The sharing economy, a term coined in 2008, is disrupting traditional industries and changing the way we live, work, and consume. It’s a system where individuals share access to goods, services, and resources, rather than owning them outright. From ride-hailing to short-term rentals and collaborative consumption, the sharing economy has witnessed explosive growth, transforming how we think about ownership and access.

Here are Some compelling statistics that showcase the remarkable impact and potential of the sharing economy;

Sharing Economy Statistics (Editor’s Pick)

- 86 million Americans have participated in the sharing economy.

- The global sharing economy market is projected to reach $335 billion by 2025.

- 70% of millennials are more likely to share goods and services than own them.

- The sharing economy has created over 1 million jobs worldwide.

- 55% of sharing economy users are motivated by convenience.

- 72% of sharing economy users are motivated by cost savings.

- 60% of sharing economy users have used services for business purposes.

- 80% of sharing economy users expect to increase their usage in the next 12 months.

- North America dominated the sharing economy market in 2022 and is expected to maintain its dominance through 2032.

General Growth and Size (Sharing Economy Statistics)

- The global sharing economy is poised for rapid expansion, surging from $150 billion in 2023 to a projected $794 billion by 2031, fueled by a robust annual growth rate of approximately 32%. (Source)

- The United States has witnessed a substantial increase in sharing economy users, climbing from roughly 44.8 million in 2016 to an estimated 86.5 million by 2021. (Source)

- The sharing economy is on the brink of a major milestone, with revenue projections exceeding $1 trillion by 2031. (Source)

- 55% of sharing economy users believe it makes it easier to get around without owning a car. (Source)

- Valued at nearly $150 billion in 2022, the global sharing economy market is on track for exponential growth, reaching $793.68 billion by 2028 with a compound annual growth rate of 32.01%. (Source)

- In 2018, the individual segment dominated the sharing economy, generating a revenue of $114.22 billion. (Source)

- Between 2023 and 2028, the sharing economy market is projected to experience substantial growth, expanding by a staggering $761.76 billion at a compound annual growth rate of 28.96%. (Source)

- The sharing economy offers easier entry, flexibility, and freedom. It attracts workers and investors, with 72% of independent workers preferring contract work and 50% of investors participating in peer-to-peer lending. (Source)

- Cost reduction is the primary advantage cited by consumers when utilizing sharing economy services, with 54% of respondents highlighting its affordability. (Source)

- Some projections put the sector’s revenues at $335 billion globally by 2025, and the scope for further widening its geographic reach remains huge. (Source)

Scope and Impact (Sharing Economy Statistics)

- While the COVID-19 pandemic temporarily impacted the US home-sharing economy, with user numbers dropping to 23.3 million in 2020, a strong recovery is expected, reaching 68.2 million users by 2023. (Source)

- The sharing economy is a global phenomenon, encompassing 9,829 companies across 133 countries and spanning diverse sectors including business, finance, food, technology, and real estate. (Source)

- Europe is a significant player in the global sharing economy, anticipated to contribute $40.2 billion in revenue, accounting for 19.2% of the total market in 2022. (Source)

- The global market for shared mobility services is expected to grow to $619.51 billion by 2026. (Source)

- Generation Z has been the primary driving force behind the sharing economy since 2022, and this trend is projected to continue in the future. (Source)

User Behavior and Demographics (Sharing Economy Statistics)

- Sharing economy consumers prioritize value and convenience over brand loyalty, with a strong majority – 83% – willing to change providers for lower prices and 62% for faster service. (Source)

- Millennials (18-34) have shown a greater inclination towards the sharing economy, particularly for pre-owned goods, with over 50% utilizing such services compared to 36% of older generations. (Source)

- Attitudes towards the sharing economy vary across age groups, with millennials (18-34) expressing significantly higher satisfaction with ride-hailing services than older demographics. (Source)

Market Dynamics and Key Players (Sharing Economy Statistics)

- Uber and Lyft have established themselves as the primary players in the U.S. ride-sharing market, boasting high levels of brand recognition among American consumers. (Source)

- Regus and WeWork emerged as the dominant forces in the U.S. coworking office space market in 2018, collectively leasing millions of square feet. (Source)

- Coworking offices have lagged behind other sharing economy services in terms of consumer awareness, with only 17% of Americans familiar with the concept in 2018. (Source)

- Ride-hailing platforms like Uber and Lyft leverage artificial intelligence to optimize pricing, offer personalized discounts, and enhance route efficiency. This data-driven approach aligns with the growing consumer expectation for tailored experiences. (Source)

- Uber’s valuation of $68 billion in 2013 marked a significant milestone, eclipsing the market capitalization of traditional automotive giants like Chrysler, Ford, and General Motors. (Source)

- The entertainment and telecommunications sectors dominated the sharing economy’s revenue landscape in 2022. (Source)

- Shared transportation emerged as a dominant force in the global sharing economy in 2023 and is poised for continued expansion. (Source)

- Airbnb has solidified its position as the leading home-sharing platform, experiencing substantial user growth in the United States. With tens of thousands of listings in major cities like New York and Los Angeles, Airbnb has transformed the hospitality industry. (Source)

- Transportation is the largest segment of the sharing economy. (Source)

Regional Market Trends (Sharing Economy Statistics)

- Sharing economy services have become widespread in the United States, with 72% of Americans using at least one platform. Online secondhand shopping and ride-hailing apps are particularly popular. (Source)

- Younger Americans, especially those under 30, are more likely to utilize sharing economy platforms as a means of generating income. (Source)

- North America has been the dominant force in the sharing economy since 2022 and is projected to maintain its leadership position through 2032. (Source)

- The United States has witnessed a dramatic surge in sharing service awareness, with adoption rates climbing from 47% in 2015 to 83% by May 2018. (Source)

- Trust in sharing economy services varies across the United States, with 19% of Northeast residents expressing high confidence in platforms like Uber, Lyft, Airbnb, and HomeAway. (Source)

- The Middle East and Africa show promising signs of sharing economy adoption, with 68% of people open to sharing or renting and 71% willing to rent from others. (Source)

- Europe’s embrace of the sharing economy is moderate, with 54% willing to share or rent and 44% open to renting from others. (Source)

- The Asia-Pacific region is poised for significant growth in the sharing economy, contributing 32% to overall market expansion between 2024 and 2028. (Source)

- Germany’s car-sharing market has expanded rapidly, with user numbers increasing from approximately 4.47 million in 2023 to around 5.5 million in 2024. (Source)

- Car-sharing remains popular in Germany, although interest slightly declined from 8.3 million in 2022 to 8 million in 2023. Despite this, the country boasts 293 car-sharing companies as of 2024. (Source)

- France’s ride-sharing market is experiencing robust growth, with a projected compound annual growth rate of 12.82% from 2022 to 2027, resulting in a market value increase of $2.47 billion. (Source)

- The e-hailing sector is driving growth in France’s ride-sharing market. With the number of smartphone subscriptions expected to reach 84.75 million by 2024, the market is primed for further expansion. (Source)

- The French e-hailing market has witnessed substantial growth since its valuation of $1.79 billion in 2017. (Source)

- Asia-Pacific residents exhibit a strong inclination towards sharing and renting, with 78% open to the concept and 81% willing to rent from others. (Source)

- Latin Americans demonstrate a significant openness to the sharing economy, with 70% expressing interest in sharing or renting and 73% willing to rent from peers. (Source)

- China’s sharing economy surpassed a transaction volume of $500 billion in 2016. (Source)

Regional Case Studies (Sharing Economy Statistics)

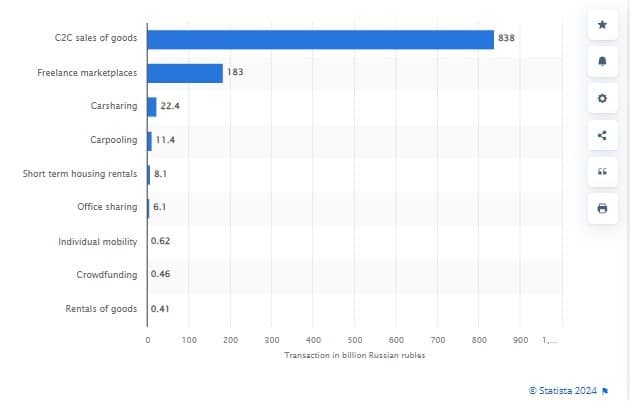

- Russia’s sharing economy is dominated by consumer-to-consumer sales, accounting for the lion’s share of the market in 2020. Freelance services and carsharing followed as significant sectors. (Source)

- Freelance services secured the second position with a market value of 183 billion Russian rubles while carsharing rounded out the top three at 22.4 billion Russian rubles. (Source)

- Airtasker has experienced explosive growth in Australia, with thousands of new members joining daily and overall membership tripling since 2014 to reach 320,000. (Source)

- Australians are increasingly leveraging the sharing economy for task completion and supplementary income, with 16% and 6.7% respectively utilizing these services. (Source)

- Awareness of major sharing economy platforms like Airbnb, Uber, and Airtasker is widespread in Australia, with nearly half the population familiar with these brands. (Source)

- The United States is demonstrating growing familiarity with the sharing economy, with 44% of consumers aware of the concept and 19% having used it for tasks. (Source)

- Australia’s sharing economy is thriving, as evidenced by Airtasker’s rapid expansion with over 100,000 new members in just six months. (Source)

Sharing Economy Trends (Sharing Economy Statistics)

- Hyperlocal sharing is the primary catalyst propelling the growth of the sharing economy. (Source)

- Artificial intelligence is revolutionizing the sharing economy by enhancing customer experiences and driving operational efficiency, with 45% of executives recognizing its critical role in 2023. (Source)

- Autonomous ridesharing is a key force behind the expansion of the French ride-sharing market. (Source)

Challenges Facing the Sharing Economy (Sharing Economy Statistics)

- The ambiguous classification and uncertain rights of gig economy workers pose a significant obstacle to the expansion of the sharing economy. (Source)

- Inconsistent national transport regulations and opposition from established transportation providers impede the growth of the ride-sharing market in France. (Source)

- Government regulation of the sharing economy is evolving rapidly, with different countries implementing varying rules and regulations. (Source)

- The sharing economy faces four primary challenges: potential exacerbation of social inequality through renting practices, the corporate nature of internet platforms undermining worker benefits, uncertain long-term sustainability, and persistent security and trust concerns. (Source)

- The most frequent issues encountered by Swedish users of sharing economy services are mistreatment by the other party and scheduling problems, both affecting 26% of respondents. (Source)

- Ride-sharing services, exemplified by Uber’s uberPOP, that employ non-professional drivers have been deemed illegal by courts in Belgium, France, Germany, Italy, and the Netherlands. (Source)

- The South Korean government banned Uber to encourage the development of alternative, locally developed apps. (Source)

- The mayor of Paris, for example, set up a team of 20 agents specifically to crack down on illegal room-sharing hosts. (Source)

Conclusion (Sharing Economy Statistics)

These statistics demonstrate the phenomenal growth and impact of the sharing economy. It’s disrupting traditional industries, creating new jobs, and offering consumers more choices and flexibility. However, challenges remain in areas like regulation, taxation, and safety. The future of the sharing economy is bright, with technological advancements and evolving consumer preferences shaping its trajectory. As the sharing economy continues to evolve, it’s crucial to stay informed about its trends and potential impact on various sectors and industries.

FAQ (Sharing Economy Statistics)

What is the trend of the sharing economy? (Sharing Economy Statistics)

The sharing economy is a contemporary manifestation of a historical concept where individuals exchange goods and services. Modern technology, particularly online platforms, has revitalized this model, enabling widespread peer-to-peer transactions.

Essentially, the sharing economy is moving from a disruptive force to an integral part of the global economy, with a profound impact on how people consume goods and services.

What are the four models of the sharing economy? (Sharing Economy Statistics)

The four sharing economy models are franchiser, principal, chaperone, and gardener.

Is the sharing economy growing?

Yes, the sharing economy is experiencing substantial growth.

Driven by technological advancements, urbanization, and changing consumer preferences, it’s expanding rapidly across various sectors. Platforms like Airbnb, Uber, and TaskRabbit have become household names, and new sharing economy models are emerging constantly.

What is the concept of a sharing economy? (Sharing Economy Statistics)

The sharing economy is an economic model where individuals collaborate to share goods and resources, transforming physical assets into accessible services. Advances in digital technology have fueled its growth and expansion.

Leave a Reply