR of 5.58% from 2022 to 2031. (Source)

- 69% of organizations prioritized cost and user experience when choosing a talent management application. (Source)

- In 2019 the global assessment services market was valued at over $6.5 billion. (Source)

- Nearly 85% of businesses utilize HR and talent management software, and 70% of leaders intend to increase their investment in this technology. (Source)

- In 2019, 45% of organizations reported that Paycor consistently met their primary talent management needs. Additionally, 30% of organizations indicated that Paycor met their primary workforce management needs. (Source)

- 24% of organizations stated that Ultimate UltiPro met their primary HR management system needs. 46% of enterprises reported that UltiPro also met their payroll needs. (Source)

- The third most common reason (72%) for implementing a TMP is to foster business growth by developing new leaders. (Source)

- The private and non-profit sectors are more likely to anticipate increases in recruitment and talent management budgets compared to the public sector. (Source)

- Only 63% of organizations gather data for staffing decisions, but only a minority use a comprehensive approach. Specifically, 21% collect data for predicting hiring needs, 16% for evaluating talent availability, and 28% for pinpointing retention problems internally. (Source)

- In 2022, around 30% of respondents reported complete alignment between their talent and business strategies, an increase of nearly 10% from 2021. (Source)

- According to a survey, companies that found their talent management highly effective were significantly more likely to outperform their competitors. (Source)

- German managers excel in accountability and accessibility, with 71% of employees feeling their manager is aware of their projects and 60% receiving prompt responses. However, only 32% of employees feel their manager helps set performance goals, and 38% receive support in setting work priorities. (Source)

- In 2019, 58% of organizations used employee referral management tools, while 88% adopted time and attendance workforce management applications. (Source)

- The HR technology market in India reached $1,040 million in 2023 and is projected to reach $2,170 million by 2032, growing at a CAGR of 8.3% from 2024 to 2032. (Source)

- Gartner predicts that by 2025, 60% of global businesses will invest in cloud-based human capital management suites due to the increasing demand for human resources and talent management solutions. (Source)

- Approximately 40% of companies anticipate increasing their recruitment and talent management budgets in the coming year, significantly more than in previous years, reflecting growing challenges and resource costs. (Source)

- Artificial intelligence (AI) is revolutionizing workplaces worldwide, with 30% of workers globally and 41% in the Asia Pacific region using AI in their daily tasks. (Source)

- The North American Talent Management Software Market is expected to grow at a CAGR of 10.6% from 2023 to 2030. (Source)

- The market for human capital management solutions is projected to grow by $13.92 billion between 2023 and 2028, with an average annual growth rate of 9.52%. (Source)

- A recent study by KBV Research forecasts that the global talent management software market will reach $19.4 billion by 2030, expanding at an average annual rate of 11.4% during the predicted period. (Source)

- The performance management segment is expected to increase at an average annual rate of 12% from 2023 to 2030. (Source)

- On-premise solutions dominated the global talent management software market by deployment in 2022 and are anticipated to reach a market value of $10 billion by 2030. (Source)

- Opportunities for growth and development are crucial for 22% of employees. (Source)

Talent Development (Talent Management Statistics)

- Nearly 40% of organizations prioritize internal talent development to fill roles, while 26% have automated certain positions in the past year. (Source)

- Almost 38% of organizations are actively investing in internal talent to meet their staffing needs. Upskilling current employees is the primary strategy to address recruitment challenges, and it is chosen by 60% of companies. (Source)

- 46% of organizations offer apprenticeships, with approximately a third providing entry-level opportunities for graduates or post-A-level students, and slightly over a quarter running internship programs. (Source)

- 47% of employees attribute their professional growth to the extra training and education they’ve received. (Source)

Talent Management Software Data (Talent Management Statistics)

- Approximately 75% of HR and talent management software buyers review user feedback before making a purchase. (Source)

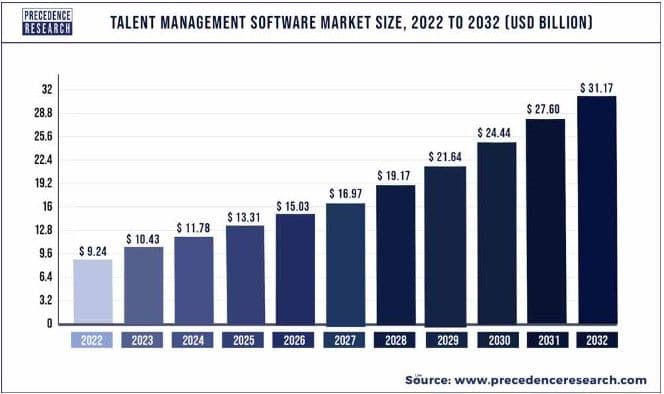

- The global market for talent management software was valued at $9.24 billion in 2022 and is projected to grow to approximately $31.17 billion by 2032, with a compound annual growth rate of 12.93% from 2023 to 2032. (Source)

- North America was the leading region in the talent management market revenue share in 2022. This region is a key market for talent management software, driven by the presence of large companies and strong adoption of new technologies. (Source)

- The United States and Canada primarily contributed to North America’s growth in the talent management software market. (Source)

- By 2032, the banking, financial, and insurance sectors are expected to surpass the IT and telecom industries in market share for talent management software, which was dominant in 2022. (Source)

- The global market for talent management software is projected to grow from $10.09 billion in 2024 to $25.36 billion by 2032, with a compound annual growth rate of 12.2% during 2024-2032. (Source)

- The increasing adoption of cloud-based platforms and mobile-based personnel management systems is a key driver of growth in the talent management software market. (Source)

- When considering HR and talent management software, buyers prioritize user experience, training, support services, data privacy, and reporting. (Source)

- Among 26 industries surveyed, property management, entertainment/media, distribution/inventory management, and investment services were the most invested in HR and talent management software. (Source)

- The global talent management software market’s value was $9.24 billion in 2022, and it is expected to reach $31.17 billion by 2032, growing at a CAGR of 12.93% from 2023 to 2032. (Source)

- The primary goals of most respondents in purchasing HR and talent management software were to attract new customers and strengthen existing customer relationships. Additionally, 60% aimed to ensure employee and consumer safety. (Source)

- The Europe Talent Management Software Market is projected to grow at an 11% compound annual growth rate from 2023 to 2030. (Source)

- In 2022, Germany was the leading country in the Europe Talent Management Software Market, with a projected market value of $1.3 billion by 2030. (Source)

- Over half of respondents cited productivity improvement as the main reason for purchasing new software. Other top reasons include managing competitive pressure and outgrowing current technology. (Source)

- HR and talent management software buyers prefer content that helps them learn to use the software and understand its benefits. (Source)

- More than 35% of buyers replace their HR and talent management software due to poor integration with other systems. Additionally, 31% switch because of bugs and unreliability or finding a better alternative. (Source)

Talent Sourcing (Talent Management Statistics)

- The talent acquisition segment was the largest in the talent management software market in 2023 and is anticipated to continue growing due to the demand for efficient onboarding, recruiting, and sourcing processes. (Source)

- In 2019, 85% of companies had adopted talent management applications for recruitment. Additionally, 88% of organizations implemented workforce management applications for time and attendance. (Source)

- In 2019, 92% of medium-sized organizations had already implemented talent management applications for recruitment. (Source)

- A survey on global talent management found that 44% of respondents used assessments during recruitment for professional positions. (Source)

- 63% of HR professionals in the Americas used pre-hire assessments as part of the hiring process. (Source)

- Organizations are increasingly offering better pay and benefits to address recruitment challenges (36%, up from 29% last year). (Source)

- Pay and benefits have become among the top factors in employer branding and attracting candidates. However, nearly 60% of organizations do not consider them among their primary attractors. (Source)

- Flexible working options are advertised for at least some jobs by 69% of organizations. It’s increasingly seen as an effective method for attracting candidates, with 54% of those facing recruitment challenges choosing to offer greater work flexibility. (Source)

- 66% of organizations have implemented hybrid/remote working policies, and 47% advertise jobs as ‘open to location.’ Such flexibility has helped 68% of these organizations attract and retain talent while also boosting productivity by 45% and engagement by 35%. (Source)

- Formal diversity policies are in place at 61% of organizations, although efforts to attract diverse candidates could be more proactive and comprehensive. One-third of organizations have achieved a more diverse workforce than the previous year. (Source)

Employee satisfaction (Talent Management Statistics)

- Only 50% of employees clearly understand their work expectations. (Source)

- About half of workers feel exhausted, drained, or burned out due to their jobs, with stress, overwhelm, and anxiety being common experiences, emphasizing the need for organizations to prioritize mental health support. (Source)

- Approximately 70% of individuals find their sense of purpose through their work, highlighting the importance of aligning daily tasks with meaningful outcomes. (Source)

- Only 15% of frontline managers and employees report feeling connected to their purpose while on the job. (Source)

- Australia prioritizes employee well-being, with 62% willing to decline a promotion for their well-being, compared to 48% globally and 43% in APAC, reflecting a strong work-life balance culture. (Source)

- Only 12% of employees express strong approval for their company’s onboarding efforts. (Source)

Challenges (Talent Management Statistics)

- From 2021 to 2022, the percentage of organizations with established talent strategies declined from 55% to 38%. (Source)

- In 2023, career progression and opportunities were the most significant challenge faced by Global Business Services organizations worldwide, with nearly half of respondents citing this issue. (Source)

- 40% of organizations identified deficiencies in their HR processes related to talent management. (Source)

- Overall, 81% of organizations attempted to fill vacancies, and 77% faced challenges attracting candidates, a significant increase from 49% in 2021. (Source)

- Recruiting for senior and skilled roles posed the greatest difficulty at 58%, while 26% struggled with hiring low-skilled candidates. (Source)

- 60% reported it is now harder to retain talent than the previous year, prompting 37% to initiate retention improvement efforts, up from 29% in 2021. (Source)

- 80% of UK employers face challenges finding talent with the necessary skills, marking a 17-year high. (Source)

- Globally, 4 out of 5 employers find it difficult to secure needed talent in 2023, a slight increase from the previous year and substantially higher than the 2015 figure of 14%. (Source)

- Demographic shifts, including declining birth rates and increased early retirements, have exacerbated talent scarcity. (Source)

- In a survey, 67% of respondents identified talent scarcity as a significant obstacle to growth. (Source)

- 60% of APAC advertising, publishing, platform, and ad tech companies believed the advertising media industry was facing its worst talent crisis. This figure was slightly higher in the U.S. at 50% and lower in Europe, the Middle East, and Africa at 44%. (Source)

- In the same survey, approximately 75% of respondents acknowledged some level of talent scarcity, with 85% of ad agencies reporting this issue. (Source)

- One-third (33%) of people managers felt their role was not worth the stress and 40% experienced a decline in mental health after assuming a leadership position. (Source)

- Only 13% of HR leaders rated their talent management practices as excellent, while 70% assessed their organization’s ability to meet talent needs as mediocre. (Source)

- Talent management has been a key priority for only 38% of organizations in the past year, an increase from 30% in 2021 but lower than in previous years. (Source)

- A survey found that 76% of advertising, agency, publishing, platform, and ad tech companies attributed inadequate training and development and insufficient prioritization of talent management to talent shortages. (Source)

- A global survey revealed that 48% of advertising, agency, publishing, platform, and ad tech companies considered the industry to be experiencing its worst-ever talent crisis, while only 21% disagreed. (Source)

- The decision-making process for HR and talent management software is time-consuming, with 65% of respondents taking three to nine months to complete a purchase and only 18% taking less than three months. (Source)

- An Australian study of 500 employers and 1,000 workers shows that 89% of employers and 71% of employees doubt their company’s ability to recruit skilled personnel this year. (Source)

- The primary issue hindering employers from attracting top talent is non-competitive salaries, identified by 30% of workers. (Source)

- Limited career advancement opportunities are a significant concern, with 30% of employers and 26% of workers worrying about this. (Source)

- Financial and accounting professionals are the most anxious about retention policies (74%), followed by business support (73%) and technology sector employees (67%). (Source)

- One in four executives (24%) believes meeting this year’s business demand will be challenging with the current talent model. (Source)

- Despite 58% seeing AI as delivering over 30% productivity gains, two-thirds are wary of implementing new technology without transforming work processes. (Source)

- Less than 30% of HR leaders in Australia view AI as a tool to enhance human intelligence, missing opportunities beyond automation. Only 16% of employees report job redesigns benefiting from new technologies. (Source)

- In Australia, 62% of businesses struggle to find talent, exceeding the global average of 50%. Additionally, 46% have difficulty retaining employees, higher than the global average of 40%. (Source)

- UK employers report talent shortages 3 percentage points higher than the global average of 77%. (Source)

- 70% of respondents acknowledge increased competition for skilled talent over the past year, with 60% indicating increased difficulty in talent retention compared to a year ago. (Source)

- 52% of employees believe their companies are lacking in providing clear and timely performance feedback. (Source)

Conclusion (Talent Management Statistics)

In conclusion, the landscape of talent management is rapidly evolving, and organizations that embrace data-driven insights will be well-positioned to attract, retain, and nurture top talent. The statistics presented in this article highlight the growing importance of talent management and its significant impact on business outcomes. By leveraging data and analytics, organizations can make informed decisions, improve employee engagement, and optimize their talent strategies. As we move towards 2024 and beyond, businesses must prioritize talent management and harness the power of data to unlock business success. By investing in data-driven talent strategies, organizations can create a workplace that fosters innovation, productivity, and long-term growth.

FAQ (Talent Mangement Statistics)

Why is talent management important in statistics? (Talent Management Statistics)

In essence, statistics provides the foundation for data-driven talent management, enabling organizations to make informed decisions, optimize performance, and ensure a sustainable talent pipeline.

Who is responsible for talent management? (Talent Management Statistics)

Talent management is typically a shared responsibility across various levels of an organization. While the HR department often takes the lead, it’s not solely responsible. Managers play a crucial role in identifying talent, providing feedback, coaching, and mentoring employees. They are often involved in performance reviews and succession planning.

Leave a Reply