Here are some Business Process Outsourcing statistics you should know;

The global business process outsourcing (BPO) market is booming, with staggering growth projected in the coming years.

BPO is no longer a niche strategy. It’s a key driver of efficiency, cost savings, and competitive advantage for businesses of all sizes.

Let’s explore the most recent BPO data to gain insights into this evolving sector.

BPO Industry Snapshot (Business Process Outsourcing Statistics)

- The insurance BPO services market is valued at USD 7.08 billion in 2024 and is projected to expand to USD 8.94 billion by 2029.

- The BPO industry is poised for substantial growth, with projected revenues reaching a staggering US$0.39 trillion by 2024.

- Small businesses exhibited a strong preference for outsourcing partners in marketing (27%), IT services (22%), and design (21%).

- Approximately 300,000 jobs are outsourced from the United States annually.

- The UAE has solidified its position as a global business epicenter, attracting multinational corporations needing robust BPO support for their international operations.

- The IT and telecom sector is projected to contribute over 32.7% of the total revenue generated by the Asia Pacific BPO market between 2022 and 2032.

- The customer care BPO market in the Middle East and Africa is projected to experience significant growth, expanding from $1,986.49 million in 2023 to $2,618.71 million by 2028.

- The healthcare-payer BPO market is growing, expanding from a valuation of USD 13.20 billion in 2021 to a projected USD 21.30 billion by 2030 at a robust CAGR of 9.5%.

- The United States is expected to dominate global revenue, with an estimated US$146.30 billion in 2024.

BPO Market Trajectory ( Business Process Outsourcing Statistics)

- The market is projected to expand at a compound annual growth rate (CAGR) of 4.67% from 2024 to 2029, culminating in a total market value of US$0.49 trillion. (Source)

- The business process outsourcing market is projected to be worth approximately US$ 318.8 billion in 2024, and it is anticipated to grow at a consistent annual rate of 8% until it reaches US$ 688.2 billion by 2034. (Source)

- Revenue within the Business Process Outsourcing industry is estimated to total US$0.39 trillion in 2024. (Source)

- Expenditure on Business Process Outsourcing is projected to average US$110.50 per employee in 2024. (Source)

- A combination of political stability, robust infrastructure, and a large consumer market within the United States fosters expansion in the BPO sector. (Source)

- The escalating demand for tailored and streamlined services is anticipated to fuel growth within the US BPO market. (Source)

- Before the COVID-19 pandemic, the global outsourcing market was assessed at a value of $92.5 billion. (Source)

- The administrative outsourcing industry is projected to generate $21 billion in revenue during 2023. (Source)

- The Healthcare payer BPO market, valued at USD 13.20 billion in 2021, is projected to attain USD 21.30 billion by 2030, demonstrating a compound annual growth rate of 9.5%. (Source)

- The United States is expected to dominate global revenue, with an estimated US$146.30 billion in 2024. (Source)

- Danish outsourcing giant ISS World reported approximately US$11.52 billion in revenue for 2023, marking a year-over-year increase of roughly US$570 million. (Source)

- Valued at USD 56.80 billion in 2022, the Business Process as a Service market is poised to expand to USD 145.30 billion by 2031, exhibiting a compound annual growth rate of 11%. (Source)

- With an estimated value of USD 92.49 billion in 2023, the global customer experience business process outsourcing market is anticipated to expand at a compound annual growth rate of 11.9% from 2024 to 2030. (Source)

- Data security is cited as a key concern by 68% of outsourced businesses exploring cloud computing options. (Source)

BPO Across Industries (Business Process Outsourcing Statistics)

- The insurance BPO sector continues to grow as insurance providers increasingly delegate non-core operations. (Source)

- While less than one-third (29%) of businesses with 50 employees or fewer engage in outsourcing, this practice is adopted by two-thirds (66%) of businesses with 51 to 500 employees. (Source)

- Business Process Outsourcing contributed approximately 29% to global IT Services revenue in 2022. (Source)

- Driven by labor scarcity and escalating public sector outsourcing, IT-related BPO services sales in Japan are anticipated to exceed 3.2 trillion yen by the 2027 fiscal year. (Source)

- Valued at USD 7.08 billion in 2024, the Insurance BPO Services Market is projected to reach USD 8.94 billion by 2029, demonstrating a compound annual growth rate of 4.76%. (Source)

- Over half of executives (52%) utilize outsourcing for business operations. (Source)

Outsourcing Services for Businesses (Business Process Outsourcing Statistics)

- Financial tasks are outsourced by approximately 44% of businesses. (Source)

- Content marketing is a commonly outsourced function, with 30% of marketing professionals utilizing external providers. (Source)

- Lead generation and cold calling are frequent outsourcing targets within operational departments. (Source)

- Accounting functions are outsourced by 37% of businesses. (Source)

- A significant portion of executives (81%) depend on external providers for some or all cybersecurity functions. (Source)

- IT services are predominantly sourced through third-party delivery models, with 76% of surveyed executives adopting this approach. This trend is expected to mirror IT outsourcing rates, reaching up to 80% adoption. (Source)

- Legal functions, tax services, HR operations, financial management, and supply chain management (including manufacturing and procurement) are the most sought-after outsourced business processes, with adoption rates ranging from 48% to 64%. (Source)

- ISS World excels in facility services, while Accenture is a leading provider of IT, help desk, HR outsourcing, and consulting services. (Source)

- Over 40% of larger organizations leverage outsourcing for HR and operational tasks, albeit without complete reliance on external partners. (Source)

Key Benefits of BPO (Business Process Outsourcing Statistics)

Cost Reduction (Business Process Outsourcing Statistics)

- Cost minimization is a primary driver for outsourcing, cited by 70% of executives as a key reason. (Source)

- Approximately 59% of global business leaders identify cost-cutting as a major benefit, alongside focusing on core competencies and addressing capacity constraints. (Source)

- To reduce expenses, 28% of businesses outsource company development. (Source)

Operational Efficiency and Growth (Business Process Outsourcing Statistics)

- Outsourced lead generation teams can boost lead generation by up to 43% compared to in-house efforts. (Source)

- Companies leverage outsourcing to streamline operations, access new capabilities, and adapt to changing market conditions, with cost reduction (57%), capability expansion (51%), and strategic agility (49%) as primary motivations. (Source)

Talent and Resource Optimization (Business Process Outsourcing Statistics)

- The significant cost of employee benefits, accounting for 29.4% of employer expenditures, according to the Bureau of Labor Statistics, drives many organizations to seek BPO solutions. (Source)

BPO Landscape and Future Directions (Business Process Outsourcing Statistics)

Global BPO Trends (Business Process Outsourcing Statistics)

- The finance and accounting segment within South Africa’s BPO market is projected to expand rapidly, with a compound annual growth rate of 13% from 2021 to 2028. (Source)

- North America captured more than 36.0% of the revenue in 2023 and is anticipated to maintain its leading position from 2024 to 2030, fueled by the increasing demand for BPO services from numerous major technology companies within the region. (Source)

- The IT business process outsourcing (BPO) market share is expected to increase by USD 281.25 billion from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 8.12%. (Source)

- The United Arab Emirates is embracing specialized BPO offerings, with Customer Experience Management (CXM) and Knowledge Process Outsourcing (KPO) gaining prominence. (Source)

- The United States BPO market is experiencing accelerated growth fueled by advancing technology adoption. (Source)

- South Africa’s BPO sector is characterized by surging demand for specialized services, particularly legal process outsourcing and healthcare outsourcing. (Source)

- Automation and AI adoption is a notable trend in the European BPO market, aimed at enhancing efficiency and cutting costs. (Source)

- Nigeria’s BPO market is witnessing a growing emphasis on voice-based services such as customer support and telemarketing. (Source)

Evolving Outsourcing Preferences (Business Process Outsourcing Statistics)

- Small businesses demonstrated a strong preference for outsourcing marketing (27%), IT services (22%), and design (21%) functions in 2023. (Source)

- In April 2020, Wipro, a business process outsourcing company, collaborated with Nutanix to provide digital database services. (Source)

- 92% of the top 2,000 global companies use IT outsourcing. (Source)

- Today, more than 40% of banking and financial institution support desk employment is outsourced. (Source)

Business Process Outsourcing Statistics By Regions

Europe Business Process Outsourcing Trends (Business Process Outsourcing Statistics)

- The UK’s BPO market is expected to generate $29.31 billion in revenue by 2024. (Source)

- The market is projected to expand at a consistent annual rate of 5.67% from 2024 to 2029, culminating in a market size of US$38.61 billion by the end of the forecast period. (Source)

- Eastern Europe’s BPO market is expected to reach $4.29 billion in 2024 and grow 3.32% annually to $5.05 billion by 2029. (Source)

- European businesses are projected to spend an average of US$283.70 per employee on BPO services in 2024. (Source)

- Europe’s BPO industry is set to expand significantly, increasing from $72.45 billion in 2023 to $132.57 billion by 2031, with an annual growth rate of 7.9% during this period. (Source)

- The UK is projected to be the leading European BPO hub, driven by its robust business environment, skilled talent pool, and strategic geographic position. (Source)

- The UK is projected to be the leading European BPO hub, driven by its robust business environment, skilled talent pool, and strategic geographic position. (Source)

- HR outsourcing emerged as the dominant segment within the UK BPO market in 2022, contributing $3.5 billion or 26.3% to the overall market value. (Source)

- The UK BPO services market generated $13.5 billion in revenue in 2022, demonstrating a consistent 5.1% annual growth from 2017. (Source)

- A substantial majority, three out of five, of British B2B companies outsource critical business operations. (Source)

- Poland is the leading BPO hub in Eastern Europe, with Romania and the Czech Republic following closely behind. (Source)

- Southern Europe boasts the highest rate of adoption of BPO and future plans among European regions. (Source)

- Businesses in Eastern Europe are expected to allocate an average of US$36.25 per employee to BPO services in 2024. (Source)

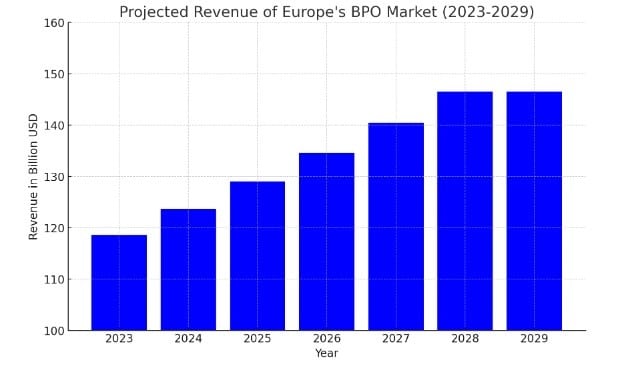

- Europe’s BPO market is set to generate $118.60 billion in revenue this year. Looking ahead, the market is projected to expand at a consistent annual growth rate of 4.32% from 2024 to 2029, culminating in a total revenue of $146.50 billion by 2029. (Source)

- The UK’s historical ties with developing countries, coupled with the shared English language, make it an ideal destination for businesses seeking to outsource their operations. (Source)

- Eastern Europe’s BPO industry is characterized by its abundance of multilingual talent. (Source)

United States Business Process Outsourcing Trends (Business Process Outsourcing Statistics)

- The Professional, Scientific, and Technical Services sector in the United States exhibits a market concentration level of 22%. (Source)

- The BPO industry in the United States is experiencing rapid growth due to changing customer expectations. (Source)

- The U.S. BPO Services market is fragmented, with no dominant players, as the combined market share of the top four companies is below 40%. (Source)

- The U.S. BPO market experienced a dip in demand as the pandemic caused a decrease in both business formation and corporate profits. (Source)

- The U.S. BPO industry is poised for consistent growth, reaching a market volume of $178.70 billion by 2029, with an estimated annual growth rate of 4.08%. (Source)

- The United States is forecast to dominate the BPO market in 2024, accounting for $146.30 billion in revenue. (Source)

- The anticipated average spending on each employee within the U.S. BPO market for 2024 is $840. (Source)

- An estimated 300,000 jobs are relocated annually from the United States to overseas operations. (Source)

Asia And The Pacific Region Business Process Outsourcing Trends (Business Process Outsourcing Statistics)

- India’s BPO industry is poised for significant growth, with a projected annual growth rate of 8.76%, leading to a market volume of $10.94 billion by 2029. (Source)

- According to the National Investment Promotion Agency, India’s retail industry is on track for substantial growth, reaching $1.1 trillion by 2027 and doubling to $2 trillion by 2032, driven by a consistent 25% annual growth rate. (Source)

- India and the Philippines are recognized global hubs for IT, customer service, and back-office services. (Source)

- India, the Philippines, and China are the dominant forces in their respective regional BPO markets. (Source)

- According to Data Bridge Market Research, India’s BPO market, valued at $6.08 billion in 2022, is projected to nearly double in size by 2030, reaching $12.38 billion. (Source)

- India’s Business Process Outsourcing market is projected to spend an average of $13.19 per employee in 2024. (Source)

- The BPO market in Japan is expected to reach $38 billion by 2025. (Source)

- The Asia Pacific BPO market is expected to be dominated by customer services throughout the decade from 2022 to 2032. (Source)

- China’s leading position in the Asia Pacific BPO market solidified in 2022, and it is expected to persist, with revenues on track to reach $35.054 billion by 2030. (Source)

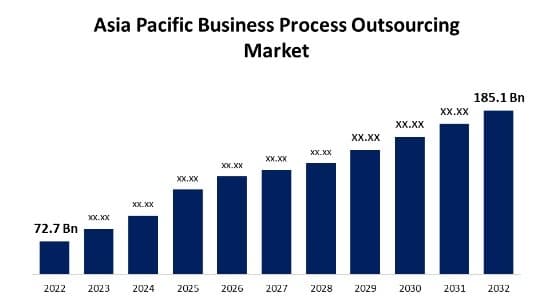

- With a projected compound annual growth rate of 9.8%, the Asia Pacific BPO market is poised to expand significantly, reaching $185.1 billion by 2032. (Source)

- The Asia Pacific BPO market is anticipated to expand at a robust 9.8% annual rate from 2023 to 2030. (Source)

- The Asia Pacific BPO market size in 2022 was at a valuation of $72.7 billion. (Source)

- The Asia Pacific Business Process Outsourcing Market Size is expected to reach USD 185.1 Billion by 2032. (Source)

- Japan’s IT-related BPO market clocked in at 2.78 trillion Japanese yen during the 2022 fiscal year. (Source)

- China is quickly building a strong outsourcing industry, and emerging outsourcing players already have strong credentials. (Source)

- The Japanese business process outsourcing market is predicted to grow at a steady annual rate of 9.1% between 2024 and 2034. By 2034, Japan will comprise 29.4% of East Asia’s overall business process outsourcing market. (Source)

Africa Business Process Outsourcing Trends (Business Process Outsourcing Statistics)

- Nigeria’s strong foundation of skilled and educated labor positions it as a prime choice for businesses seeking BPO services. (Source)

- Nigeria’s BPO industry is set to achieve a $0.70 billion valuation in 2024, followed by a robust growth period at an 11.93% compound annual growth rate, culminating in a market size of $1.23 billion by 2029. (Source)

- South Africa’s BPO industry is poised for rapid growth, expanding at a 13.2% annual rate to reach a valuation of $3.6 billion by 2027. (Source)

- Employing more than 270,000 people in 2020, South Africa’s BPO industry is a vital job creator. Government targets aim to boost this number to 500,000 by the decade’s end. (Source)

- The 2021 EF English Proficiency Index placed South Africa in the 12th position, surpassing rival outsourcing locations, including Poland. (Source)

- The average expenditure per employee within South Africa’s BPO market is projected to be $75.21 in 2024. (Source)

- The time zone differential benefits South Africa’s BPO market considerably. (Source)

- From a $2.16 billion valuation in 2022, South Africa’s BPO market is expected to soar to $6.49 billion by 2031. (Source)

- South Africa is considered the leading African country for business outsourcing, according to service providers. Cape Town has become a preferred destination for BPO establishments. (Source)

- South Africa’s BPO industry is forecast to attain a $1.89 billion valuation in 2024, followed by consistent annual growth of 3.64%, leading to a market size of $2.26 billion by 2029. (Source)

- Customer service is the undisputed leader in South Africa’s BPO market, accounting for more than 31% of the market in 2019. This segment is expected to experience significant growth, with a high CAGR forecast for the period 2021 to 2028. (Source)

- Nigerian BPO companies are projected to spend an average of $9.02 per employee in 2024. (Source)

Middle East Business Process Outsourcing Trends (Business Process Outsourcing Statistics)

- The United Arab Emirates’ BPO market is projected to generate approximately $0.98 billion in revenue by 2024. (Source)

- The customer care BPO market in the Middle East and Africa is projected to grow from $1.99 billion in 2023 to $2.62 billion by 2028 at a steady annual growth rate of 5.7%. (Source)

- The Saudi Arabian business process outsourcing market is anticipated to grow significantly from 2024 to 2030. (Source)

- The increasing number of new businesses is propelling the U.A.E. to the forefront of the Middle East and Africa’s BPO market. (Source)

- Middle East and Africa BPO market, with a projected 7.1% compound annual growth rate between 2023 and 2030. (Source)

- The market is expected to grow steadily at a 4.82% annual rate from 2024 to 2029, reaching a total value of approximately $1.24 billion by the end of the forecast period. In 2024, the average expenditure on each BPO employee will be $141.00. (Source)

- Small and Medium Enterprises (SMEs) are increasingly turning to outsourcing, significantly contributing to expanding the UAE’s BPO market. (Source)

- The UAE has emerged as a global business hub, attracting numerous multinational corporations seeking BPO services to support their worldwide operations. (Source)

- Data Bridge Market Research forecasts substantial growth for the UAE’s BPO market, which is valued at $1.8 billion in 2023 and is expected to reach $3.3 billion by 2031. (Source)

Conclusion (Business Process Outsourcing Statistics)

The BPO market is evolving rapidly, driven by technological advancements and the ever-growing need for businesses to streamline operations and optimize costs.

Gain a competitive edge by keeping abreast of the newest BPO data and unleash your business’s maximum capabilities.

Frequently Asked Questions (Business Process Outsourcing Statistics)

What are the stats about business process outsourcing?

The U.S. BPO industry is poised for consistent growth, reaching a market volume of $178.70 billion by 2029, with an estimated annual growth rate of 4.08%.

What percentage of businesses outsource?

A significant portion of small businesses, around 37%, rely on external providers for IT services and accounting. Other functions commonly outsourced include digital marketing (34%), human resources (24%), and customer service (24%).

How big is the business process outsourcing industry?

The global Business Process Outsourcing (BPO) market, valued at a substantial USD 340.99 billion in 2022, is projected to grow at a steady CAGR of 6.13% until 2028, reaching a total market size of USD 487.14 billion.

What is the top 1 outsourcing country?

India is a premier outsourcing destination, offering a vast pool of highly skilled professionals, courtesy of its vast higher education system, which is the largest in the world.

Which industry outsources the most?

The IT sector outsources the most, followed by Health care, Finance, Retail, and Insurance.

Who gains from outsourcing?

By outsourcing to regions with lower labor costs, companies can significantly improve their profit margins while simultaneously offering consumers more affordable products or services.

Leave a Reply